Back

Kimiko

Startups | AI | info... • 9m

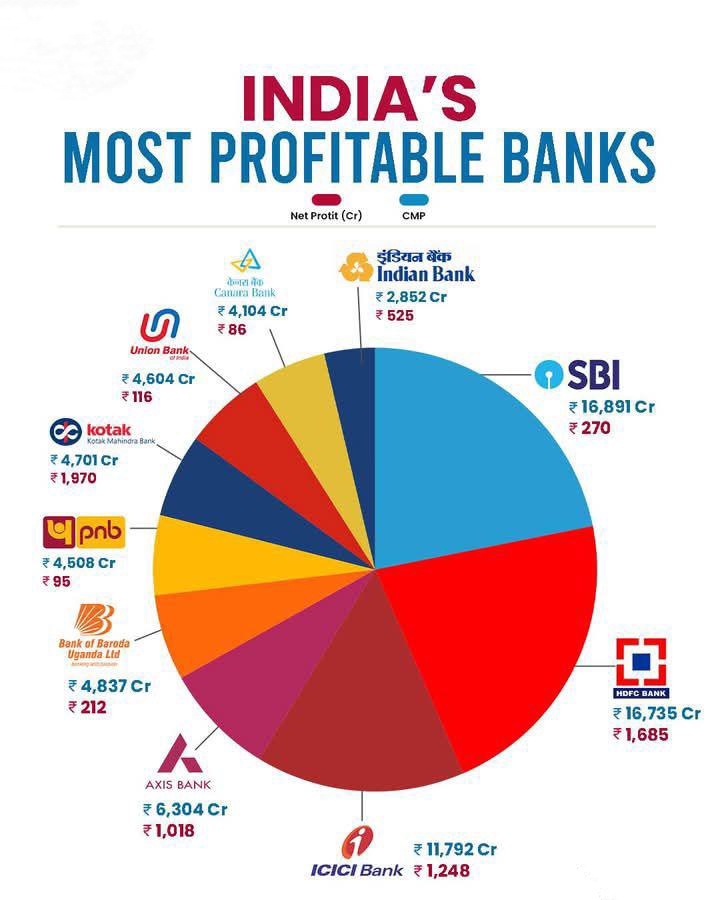

From SBI to HDFC, here are the banks minting money in style!

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 4m

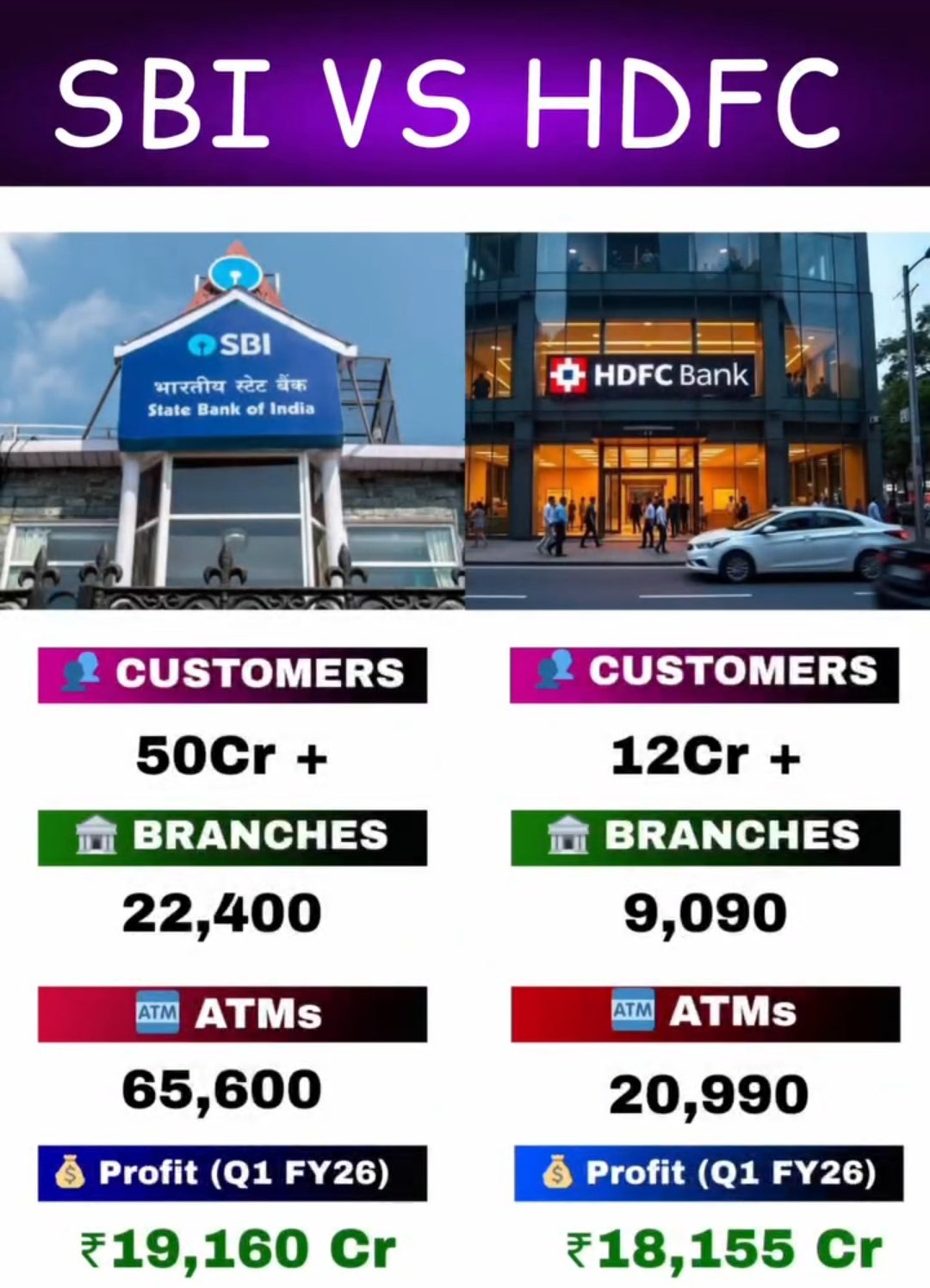

SBI vs HDFC Bank – The Battle of India’s Banking Giants! 🇮🇳 SBI: 50 Cr+ customers | 22,400 branches | ₹19,160 Cr profit 🏦 HDFC Bank: 12 Cr+ customers | 9,090 branches | ₹18,155 Cr profit 👉 Who’s the real king of Indian banking? Comment your o

See More

Ravi Handa

Early Retiree | Fina... • 1y

I tried a few apps / websites for redeeming funds over the last few days. Here are they ranked based on my experience: Indmoney App MFcentral Website SBI Invest App Kuvera App HDFC Fund Website . . (1000 layers of shit) . . ICICI Prudential Websit

See MoreManish

My name is Manish Vi... • 1y

📉 Just published a new analysis on HDFC Bank's recent stock decline. Curious about the reasons behind it? Head over to for an in-depth look! https://medium.com/@manishvishav/understanding-hdfc-banks-q1-results-and-stock-decline-an-in-depth-analysis

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)