Back

VCGuy

Believe me, it’s not... • 12m

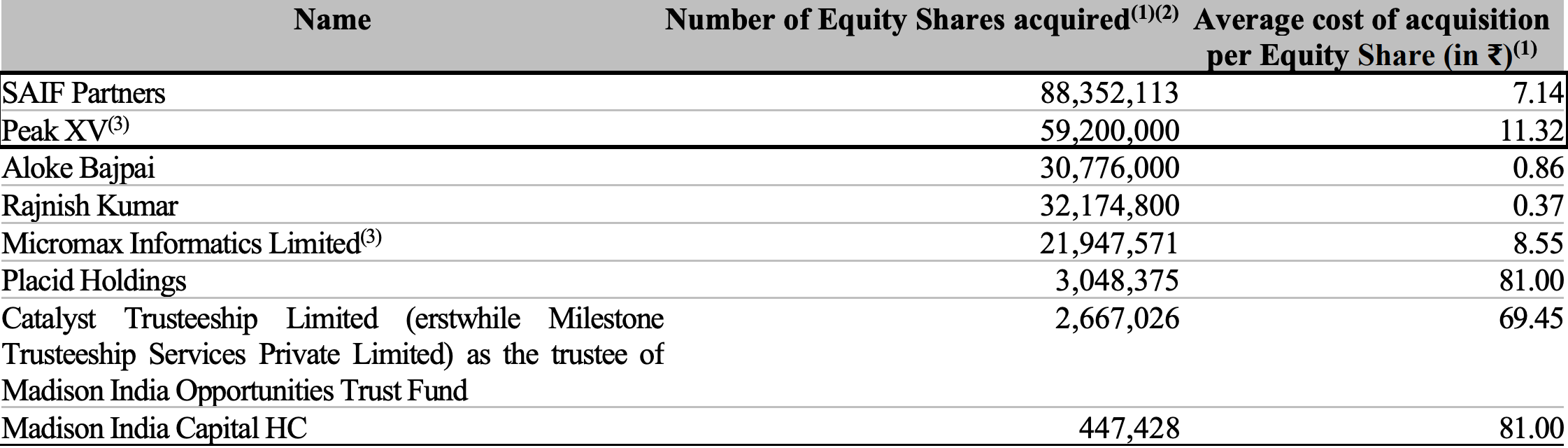

In venture capital, one lesser-known tool that plays a significant role is SPVs. Special Purpose Vehicles (SPVs) → structures that pool capital from multiple investors for a single investment. In simpler terms, imagine you and four friends want to invest in a startup. Instead of each handling your own paperwork, you form an SPV, which - - Simplifies the process - Makes it easier for startups to manage equity - Allows smaller amounts to be pooled together to meet the investment threshold To help you see how SPVs compare to traditional VC funds, I've mapped out the differences below⤵️

Replies (3)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 3 About Basic Finance Concepts Here's Some New Concepts 4. Investment Stocks: Shares in a company that give investors ownership rights and potential dividends. Bonds: Debt securities where investors loan money to companies or governments in re

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)