Back

Prince Kumar

Saving ab aadat nahi... • 9m

Thanks for asking! Yes, it may sound similar to an FD at first, but there’s one major difference: In a traditional FD, money can be withdrawn early (with penalty), which reduces financial discipline. In our app, once money is time-locked, it cannot be withdrawn before the set time — not even with a penalty. This helps people build real savings habits, avoid impulsive withdrawals, and stay committed to their goals.

More like this

Recommendations from Medial

Inovbiz Studio

Inspire. Innovate. S... • 10m

Business Tips #11 How to Build Discipline and Stay Consistent ⚡ Motivation fades, but discipline builds success! 💡 Here’s how to stay consistent in business: ✅ 1. Set Clear Goals – Know what you’re working toward. Break it down into daily steps. ✅

See MoreRishabh Agrwal

Desire & faith have ... • 11m

Can Anyone Know About Pareto Principle in Stock Market The Pareto Principle (80/20 Rule) applies to stock trading and investing. 2. Around 80% of traders lose money, while only 20% make consistent profits. 3. Most failures result from greed, lac

See MorePrince Kumar

Saving ab aadat nahi... • 9m

Hi Investor Name Mera naam Prince hai, main ek simple aur impactful fintech app idea par kaam kar raha hoon jiska naam abhi “Safe Future” socha gaya hai. Idea: Ek digital saving app jahan users apna paisa ek time-lock ke through save karte hain — j

See MoreRybitic

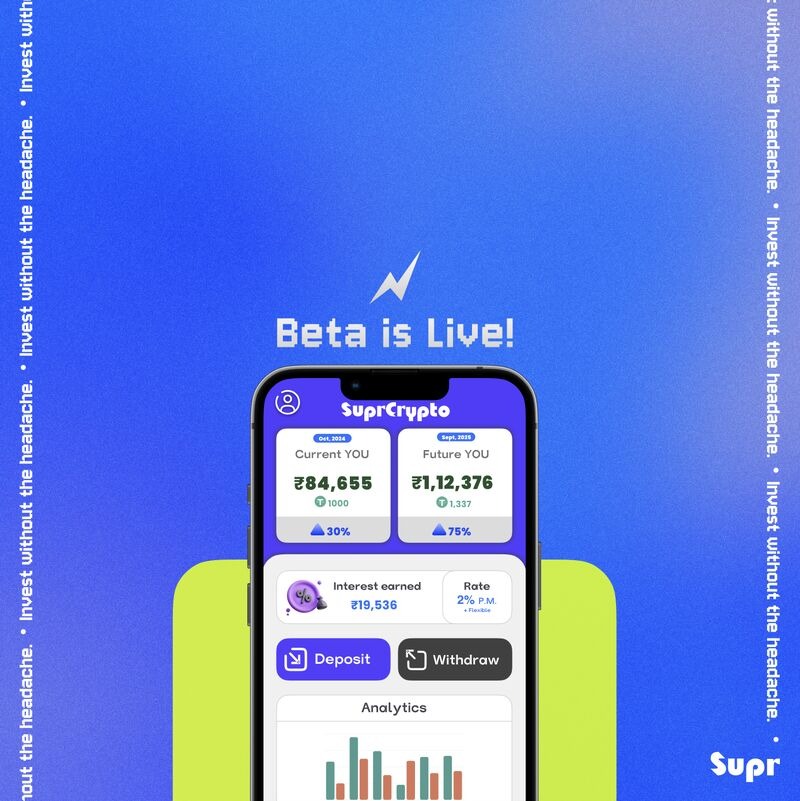

Founder and CEO at S... • 10m

After months of relentless work, we've finally made beta access to Crypto FD live today. If you're wondering what Crypto FD is, it's like a regular bank's FD where you deposit a fixed amount for a certain tenure but with significantly higher returns

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)