Back

Anonymous 1

Hey I am on Medial • 10m

Accel india too

More like this

Recommendations from Medial

Startup Honor

Startup Honor - Your... • 1y

With $650 million in investor commitments, Accel, an early-stage investor of Flipkart and Swiggy, has closed its eighth fund dedicated to India. With this, Accel will have committed over $3 billion in investments in India overall, as per reported by

See More

VCGuy

Believe me, it’s not... • 1y

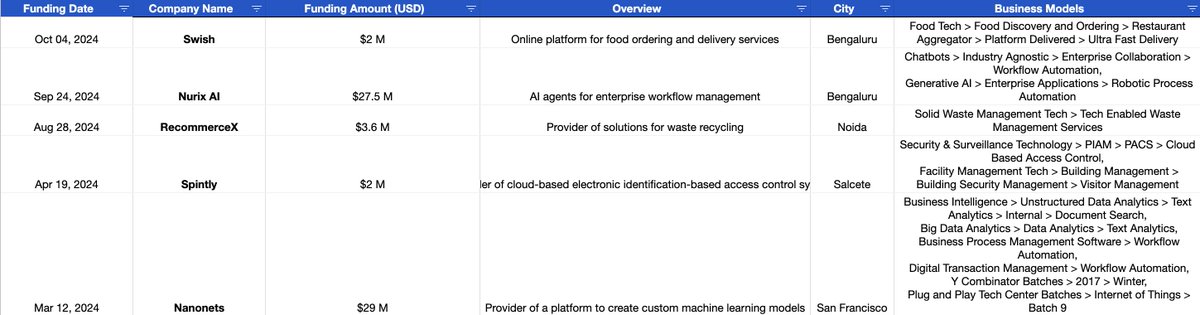

Accel closed its 8th India fund with a $ 650 M corpus. Since entering India in 2008, Accel has been a key investor in some of the most influential startups. 📄A few early investments of Accel that have become behemoths today - - Myntra: Seed inv. i

See More

VCGuy

Believe me, it’s not... • 9m

Accel in India has come a long way. Entered 2008→ acq. Erasmic Venture Fund —transforming EVF’s $10 M seed fund into 'Accel Venture Fund I'. Fund II closed in 08' with $60 M. Fast forward to today, the latest fund has 10x’ed, closed at a $650 M co

See More

Download the medial app to read full posts, comements and news.