Back

The next billionaire

Unfiltered and real ... • 1y

What to Include in a Data Room for Investors: Essential Guide for Startups : Building an Investor Data Room: When to Share What with Investors Never share all company data upfront - even if investors request immediate data room access. Instead, follow a strategic two-stage sharing process aligned with investor commitment levels. Stage 1: Pre-Term Sheet (Share After Initial Interest) Share only after positive first calls and clear investor engagement: Early Sharing (Immediately After Good First Call): - One-page business overview - Current pitch deck (PDF) - Company website and social media links - High-level team structure with key roles - Basic traction metrics and customer data Secondary Sharing (After 2-3 Positive Discussion Rounds): - Market sizing data and competitive analysis - High-level financial metrics showing growth - Basic cap table summary - Customer acquisition metrics (CAC, LTV) - Product-market fit indicators Stage 2: Post-Term Sheet (Share Only After Receiving Term Sheet) Never share these before getting a term sheet: Legal & Corporate: - Full incorporation documents - Board meeting minutes - Operating agreements - Detailed shareholder agreements Financial & Operational: - Detailed financial models and projections - Complete cap table with all investor details - Employee stock option plans - Tax returns and audit reports Contracts & IP: - Customer and vendor contracts (>$25K) - All intellectual property documentation - Patent and trademark filings - Property leases Sensitive Information: - Detailed technology documentation - Employee agreements and compensation - Pending litigation details - Strategic roadmaps Best Practices: 1. Use Google Drive - it's secure enough for early-stage startups. 2. Create separate folders for Stage 1 and Stage 2. 3. Only grant access to specific folders based on deal progress. 4. Track who accesses what and when. 5. Always password-protect sensitive documents. Red Flags to Watch: - Investors demanding Stage 2 data before meaningful engagement - Requests for sensitive information without clear investment intent - Pushing for technical details before business alignment Remember: Information sharing should mirror investor commitment. The more serious they become, the more data you share. This protects your company while maintaining professional investor relationships. Credits: Sahil S/linkedin

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 5m

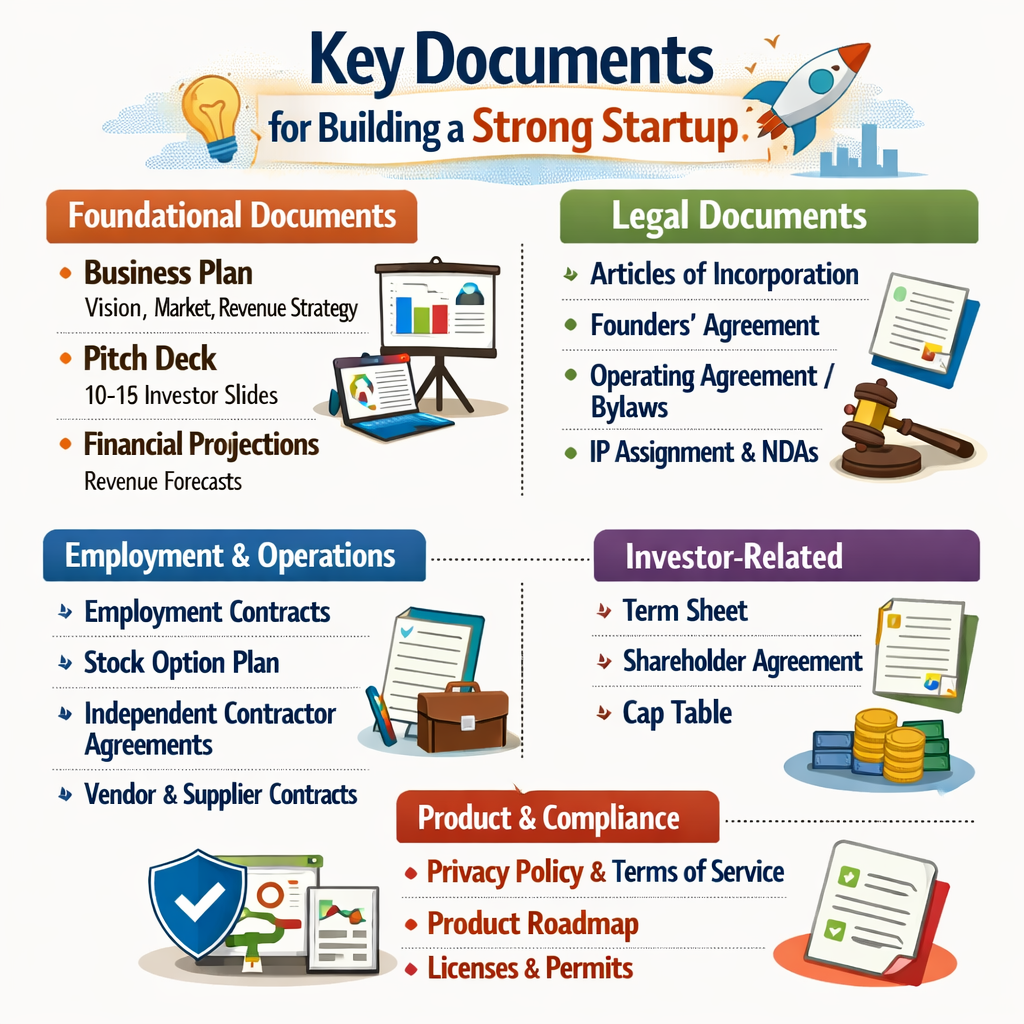

Quick, step-by-step guide to the essential documents you need before the first investor intro — from pitch to close — all in 1:30 for YouTube Shorts. Start with a crisp Pitch Deck and Executive Summary, then a clean Cap Table and 12–24 month Financia

See MoreChintan Udani

I'm a pro medialist • 7m

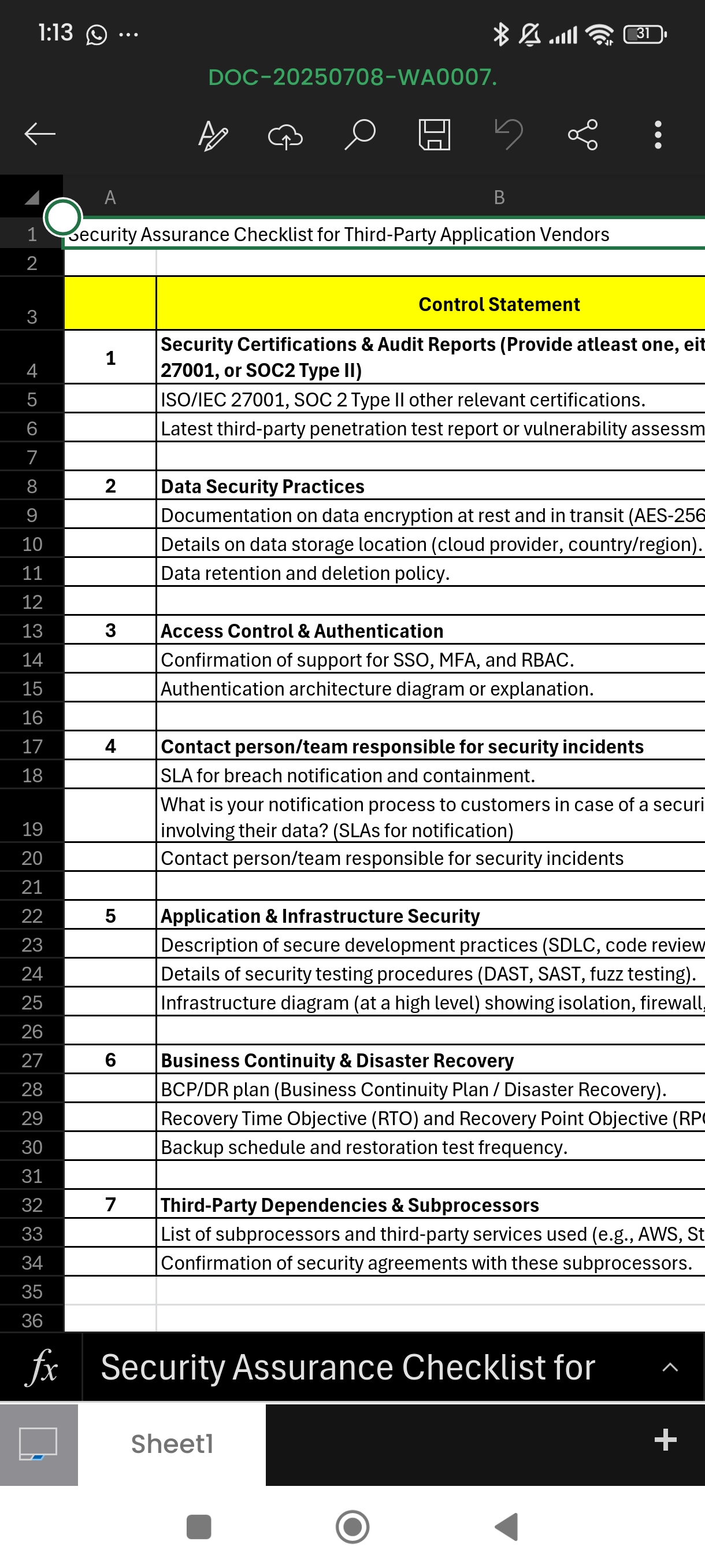

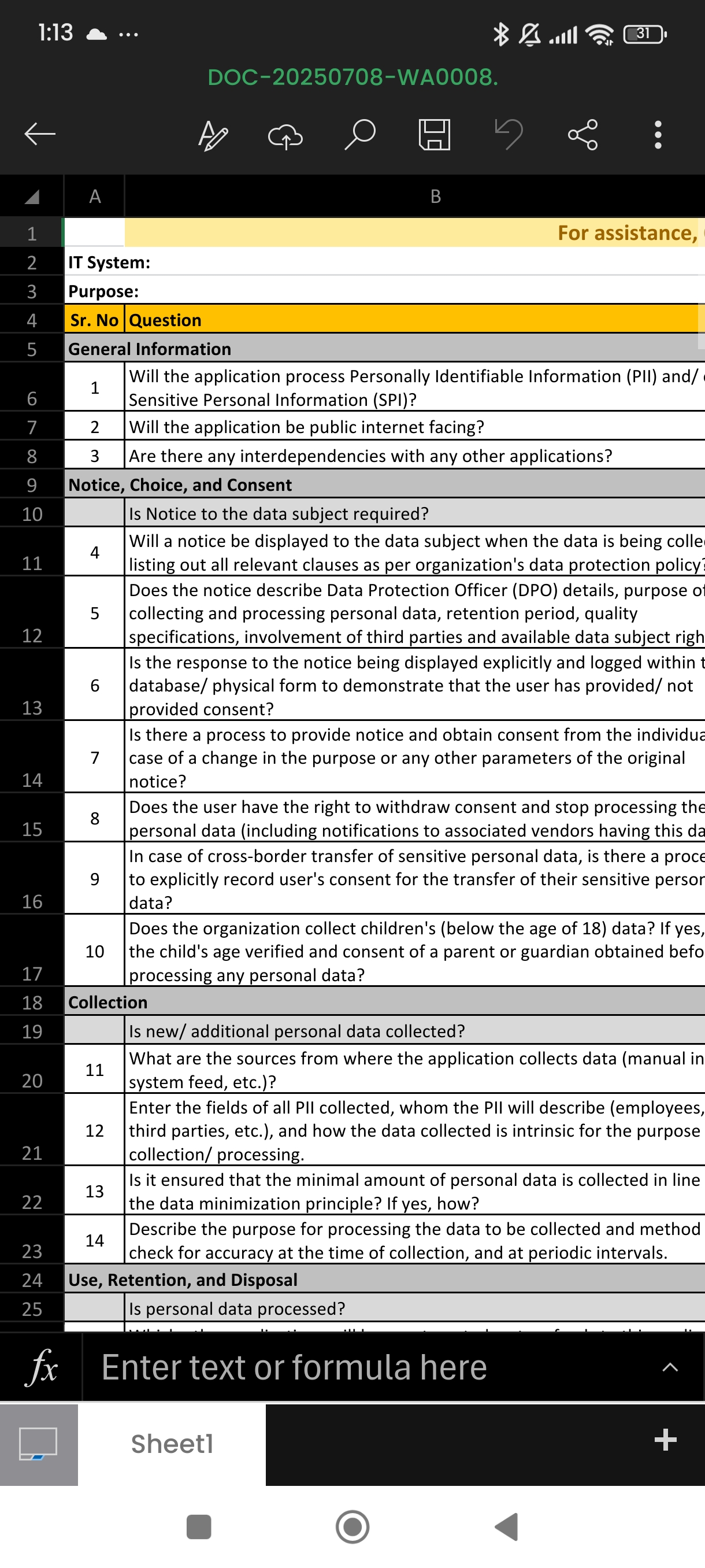

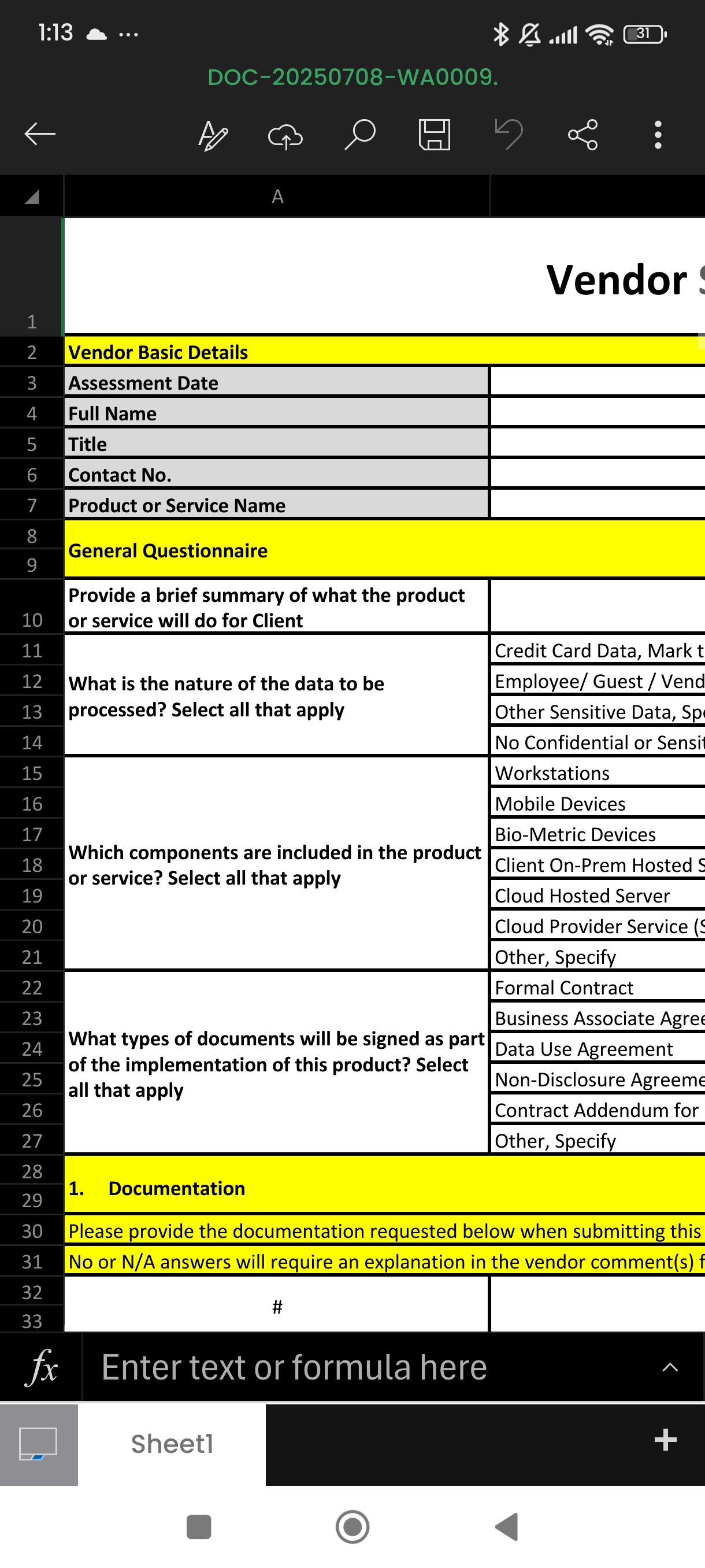

sharing here a preview of the compliance list you have to go through to get type 2 soc, ISO and HIPAA and other certificates of security of data. And the best part, AI doesn't give a shit about all of these things while creating apps! In fact most pe

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)