Back

Nexora

"igniting tomorrow's... • 11m

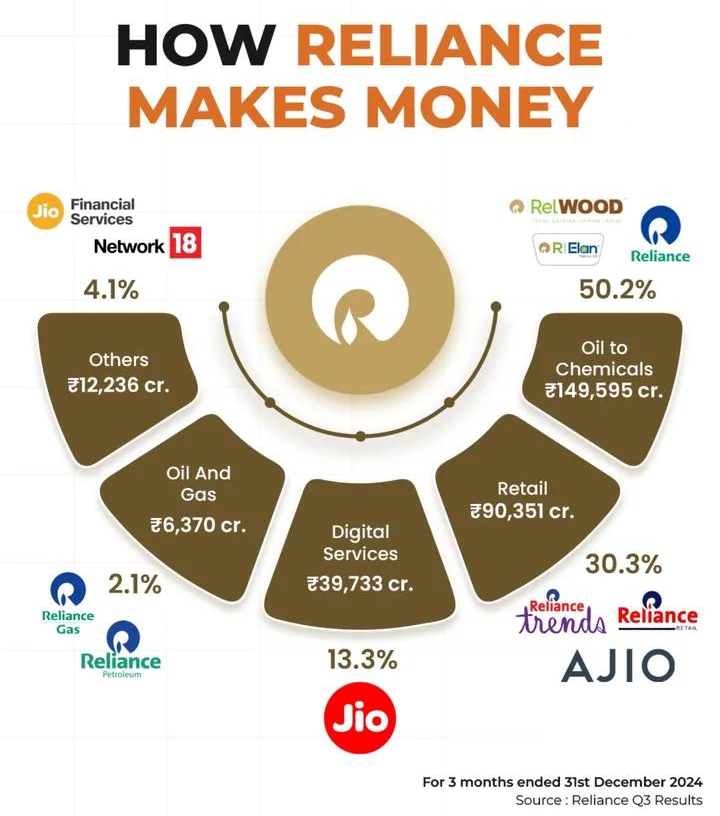

*Reliance Industries Insider Trading Case* *Overview* : 💳 Reliance Industries Ltd. was accused of insider trading related to the sale of Reliance Petroleum shares in the futures and options segment in 2007. *Key Points:* 😃 ➡ Insider Trading: Allegations of using unpublished price-sensitive information to avoid losses. ➡ Regulatory Action: SEBI investigation and subsequent penalties imposed on Reliance Industries. ➡ Market Impact: Debate on the definition and proof of insider trading in complex transactions. *Takeaways* : 😎 ➡ Market Integrity: Highlighting the complexities of proving insider trading in large-scale transactions. ➡ Regulatory Vigilance: The importance of clear regulatory guidelines for futures and options trading. ➡ Corporate Transparency: The need for robust surveillance systems to detect market manipulation. *React with ❤ if you find it informative* @Nexora

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

Tax and Accounting Compliance within the Online Gaming Sphere!! How it Started in CGST ACT ➡SCHEDULE III of the CGST Act contains “Activities or Transactions which shall be treated neither as a Supply of Goods nor a Supply of Services” #Old Para 6

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)