Back

Poosarla Sai Karthik

Tech guy with a busi... • 10m

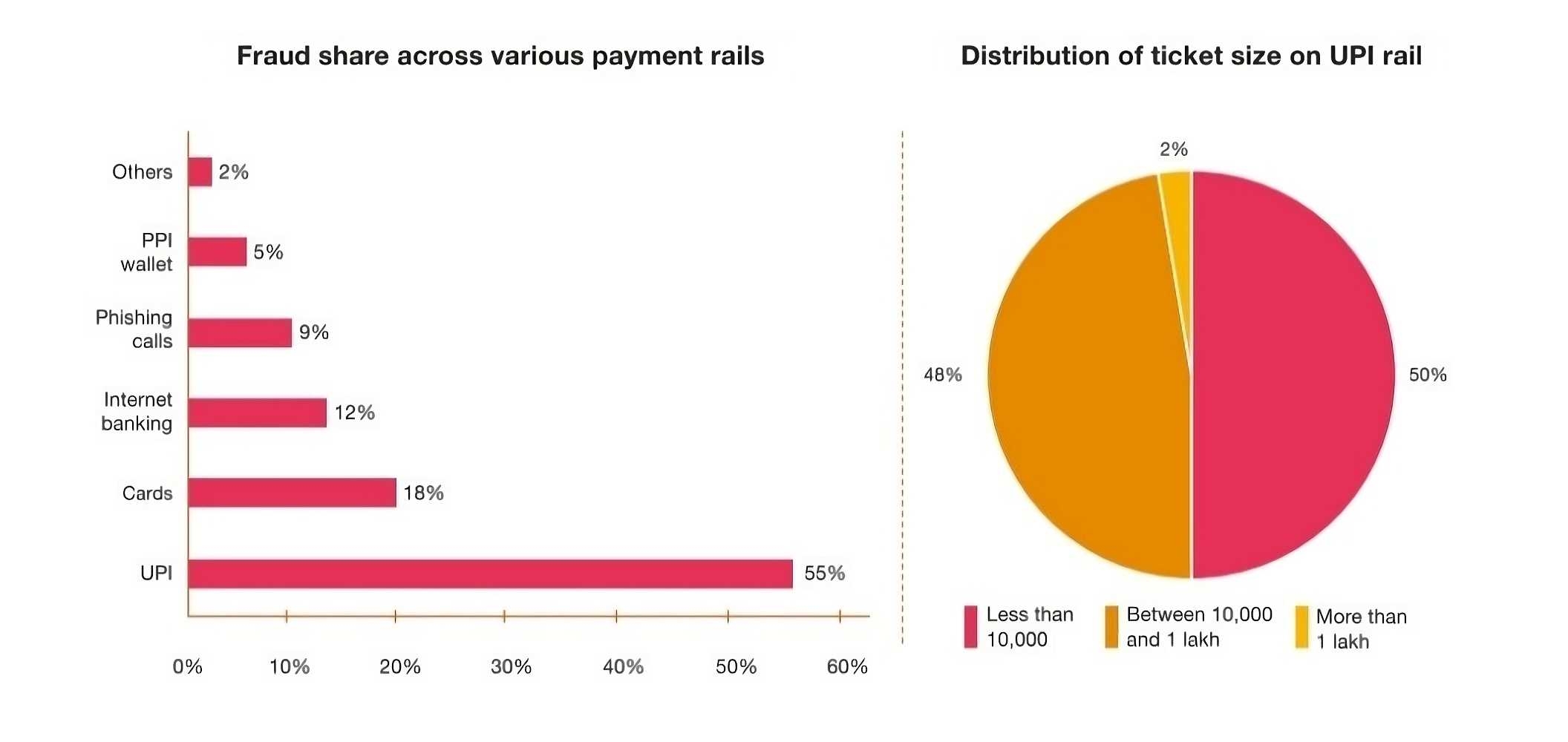

In recent years, frauds between Indian startups and investors have led to losses of about ₹4,000 crore. These incidents often involve startups misrepresenting financials, hiding liabilities, or exaggerating growth to secure funding. As more startups rush to raise capital, the lack of transparency has led to increased disputes and legal issues with investors. On a broader scale, financial frauds affecting consumers also continue to rise. In 2023, over 1.13 million cases were reported, with losses amounting to ₹7,488 crore. These usually involve fraud on digital platforms. To tackle this, the Indian government and the Reserve Bank of India (RBI) have introduced systems like the Central Payments Fraud Information Registry and the Citizen Financial Cyberfraud Reporting and Management System to improve transparency and protect the ecosystem.

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

As Tesla gears up for its India debut, reports suggest the electric vehicle giant, led by Elon Musk, intends to establish an assembly plant in Satara, Maharashtra. This completely knocked down (CKD) facility would involve importing finished vehicle

See More

DataSpace Academy

Learn, Secure & Earn • 9m

What is the Importance of Cybersecurity for Digital Payments? Digital payment frauds are rising and that too in alarming numbers. Worse, the integration of advanced technologies like AI has only aggravated the crime scene. In that light, it’s more t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)