Back

The next billionaire

Unfiltered and real ... • 1y

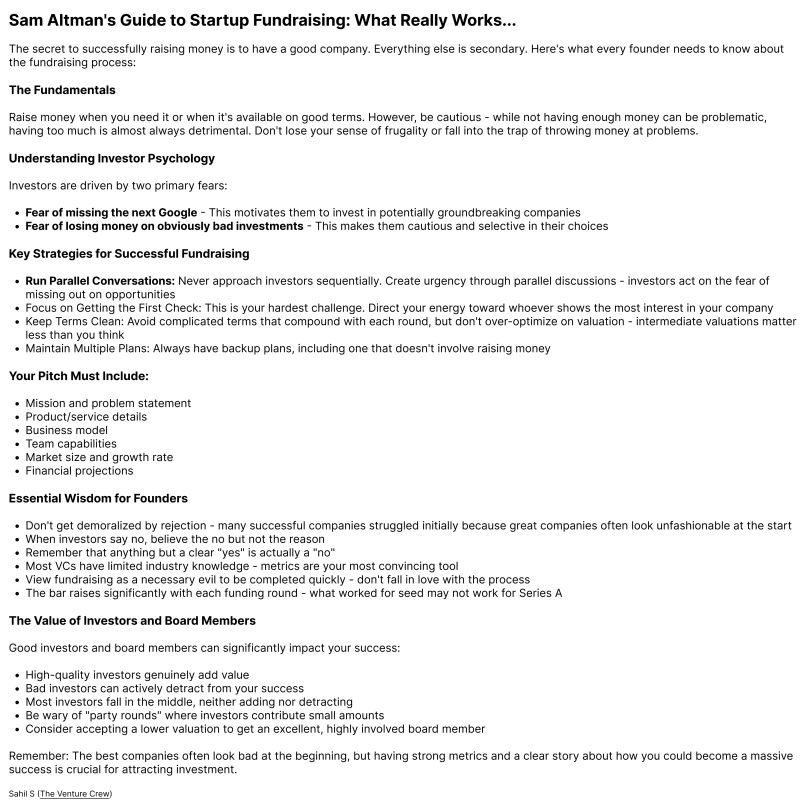

Sam Altman's Guide to Startup Fundraising: What Really Works... "Raise money when you need it or when it's available on good terms. However, be cautious - while not having enough money can be problematic, having too much is almost always detrimental. Don't lose your sense of frugality or fall into the trap of throwing money at problems. To raise funding successfully, you need to understand the psychology of investors. Investors are often driven by two primary fears: 1️⃣ Fear of missing the next Google - This motivates them to invest in potentially groundbreaking companies. 2️⃣ Fear of losing money on obviously bad investments - This makes them cautious and selective in their choices. But here's what most founders get wrong: → They pitch sequentially instead of creating urgency through parallel conversations. → They focus too much on valuation instead of finding the right partners → They get demoralized by "no's" without realizing many successful companies looked unfashionable at first → They overcomplicate their story when metrics speak louder than words So, what's the best strategy to raise money? What must your pitch include to stand out? Why do some bad-looking companies get funded while good ones don't? How can you tell if an investor is genuinely interested? When should you accept a lower valuation? Credit: Sahil S/linkedin

Replies (13)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 5m

Common fears startup founders go through: Fear of failure – pouring years of effort and savings only to see it collapse. Fear of running out of money – not being able to raise funds or generate revenue in time. Fear of rejection – investors, custo

See More

Rohan Saha

Founder - Burn Inves... • 7m

Meesho’s officially filed its DRHP with SEBI they are planning to raise ₹4,200 crore. But honestly the real question is the valuation If they are pulling in that kind of money you know the valuation's gonna be massive and if they are pricing the IPO

See MoreSairaj Kadam

Student & Financial ... • 10m

The #1 reason customers don’t buy from you? Fear. Fear of wasting money. Fear of being disappointed again. Fear of making another bad decision. Your job: Build so much trust and credibility that doubt dies. Leave them thinking: "This will work. It al

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)