Back

Havish Gupta

Figuring Out • 1y

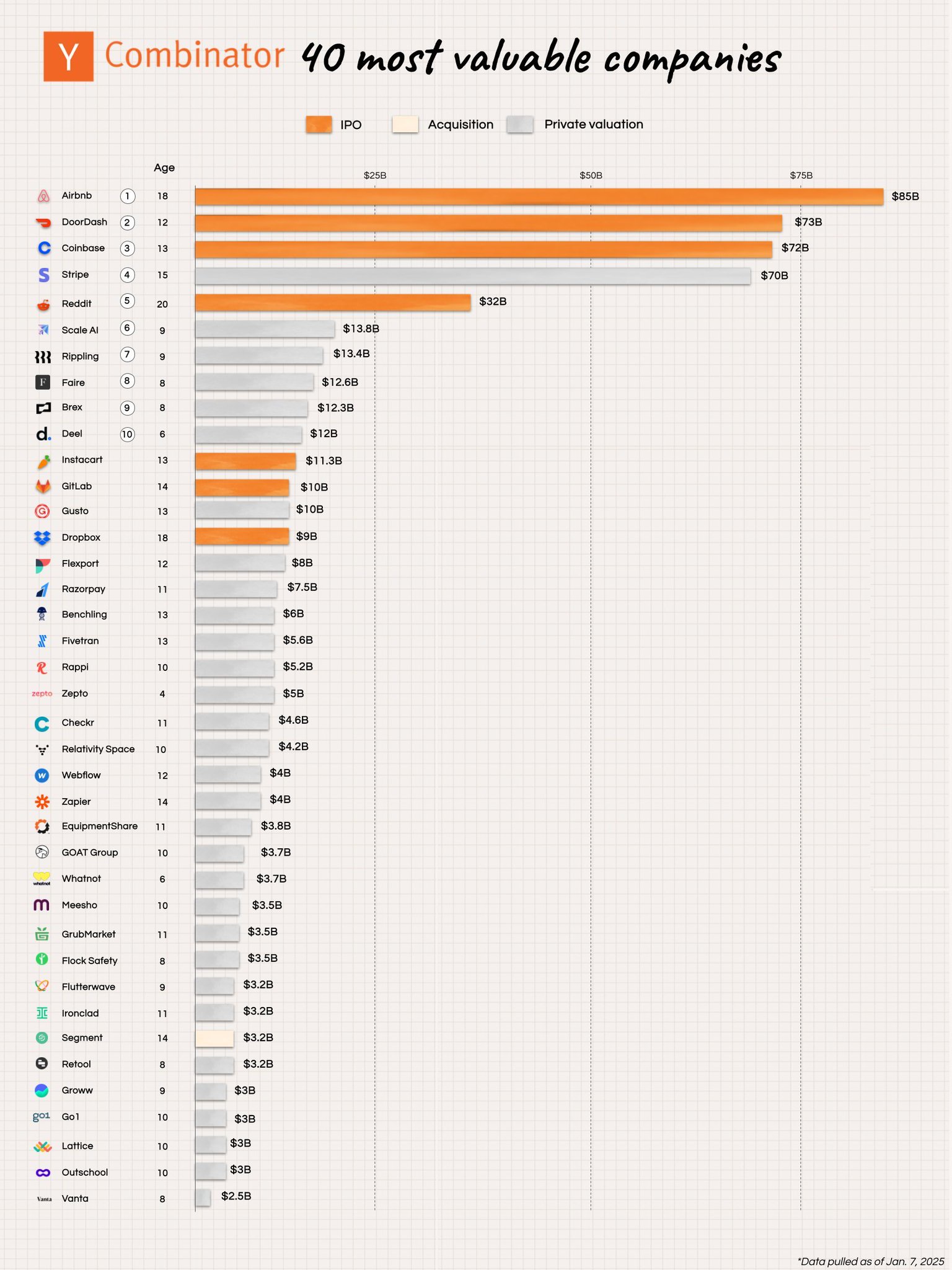

Zepto, Meesho, RajorPay and Groww are the only huge yc companies from India.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

• In 2024, Companies like Razorpay,Zepto and Groww are moving to India , I don't know exactly but I thought this is the reason for IPO and India is one of the fastest growing markets in the world 🚀 📈. • Groww moves domicile to India from the US •

See More

Kavish Goyal

Aspiring Entrepreneu... • 1y

There are more than 2000 fintech companies in India. Amongst these 1800+ fintech companies are startups. Moreover, 42% of the fintech companies are based from Bangalore and Mumbai. Still there are only 20 fintech unicorns in India. What could be

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

Karbon , lava , Micromax , intex , and I ball all are the Indian smartphone companies and they are facing huge loss and toxicity just because of few things. If I make oprating system , processor , camera , search engine , and app store then I am

See MoreVCGuy

Believe me, it’s not... • 1y

Indian startups are Reverse Flipping. Many startups incorporate in countries like Singapore, Mauritius, the US (primarily for SaaS), or the Cayman Islands for several reasons: - Ease of doing business - Tax incentives - Better funding opportunities

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)