Back

Karunakar

1% Better • 1y

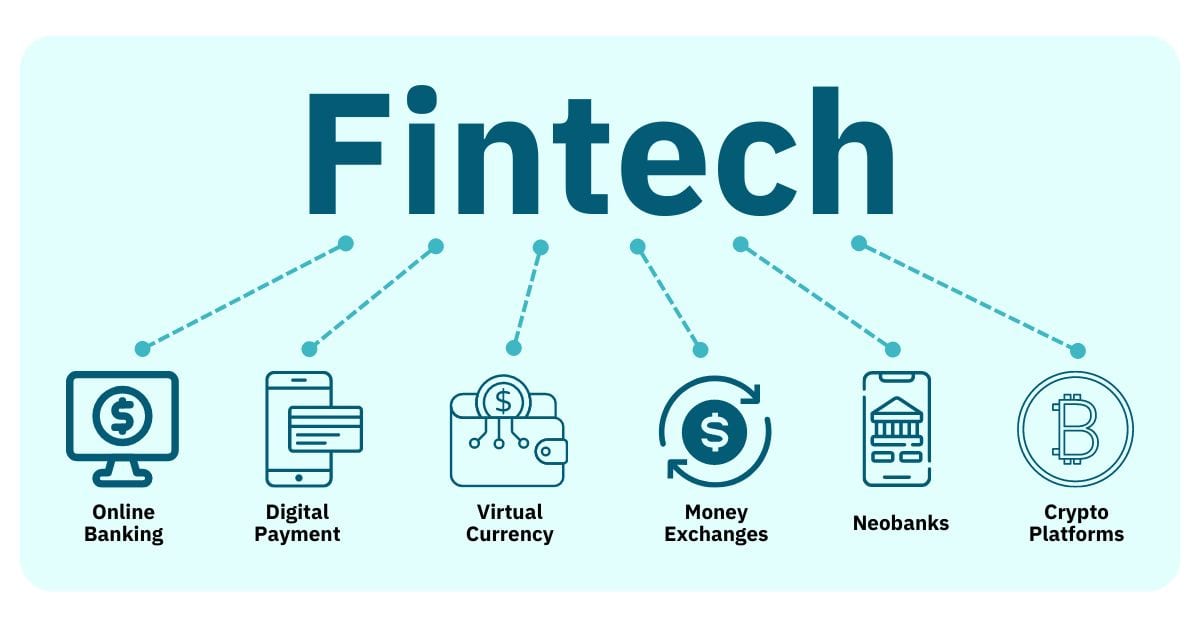

🚀 This Week in Startups & Investments (Jan 25–31, 2025) 🔥 The startup ecosystem continues to evolve, with major funding rounds, strategic shifts, and industry trends shaping the landscape. Here’s what’s making waves: 💰 Big Funding Rounds: Startups across sectors secured significant investments, fueling innovation and expansion. 📉 Sequoia Capital Reduces Crypto Fund: As the market tightens, Sequoia is shifting focus—what does this mean for crypto startups? 📊 Wiz Names New CFO Pre-IPO: Cybersecurity giant Wiz is gearing up for a public debut—a move to watch! 🎓 Older Entrepreneurs Turning to Executive MBAs: More founders over 54 are leveraging EMBA programs to launch their startups—proving it's never too late to build! 🇪🇸 Madrid Surpasses Barcelona in Startup Investments: With €605M raised in 2023, Madrid is booming—especially in mobility & fintech. 🏆 Australia’s Top 100 Innovators of 2024: A diverse lineup of founders and companies is reshaping industries. 💡 Fintech Startups to Watch: Despite challenges, 49 fintech disruptors are making bold moves in banking & payments. 📈 Cobee’s Growth Before Acquisition: The Spanish startup hit €5.58M revenue before its Pluxee (Sodexo) acquisition. 🔄 Brex’s Strategic Shift & Layoffs: A new leadership structure and cost-cutting measures signal a reshaped fintech strategy. 🤖 DeepSeek’s AI Expansion: The hedge fund background of DeepSeek’s founder is fueling an AI-driven breakthrough. 🔥 The startup world never stops moving. Which of these stories caught your attention the most? Drop your thoughts below! 👇 #Startups #Investment #VentureCapital #Innovation #Fintech #TechTrends

Replies (3)

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 11m

Google in Talks to Acquire Cybersecurity Startup Wiz for $30 Billion Google (Alphabet) is reportedly in advanced discussions to acquire Wiz, a cybersecurity startup, for a whopping $30 billion—potentially making it Google’s largest acquisition ever.

See More

gray man

I'm just a normal gu... • 11m

Alphabet Inc., Google's parent company, has agreed to acquire cybersecurity startup Wiz for $32 billion in cash. This acquisition, the largest in Alphabet's history, aims to integrate Wiz's security platform into Google Cloud's infrastructure while

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)