Back

Shubman Gill

COME, JOIN THE FORCE... • 1y

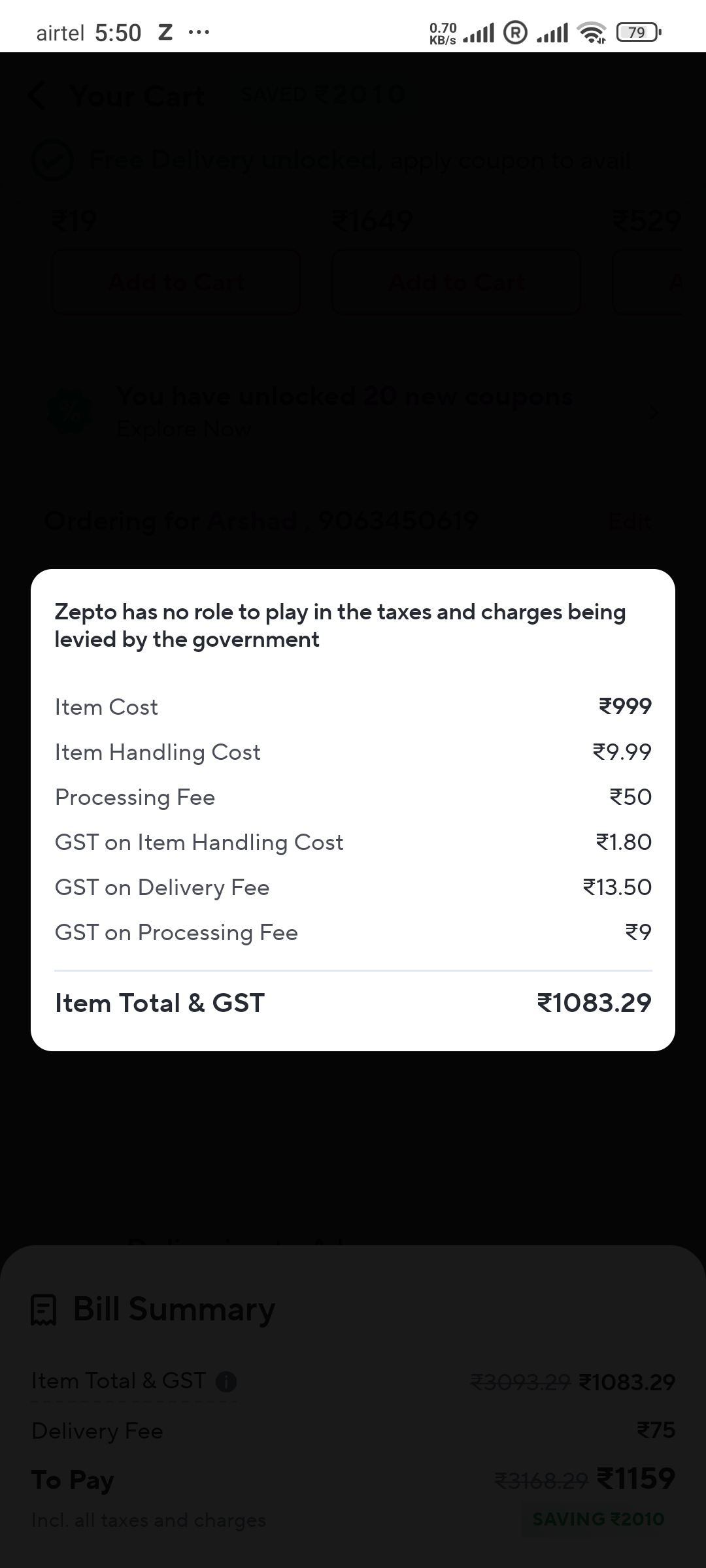

Govt. regulations, or should we say because of ITC

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Sattenapalli Mani Bhavan

•

10X Technologies • 10m

Any VC or Angel recommendations or fundraising help for 60Lakhs for developing, MVP of World's first AI powered smart speaker? Where should we reach out to and all? most early stage VCs say no and say our cheque size is too small, they invest big mon

See More Reply

12

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Reply

2

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)