Back

Havish Gupta

Figuring Out • 1y

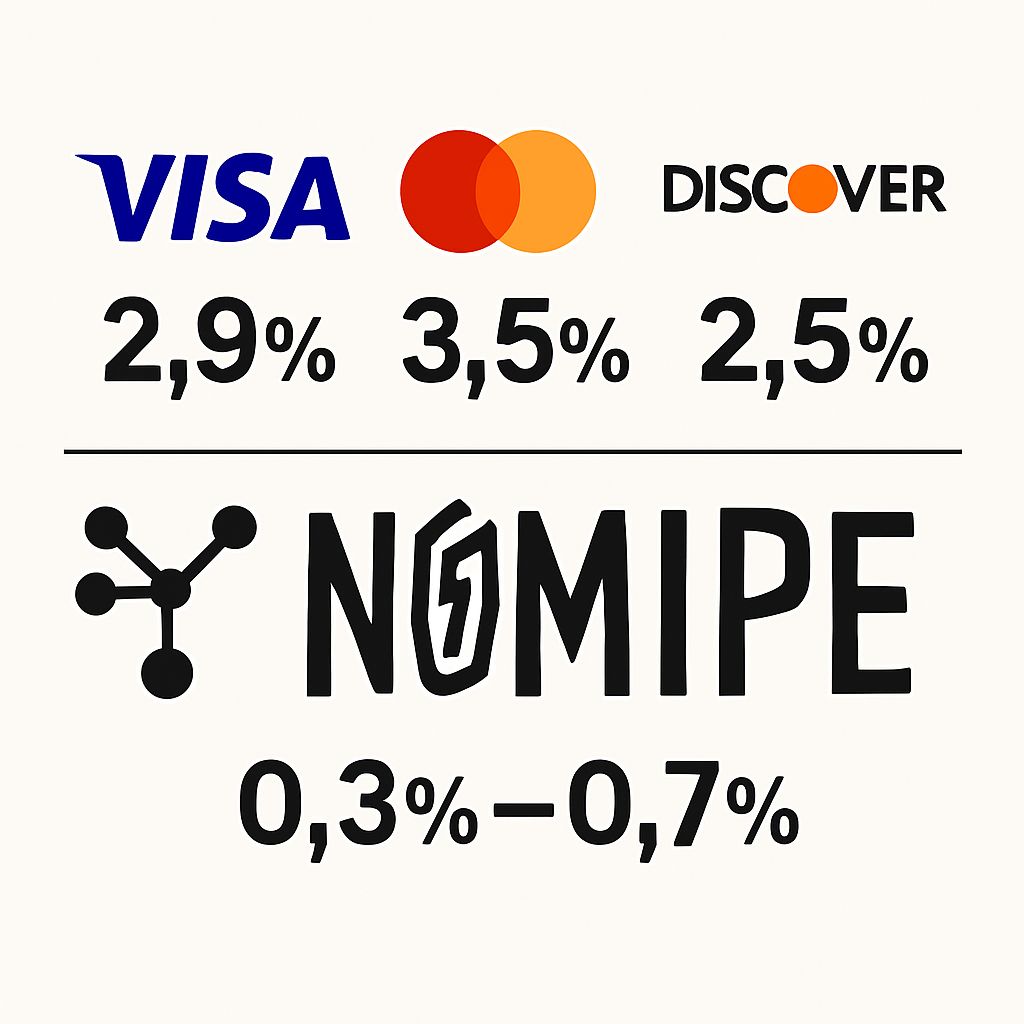

This Company Powers PayPal and Stripe! But How? So the story starts in 2013, when Zach and William tried to build consumer financial management app, including a budgeting and bookkeeping software. However, they soon realized a much bigger problem: And it's that it’s very difficult to connect with bank's servers for various tasks. This led them to pivot and focus on solving that problem by working on bank APIs. And that’s how Plaid was born! Plaid is an API company that provides access to a range of tools such as bank account linking, balance checks, bank-to-bank payments, identity verification, credit score checking, and much more. It’s like an all-in-one solution for devs, providing everything they need for working with banking and financial services. Plaid’s seamless experience is the reason why even multi-billion dollar startups like Stripe and PayPal use Plaid’s API for their services. And thus what started as a budgeting app with $2.8 million in seed funding is now valued at $13.4 billion, with revenue exceeding $300 million. Its currently operational primarily in North America and Europe. Visa also attempted to acquire Plaid for $5.3 billion, but the deal was blocked due to U.S. competition regulations. Can such company rise in India As well? What do you think?

Replies (5)

More like this

Recommendations from Medial

Ashish Singh

Finding my self 😶�... • 1y

🚀Stripe, the Y Combinator startup and leading payment processing company, is expected to go public in early 2025. 🌐Key Details -- Valuation: After a drop from $95 billion in 2021 to around $50 billion in 2023, Stripe's valuation is projected to re

See More

Havish Gupta

Figuring Out • 1y

How Two Brothers Built a $100B Company! This is the story of Patrick Collison and John Collison, two Irish brothers with a passion for technology and entrepreneurship. In 2010, the Collison brothers were frustrated by the complexity of online payme

See More

Mayank Kumar

Strategy & Product @... • 1y

Ending the day with this. Happy reading! The Rise of Unicorn Startups: What’s Next? Unicorn startups—those valued at over $1 billion—are reshaping industries. Companies like Airbnb, Stripe, and ByteDance have set new standards. But what's next?

See MoreKolkata Index

News on Infrastructu... • 1y

☀️How Stripe Secured Its First Funding: A Pre-Seed Success Story In 2010, brothers Patrick and John Collison had a vision to simplify online payments. Their startup, Stripe, aimed to provide developers with seamless tools to accept payments. But ge

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)