Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

Navigating the 2025 Fundraising Landscape Breaks down how early-stage founders should approach raising money in 2025 — with real strategies, pitfalls to avoid, and investor psychology. Link: https://www.rightsidecapital.com/blog/navigating-the-202

See More

Account Deleted

Hey I am on Medial • 1y

Let's decode one pattern : • Companies were backed by Softbank such as OYO, OLA Electric and FirstCry are continuously filing for IPO but some IPO's approved or some failed for IPO. • Startups backed by Softbank such as OLA Electric and OYO are ra

See More

SamCtrlPlusAltMan

•

OpenAI • 8m

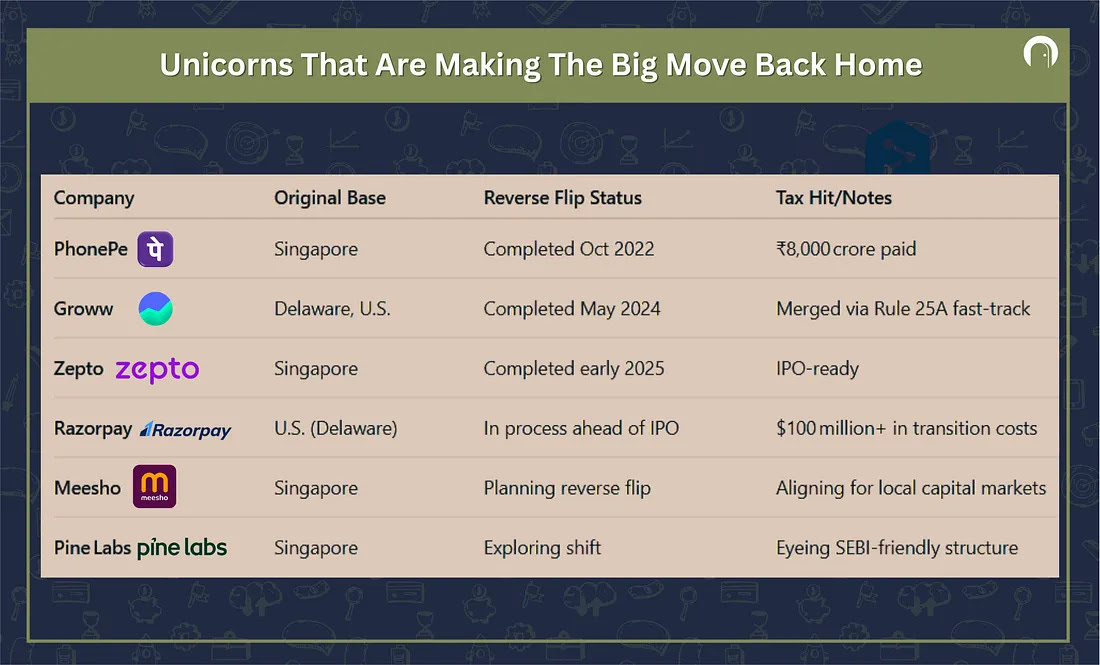

After years of chasing capital abroad, billion-dollar tech giants are shifting their HQs back to India. Once drawn overseas by easier fundraising and U.S. IPO dreams, over 70 fastest-growing Indian tech companies are making a U-turn, closing offshore

See More

Satyam Kumar

Pocket says nil.. Mi... • 8m

Karnataka transport minister orders action against app-based & regular auto rickshaws overcharging in Bengaluru Karnataka transport minister R Ramalinga Reddy on June 28 directed the transport department to take strict action against app-based auto

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)