Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

50% Agreed but you need to understand the dynamics of seed funding and it's all about how you develop you MVP or gained traction for showing credibility and making time convince for getting good deal for both

More like this

Recommendations from Medial

SHRINIVAS REDDY

Prompt engineering, ... • 1y

I think Securing investment can be challenging for non-IIT alumni, as they may lack the established networks and credibility of IIT graduates. However, a strong business model, clear market potential, and demonstrated traction can help attract invest

See More

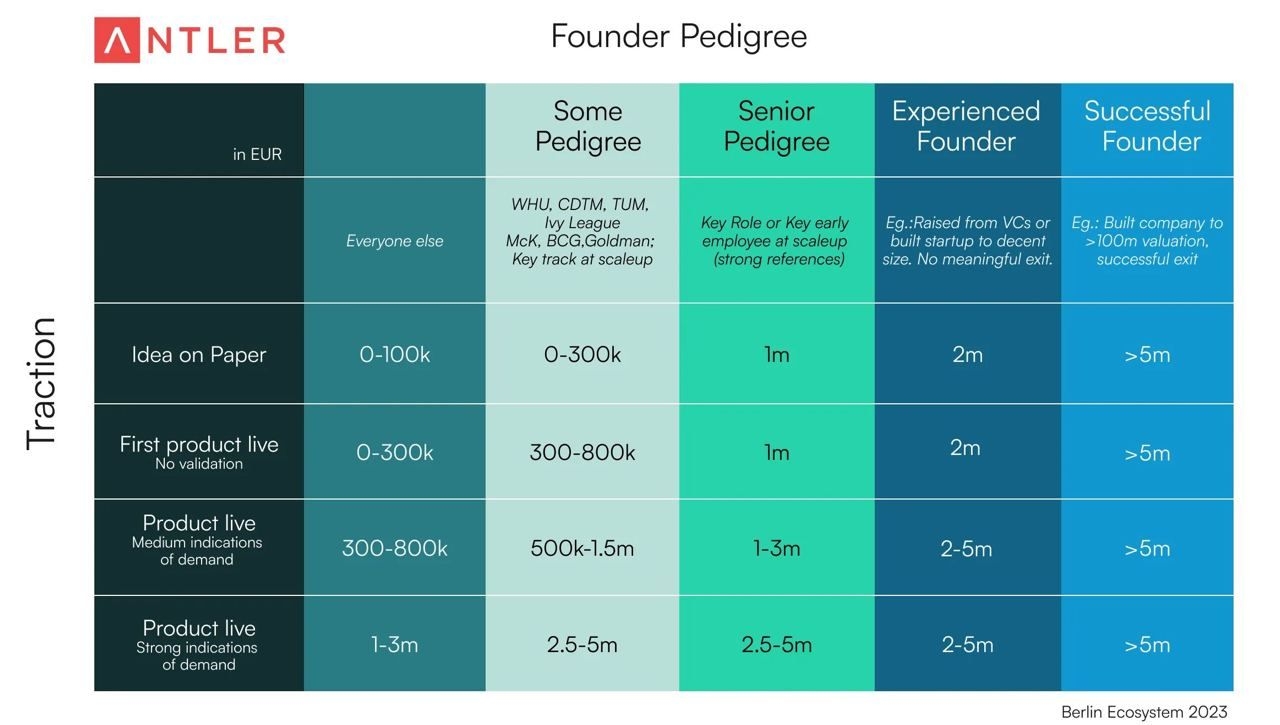

Kavish Goyal

Aspiring Entrepreneu... • 1y

Top 10 accelerators that you can apply at a super early stage 👇 1. Y Combinator | Pre-Seed, $500k for ~10% 2. Entrepreneur First | No team, $250k for ~9% 3. South Park Commons| Pre-Idea, $1M 4. Antler Global | Pre-Seed, $250k for 9% 5. Sequoia

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)