Back

Account Deleted

Hey I am on Medial • 1y

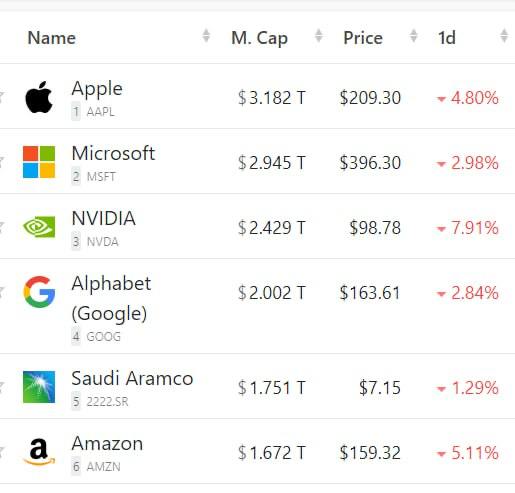

🚨 NVIDIA on course to lose $350 billion in market value based on pre-market trading; shares drop up to 7%.

2 Replies

1

15

Replies (2)

More like this

Recommendations from Medial

DIVYANSHU MHATRE

Work on your ideas • 1y

Nvidia CEO Jensen Huang's net worth has surged from $3 billion to $90 billion in the past five years, primarily due to the soaring value of Nvidia shares. On Thursday, Nvidia's stock reached a record high, boosting Huang's stake value by $7.7 billio

See More Reply

5

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)