Back

Siddharth K Nair

Thatmoonemojiguy 🌝 • 8m

Why Myntra Still Has a 55% Market Share: A Case Study in Smart Strategy In India’s rapidly evolving fashion e-commerce space, Myntra’s continued dominance is nothing short of impressive. With over 55 percent market share in 2024, Myntra has managed to not only survive intense competition but also emerge as the undisputed leader. Its journey is a masterclass in resilience, timely pivots, and smart execution Let’s explore the key reasons why Myntra still leads the fashion e-commerce market in India 1. From Gifting to Fashion Myntra was founded in 2007 by Mukesh Bansal, but not as a fashion company. It started as a platform for personalized gifting, offering custom t-shirts, mugs, and merchandise. While the concept was unique, it was too niche and hard to scale During this phase, Mukesh noticed two things. First, most orders were for apparel. Second, fashion is a habit-driven category customers keep coming back. This insight led to Myntra’s major pivot in 2011 into fashion e-commerce, focusing on selling clothes and accessories from major brands 2. Surviving a Crowded Market By 2011, the Indian e-commerce sector exploded with funding. Players like Jabong, Koovs, and Fashionandyou entered the scene, while Amazon also launched operations in India. Myntra chose a unique strategy to stand out While most others used a marketplace model, Myntra adopted an inventory-led model. This meant buying products from brands and storing them in its own warehouses. This gave the company control over product quality, delivery, and customer experience crucial advantages in fashion retail They also launched an app early, redesigned their website to look professional, and introduced a 30-day no-questions-asked return policy setting new standards for customer trust in online shopping 3. The Flipkart Lifeline In 2013, Myntra nearly went bankrupt. With no money in the bank and investors pulling out, things looked bleak. But in 2014, Flipkart acquired Myntra for 330 million dollars. This deal gave Myntra financial stability and access to Flipkart’s massive customer base Two years later, Myntra acquired its biggest competitor, Jabong, for 70 million dollars, eliminating direct competition and becoming the largest player in online fashion 4. Launching Private Labels After gaining stability, Myntra focused on growing its revenue through private labels like Roadster, HRX, and Mast & Harbour. These brands gave Myntra full control over pricing and production, boosting profit margins By 2017, 40 percent of Myntra’s gross merchandise value came from in-house brands. While it increased costs, it also solidified Myntra’s position as not just a retailer, but a brand creator 5. A Shift Toward Profitability Post Flipkart’s acquisition by Walmart, Myntra was asked to reduce losses and move toward profitability. This led to major changes in its business model Instead of relying heavily on private labels, Myntra opened its platform to more third-party sellers. It began charging for services like advertising, logistics, and platform fees. This asset-light model allowed brands to gain visibility while Myntra earned revenue without managing inventory Between FY21 and FY24, ad revenue jumped from ₹195 crore to ₹712 crore, while logistics revenue grew to ₹2,439 crore. These changes helped Myntra reduce risk and become more scalable 6. Fixing the Return Problem One of the biggest challenges in fashion e-commerce is high return rates, often over 30 percent. Myntra tackled this with a few key steps They introduced a flat platform fee of ₹20, added higher shipping fees for customers who return frequently, and shortened return windows for certain brands. These moves cut down logistics costs and discouraged impulse purchases Myntra also invested in faster deliveries. With same-day and next-day shipping, customers are less likely to cancel or change their minds mid-order As a result, logistics costs dropped from ₹2,600 crore in FY23 to ₹1,877 crore in FY24 7. The Road Ahead Thanks to these strategic changes, Myntra became profitable in FY24, bouncing back from a ₹782 crore loss the previous year. With over half the market under its control, the company is now preparing for an IPO, likely after Flipkart’s in 2026 By balancing growth with sustainability, Myntra has positioned itself not just as a leader in fashion e-commerce, but as one of India’s most successful digital-first businesses Final Thoughts Myntra’s journey is a lesson in adaptability. From a gifting startup to a fashion giant, from near-bankruptcy to profitability, it has constantly reinvented itself. By focusing on user experience, brand partnerships, and monetization beyond product sales, Myntra has built a business that is hard to beat Whether you’re a startup founder, a business student, or just someone curious about e-commerce, Myntra’s story offers rich insights into what it takes to win and keep winning in one of the toughest industries out there

Replies (2)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

Following the Pahalgam attack and rising calls for a boycott of Turkey due to its support of Pakistan, Indian e-commerce giants Myntra and Reliance-owned AJIO have ceased the sale of Turkish clothing brands such as Trendyol, Koton, and LC Waikiki on

See More

gray man

I'm just a normal gu... • 10m

Raghu Krishnananda, the Chief Product and Technology Officer (CPTO) of Flipkart-owned fashion e-commerce platform Myntra, has stepped down after five years with the company. According to an internal memo accessed by Inc42, Myntra CEO Nandita Sinha s

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

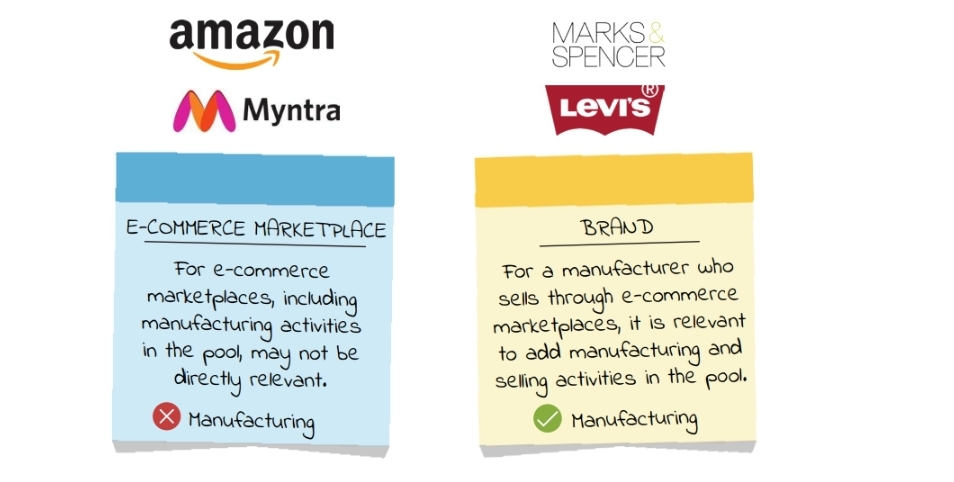

🛒 E-commerce Marketplace vs. Brand! 🏭💡 Not all online sellers are the same! Amazon & Myntra operate as marketplaces focusing on sales rather than manufacturing. Meanwhile, Marks & Spencer & Levi’s are brands handling both manufacturing & selling!

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)