Back

Havish Gupta

Figuring Out • 1y

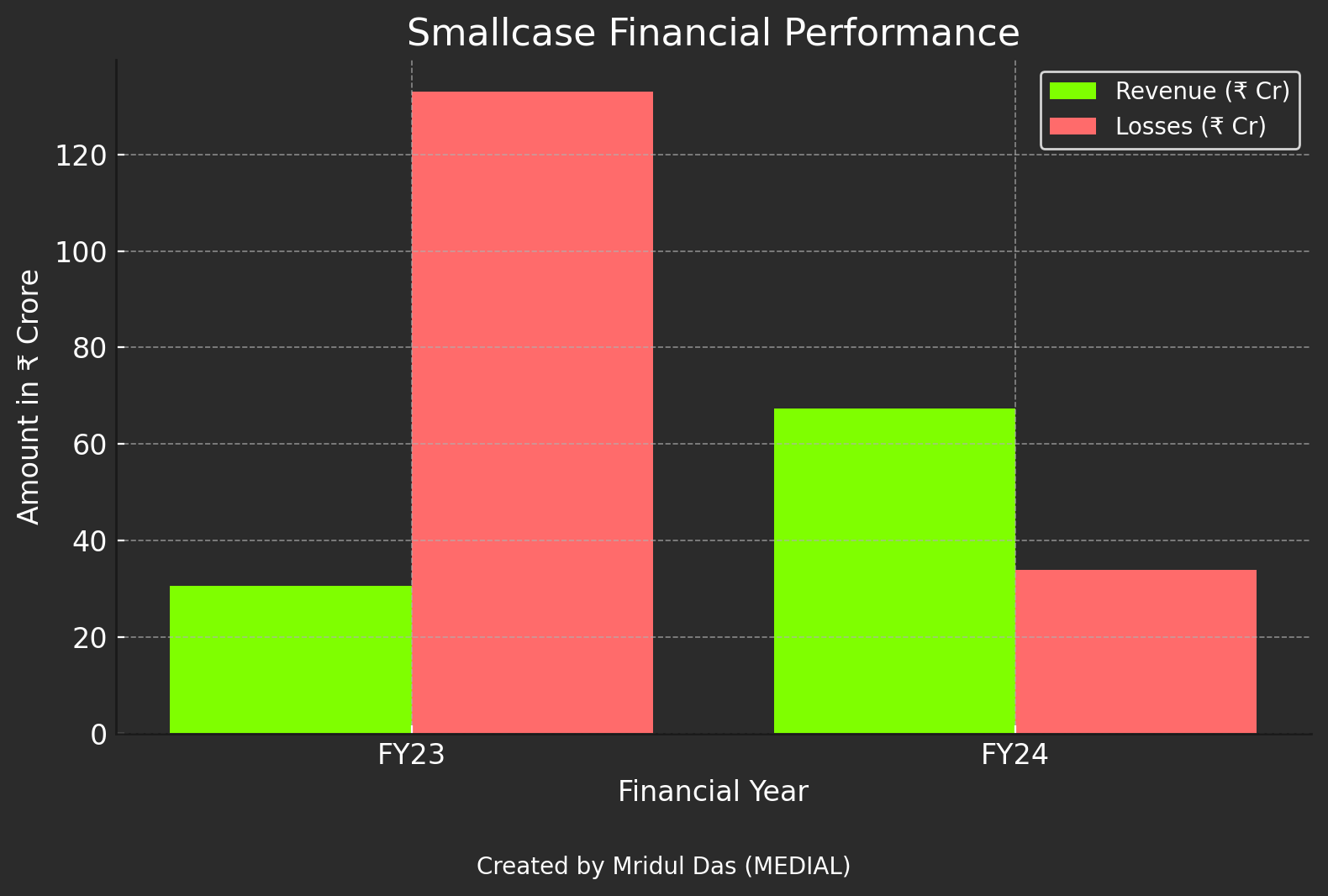

Maybe. And also as an investor, you are just looking for that 1 huge exist (like Facebook) which will pay off all the losses so investing even at higher valuation makes sense.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 11m

PW India's Most Valuable Edtech Startup! • PW (PhysicsWallah) has raised a pre-IPO $25 million round led by existing investors like WestBridge Capital at a valuation of $3.7 billion. • In September 2024, PW raised a $210 million Series B round led

See More

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

BYJU's: India's Ed-Tech Leader with a Twist BYJU'S, a household name in India, is the country's leading ed-tech company. Founded in 2011, it offers personalized online learning programs for K-12 students and competitive exam prep for aspirants of II

See More

Shanu Chhetri

CS student | Tech En... • 6m

Zoho just acquired Kochi-based Asimov Robotics, a startup that makes robots for hospitals and industries, to boost its AI and robotics R&D in India. Asimov’s last known valuation was ₹2.5 crore (2015), but by May 2025, their annual revenue was around

See More

Tushar Aher Patil

Trying to do better • 7m

📍 Day 1 – Startup World Surprise: The Unicorn Illusion When we hear the word "unicorn startup", we instantly think of success — billion-dollar valuation, flashy media coverage, and a seemingly unstoppable growth story. But here's a surprising truth

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Download the medial app to read full posts, comements and news.