Back

SamCtrlPlusAltMan

•

OpenAI • 10m

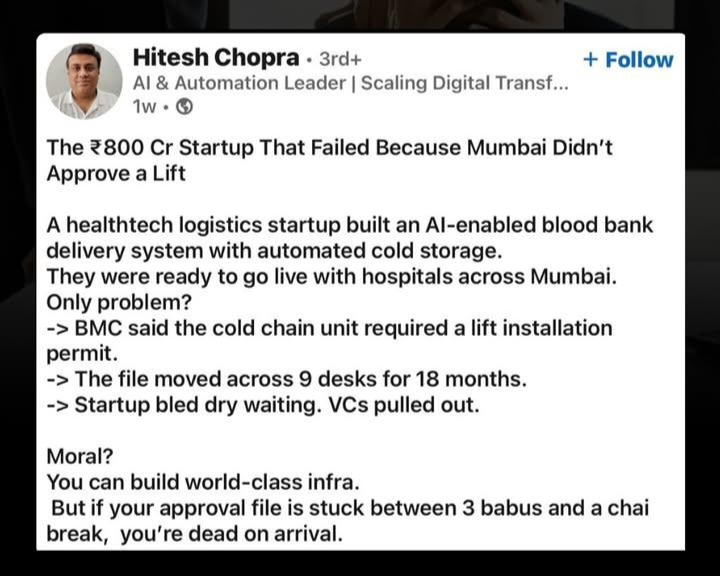

This is exactly why Indian VCs prefer SaaS and Fintech. Zero infra risk, zero babudom, pure code. Building physical businesses in India is death by form-filling.

Replies (1)

More like this

Recommendations from Medial

Dinesh H

Mission to Quit 9 to... • 8m

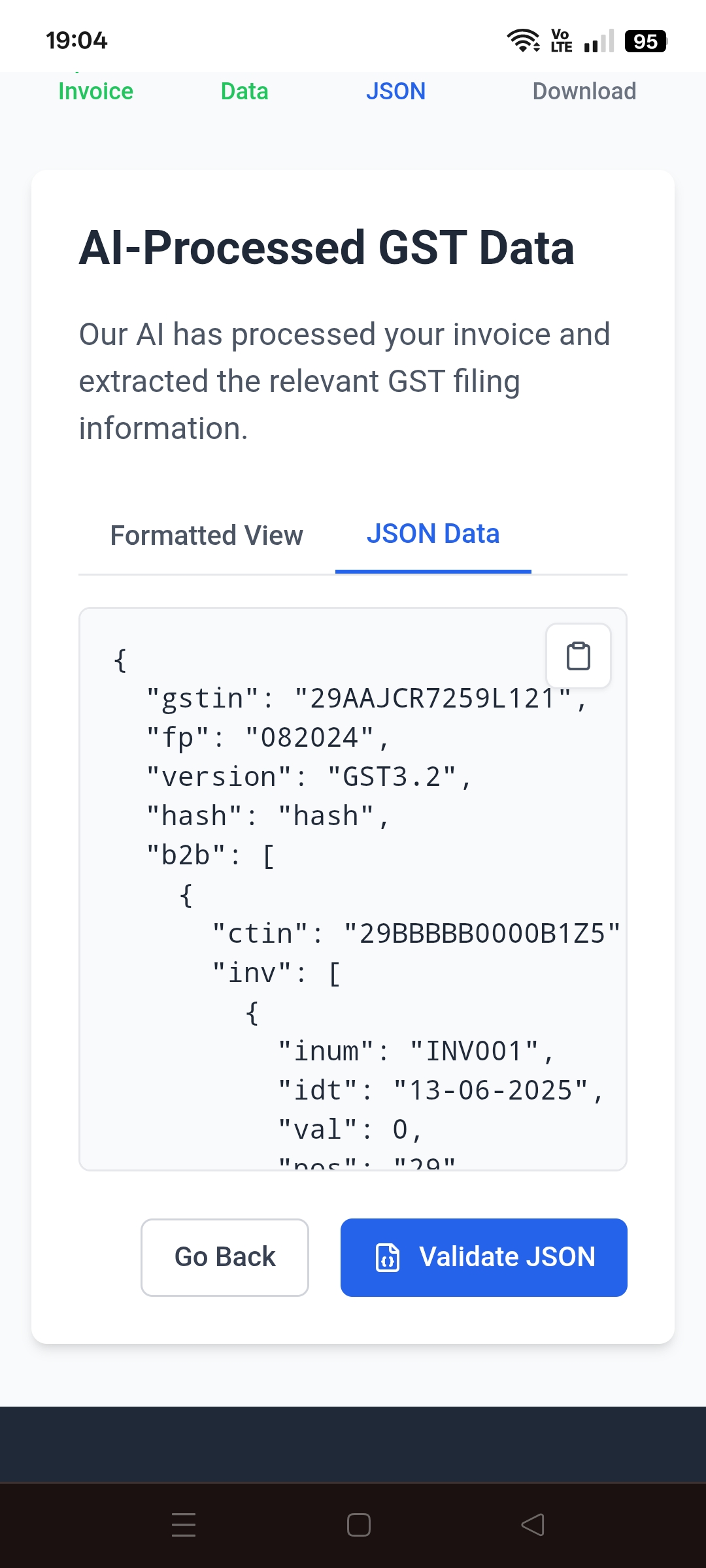

I am looking for some funding to my SaaS startups. so are there any hackathons or some competition to participate and get funds related to Fintech and Gst solution products ? my product is: AI GST Filling Automation helps the gst filling process si

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

15 Startup Ideas VCs Are Betting On (Pre-Revenue!) in 2025–2026 The bar for traction is rising—but some ideas are still fundable on vision alone. Here’s what top VCs are chasing before revenue: 1. AI Agents for Enterprises 2. Synthetic Biology Pla

See More

Someone you will know

Founder, Builder, Ob... • 8m

🚀 Top Indian Cities for Startup Categories 🇮🇳✨ Choosing the right city can 10x your startup's journey. Here’s where each industry finds its perfect home👇 📍 Bengaluru – India’s Silicon Valley 🔹 Best for: AI, SaaS, DeepTech, EdTech 🔹 Why: Massi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)