Back

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 9m

I was reading Urban Company’s DRHP, and it hit me hard when I saw "REDSEER" mentioned in there. I’ve seen REDSEER in the IPO papers of so many recent startups, I did a quick 15min search through all 25 of them from the last 3yrs. And guess, what, 8

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

Governments are tightening rules on AI and chips, pushing companies to look for safe suppliers in trusted countries. Investors are also shifting money toward regions like India and SE Asia. It’s a clear domino: new rules → buyers pick trusted product

See MoreRahul Agarwal

Founder | Agentic AI... • 20h

AI is diverging. Fast. Two versions are emerging. Both start from the same foundation. Both heading in opposite directions. OpenAI introduced ads in ChatGPT. Free and $8/month users see them. Paid Plus and Pro users do not. The debate over ads mis

See MoreCA Yugesh

Chartered Accountant... • 1y

🚀 Picture this: You're about to launch your dream business. You've got passion, a killer idea, and a vision that keeps you up at night. But there's this mysterious world of financial terms that feels like a complex puzzle. Today, we're unraveling on

See MoreAdithya Pappala

Busy in creating typ... • 1y

🤫Only 1 Secret to raise funds from VC'S but sadly no-one is talking about It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Etc... Even tho

See More

brijesh Patel

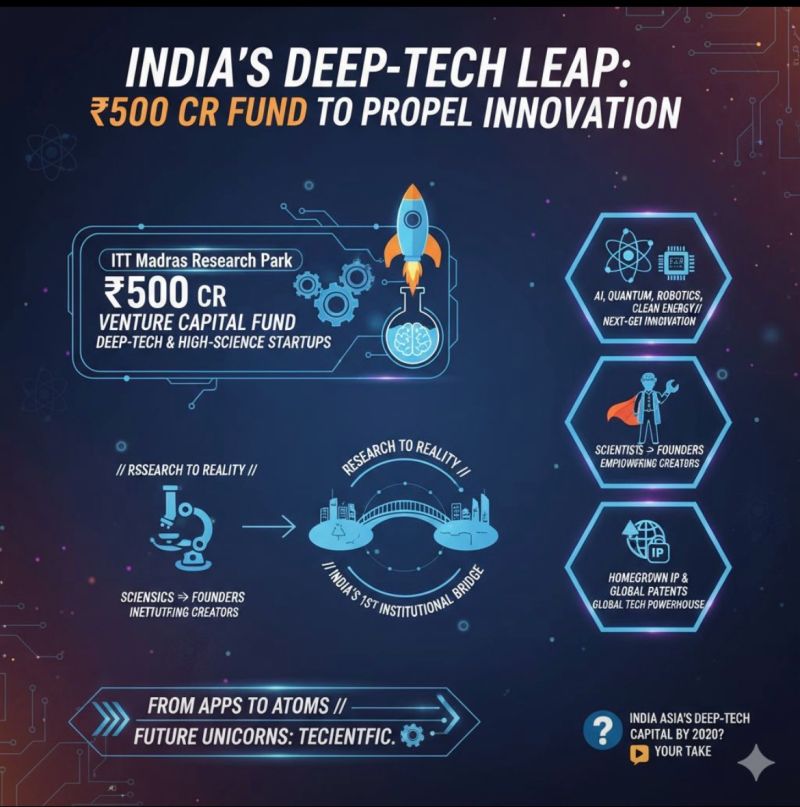

Founder | Venture Pa... • 4m

🚀 India’s Deep-Tech Revolution Just Got ₹500 Crore Stronger. The IIT Madras Research Park has announced a ₹500 Cr Venture Capital Fund — dedicated exclusively to deep-tech & high-science startups. This isn’t just another investment pool. It’s Indi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)