Back

The next billionaire

Unfiltered and real ... • 1y

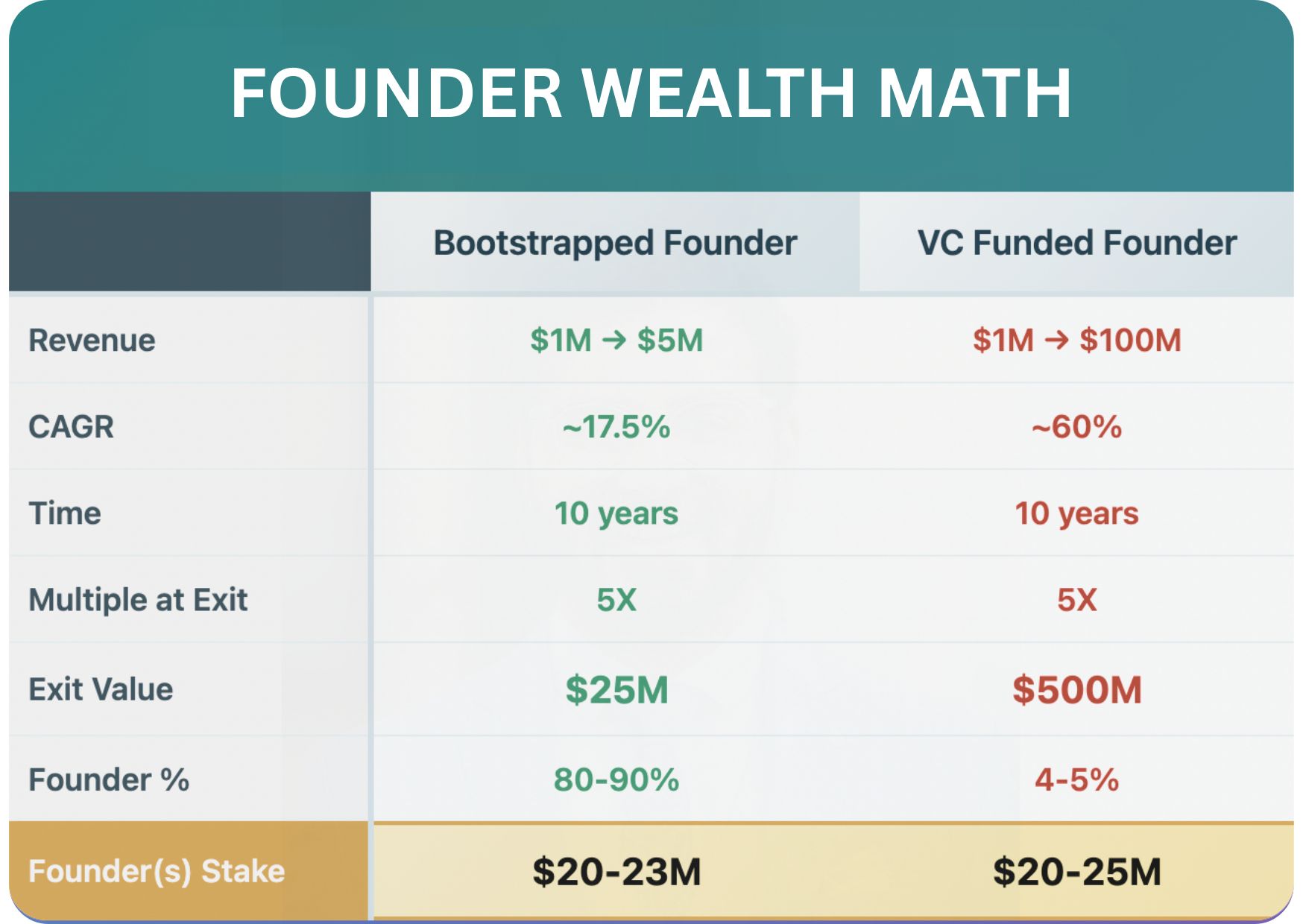

Found this amazing VC vs Bootstrap Analogy! Give it a read. VCs sell you dreams. But bootstrappers build wealth today. Turning down every investor pitch for 12 years to bootstrap to $5M ARR has proven to be the best bet of my journey. Here's the math nobody talks about: VC Path: - Raise $43M total - Dilute to 7% - Hire 120 people - Burn $800K monthly - Hope for a $100M exit - Walk away with $7M after 7 years - If you're lucky (1% chance) Bootstrap Path: - Build with customer revenue - Keep 100% ownership - Run efficient (5-25 people) - $10M ARR - $3-5M/year in your pocket - $30-40M exit available anytime - Complete freedom of choice Truth: I’ve been on both sides of this equation. Simple math of a $5M bootstrapped business beats the glamorous story of a strategic exit because: 1. it's achievable (thousands have done it) 2. it's profitable (50% margins) 3. it's yours (no board approval) 4. it gives options: - work on your terms - sell for $20M - $30M or scale to $100M - take $1.5M/year or reinvest all I continue to build my companies this way right now: - clear focus: sustainable SaaS $1M-$30M - real advantages: founder control, market fit, margins - actual freedom: every dollar of growth is ours The numbers don't lie: - 98% of funded founders end with nothing - Meanwhile, thousands of bootstrappers make $1M+/year The real unicorn isn't a $100M exit. It's complete freedom with real wealth. That's why $5M bootstrapped ARR is the new standard. Let VCs chase their 1% dreams. Smart founders are choosing 100% of something real. source: Alex Turnbull/linkedin

Replies (4)

More like this

Recommendations from Medial

Ashish Singh

Finding my self 😶�... • 11m

🚀Funding Galore: Startup Funding of Week (Mar 3 - Mar 8) Total Funding: $385.5M Top Funded Startups: Darwinbox - $140M (HR platform) LeapFinance - $100M (Student loans) InsuranceDekho - $70M (Insurance platform) Swish - $14M (Fintech) MaxIQ -

See MoreKaustubh Bhatter

Founder, Sharpener |... • 1y

Big milestone! We reached 2cr in ARR -Bootstrapped! Hell yeah! I know I have a long way to go, and we will undoubtedly hit much bigger milestones by the next financial year, but really want to thank the supportive ecosystem of India. Need any sugge

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Mehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreBhavin Bhavsar

Entrepreneur and You... • 5m

saw this meme today and had to share it because honestly the startup scene sometimes feels exactly like this VC backed founders royal life jeete hain bootstrappers quietly build karte hain, har rupee aur har customer count karte he TBH I saw both ar

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)