Back

Kashif Bakhshi

•

Radaris • 1y

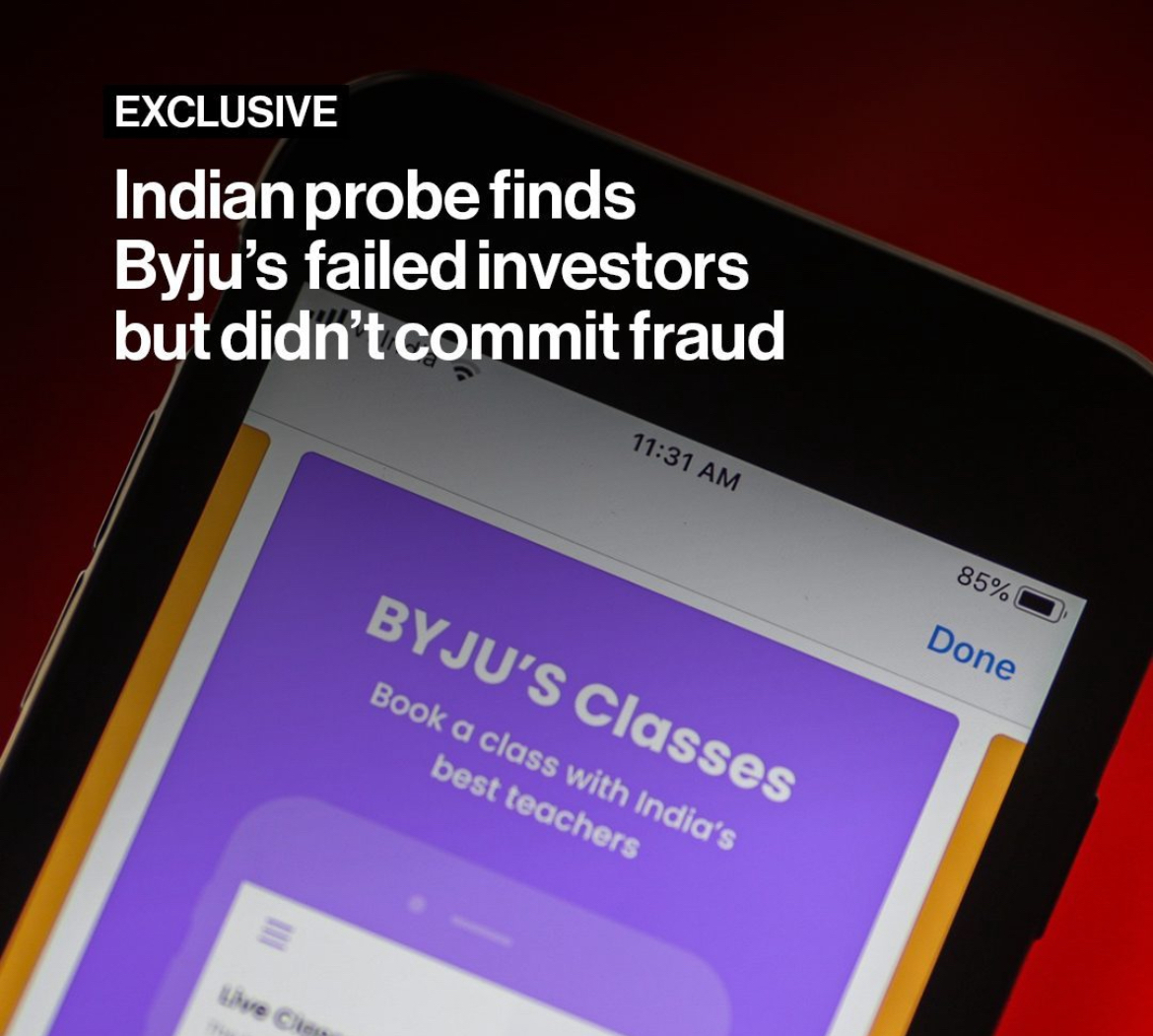

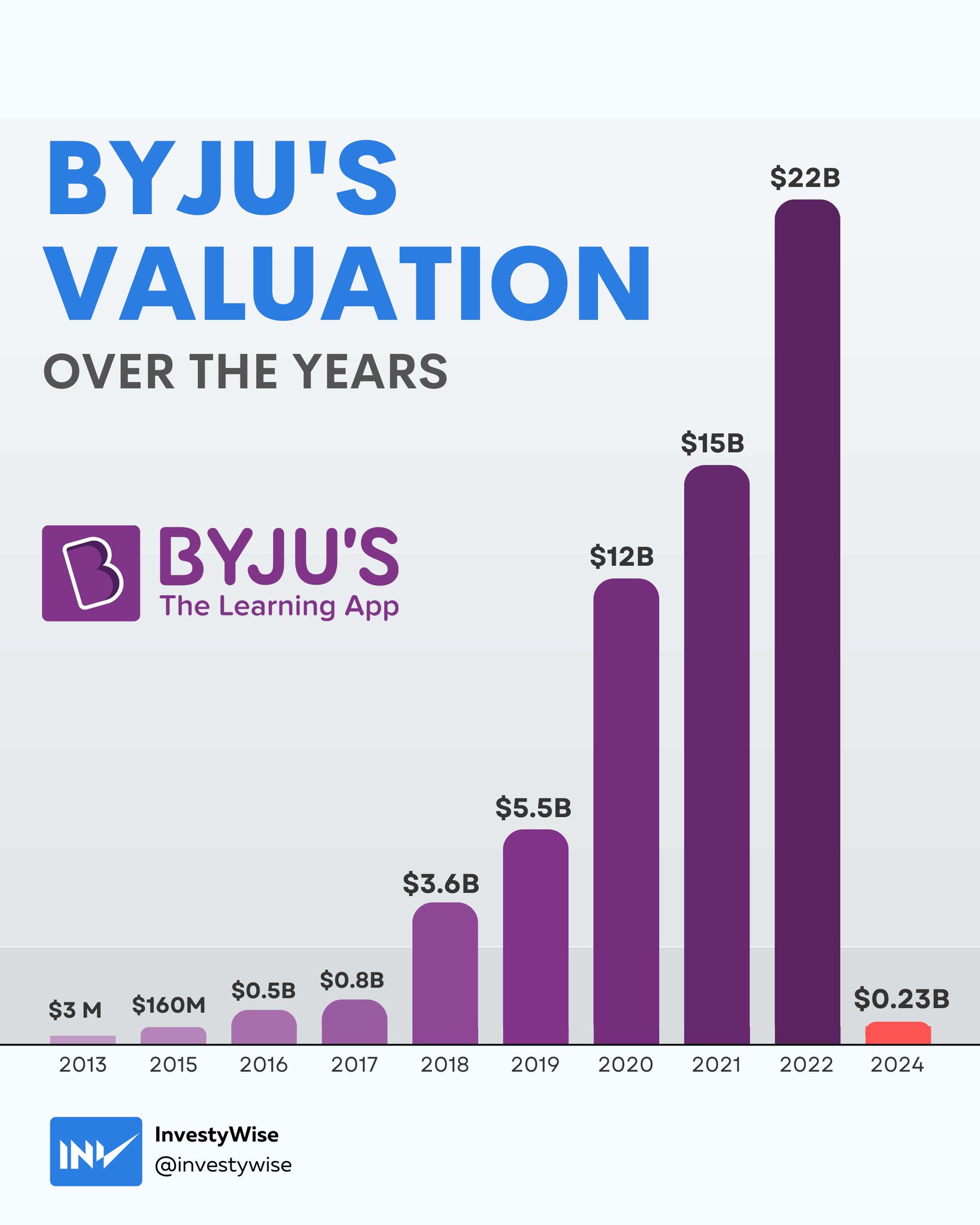

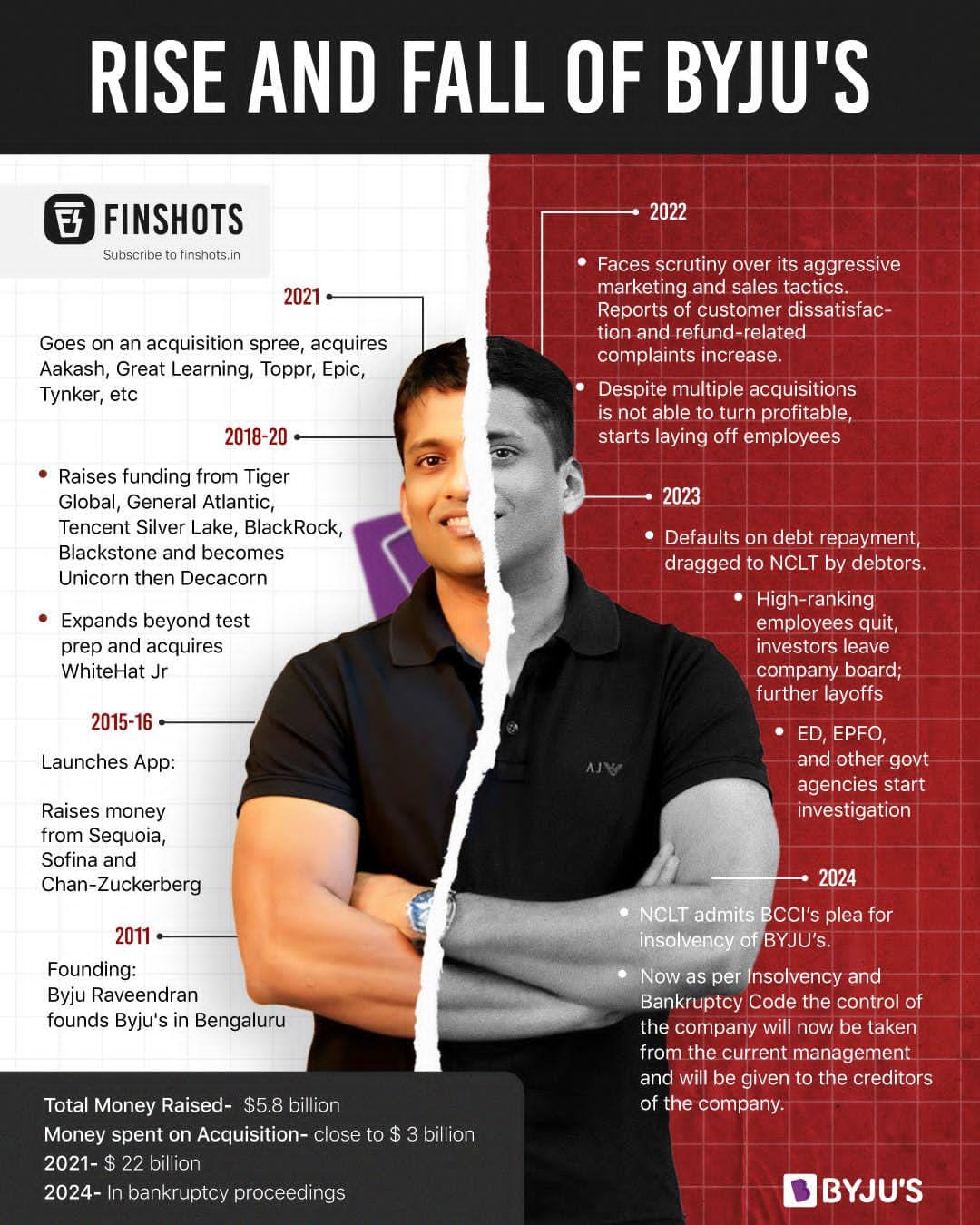

As of October 2024, the ed-tech company Byju's is valued at zero. The company's founder, Byju Raveendran, stated that the company's valuation has plummeted to zero. Explanation Byju's was once valued at $22 billion. The company's valuation dropped due to a number of factors, including the global market crash, regulatory scrutiny, and increasing competition. Byju's founder said that the company's acquisition of more than two dozen businesses to grow into new markets was disastrous. The company was unable to secure new funding after some of its important backers left the board. The company's aggressive expansion strategy, characterized by numerous acquisitions, came under scrutiny. The company faced regulatory scrutiny and increasing competition in the Indian ed-tech sector.

Replies (1)

More like this

Recommendations from Medial

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

BYJU's: India's Ed-Tech Leader with a Twist BYJU'S, a household name in India, is the country's leading ed-tech company. Founded in 2011, it offers personalized online learning programs for K-12 students and competitive exam prep for aspirants of II

See More

Rishav Kumar

🚀 Aspiring Entrepre... • 12m

Byju's: From EdTech Unicorn to Insolvency Woes - What Went Wrong? Remember when Byju's was the poster child of the Indian startup ecosystem? "Padhai ka superhero," they called it! But fast forward to 2025, and the narrative has taken a dramatic tu

See More

Swapnil gupta

Founder startupsunio... • 8m

😱 Risks and Challenges Ahead for Facebook 1. Regulatory Scrutiny: Increasing government oversight on privacy practices. 2. Competition from Emerging Platforms: TikTok's rapid growth poses a threat. 3. Technological Barriers: Scaling AR/VR hardwa

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)