Back

Jayant Mundhra

•

Dexter Capital Advisors • 10m

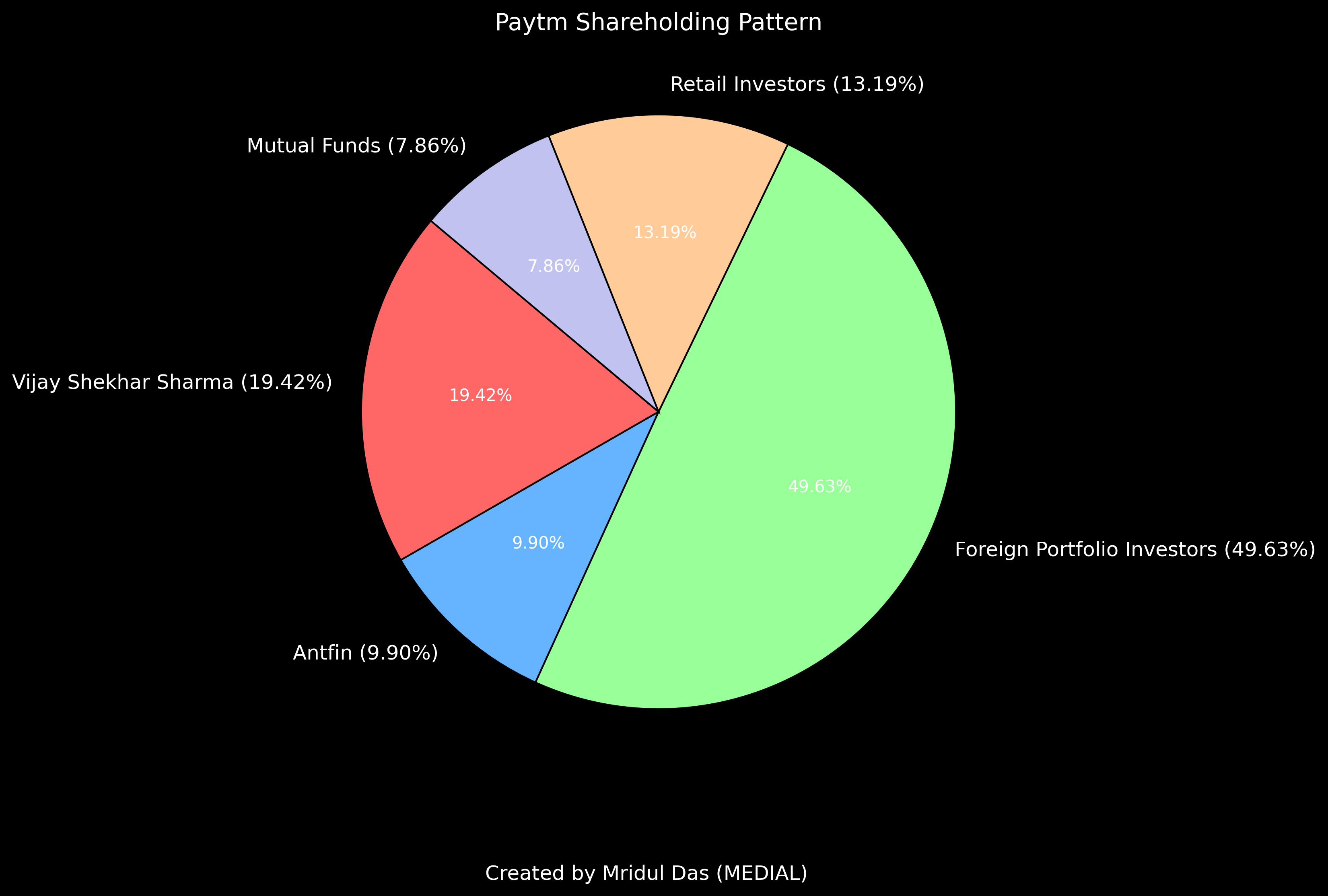

Nobody in India ever talks about how Paytm’s Vijay Shekhar Sharma is literally holding a 10.3% stake ON BEHALF OF China’s Jack Ma! 🙏🙏 This is a stake that VSS did not pay a dime for, and was rather loaned by Jack Ma’s Antfin via a smart transaction - financial engineering at its best. - On 14 July ’23, VSS registered an asset management firm called Resilient Asset Management BV (RAM BV) in Netherlands - By 19 July, 2 more directors were onboarded on its board. Identities are not known Then, just days later, Paytm announced that its Chinese shareholder Antfin had transferred 10.3% stake in Paytm to RAM BV, paid for in the form of Optionally Convertible Debentures (OCDs). .. What are OCDs? - In layman's terms, OCDs are like proof of loan, issued when you borrow money or some other asset (read: Paytm shares) - The OCDs owner has the right to convert the same into equity at the end of the tenure mutually decided, or else at the time of its wish But, wait! Why did Antfin not take cash? Cuz, there was no intent to sell its shares in Paytm. .. Means? Antfin has the right to convert the OCDs into a direct shareholding in RAM BV, which will give it back an indirect shareholding in Paytm, any damn moment! Means, VSS owns 10.3% Paytm shares, but only for a mutually decided time - which he has never disclosed to public shareholders. But, why are they doing this? Because of the big Chinese shareholding in Paytm, RBI & IRDAI erected multiple regulatory bottlenecks for Paytm’s growth. - RBI rejected Paytm’s NBFC application - IRDAI nixed Paytm’s purchase of Raheja QBE General Insurance - Its payments aggregator licence has been stuck for years - Even the business CEO quit in Jan ’25 - The chances of Paytm Payments Bank being allowed a small finance bank licence were nil due to big Chinese shareholding. Though since then, the bank finally collapsed anyway .. But, all this financial engineering has not helped, because RBI and IRDAI have not played along with Paytm’s aforementioned growth plans, denying licences & approvals, able to see through the scheme between VSS and Jack Ma. Now, this raises the question, what if RBI & IRDAI don’t play by Paytm’s wishes for a long time? - Antfin can sell the OCDs to someone else who would be interested in an indirect stake in Paytm (including VSS) whenever the shares will be worth much more - Just in case RBI and IRDAI approve Paytm’s stuck plans, Antfin can then exercise the OCDs to move ownership of RAM BV from VSS to itself, reclaiming its 10.3% stake in Paytm after clearing all Govt approvals and licences Shady, smart and cunning. Did you know this?

Replies (3)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 10m

Domestic institutional investors increased their stake in fintech major Paytm during the fourth quarter (Q4) of the financial year 2024-25 (FY25). According to the quarterly shareholding data filed by Paytm with the stock exchanges, domestic mutual

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 6m

Antfin, an affiliate of Alibaba Group, is reportedly set to sell 18.8 Cr shares of foodtech major Eternal in a block deal worth around INR 5,375 Cr (about $613 Mn). This comes a day after the investor exited fintech major Paytm. Citing sources, CNBC

See More

Amit Kumar

Make it work, make i... • 1y

Zomato Block Deal: Antfin Singapore To Offload Shares Worth $408 Mn. Amid Zomato’s bull run on the bourses, Ant Group’s arm Antfin Singapore is reportedly looking to sell the foodtech giant’s shares worth $408 Mn (INR 3,422.84 Cr). As per a report

See MoreLinkrcap Studio

A digital news platf... • 23d

The stake of domestic mutual funds (MF) in Paytm stood at 14.34%, via 36 schemes, in Q3 FY26 as against 16.25% stake held by them through 40 schemes in the previous quarter. Meanwhile, the holdings of alternate investment funds (AIFs) and insurance

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)