Back

Sairaj Kadam

Student & Financial ... • 1y

Hey guys! Just had a realization about how credit really works, and I think it's something every aspiring entrepreneur should know! So, I’m about to dive into my CA studies, and while doing some pre-study research, I came across some pretty crazy insights about credit. Here’s the big takeaway: credit isn’t just for taking loans or paying bills – it’s actually a powerful tool you can leverage in all kinds of ways, like launching businesses, making big investments, and scaling up projects. Think about this: when Elon Musk bought Twitter, do you think he used only his own cash? Nope! He built his portfolio, showed proof of assets, and used credit to fund a massive acquisition. That’s how top players move. And yes, it’s risky – but with the right knowledge and a strong gut, it’s a game-changer. Now, here’s what I’m learning about using credit effectively: 1. Know Where You’ll Invest – Before you take any loan, be clear on where you’re putting that money and the potential returns. Every decision should have a strategy behind it. 2. Choose Your Lender Wisely – Whether it’s a bank or other sources, find out who’s offering you the best deal. Consider factors like interest rates, repayment terms, and flexibility. 3. Set the Right Time Frame – Time is everything. If you’re borrowing, make sure you’re prepared to pay it back within the terms, regardless of cash flow. The lender doesn’t care if your plan works out or not – they just want their money back on time. If you’re driven, informed, and a bit bold, using credit can be a smart way to fuel your goals. Just remember, the more prepared you are, the better you can handle the risks involved. Let me know what you think – is this a strategy you’d be open to trying? Drop a comment below! Don’t judge me for just including all of this in very small words or sentences. I just framed it in a condensed way. If you want to see this in more detail, let me know.

Replies (3)

More like this

Recommendations from Medial

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Credit Credit is a kind of loan handed out by financial institutions to businesses and individuals. You can think of it as the ability you have to borrow resources from a lender to pay at a later date, with interest for usin

See MoreOnly Buziness

Everything about Mar... • 4m

Ever wondered why you end up buying the “medium” popcorn at the theatre instead of the small one? That’s the Decoy Effect at work—a pricing illusion so sneaky it makes you think you’re choosing wisely. Businesses add a third “decoy” option just to pu

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 8m

🤖 I asked GPT one question — and it EXPOSED the AI game. Me: "Why is AI free when it costs billions to build? Are we the product?" GPT: “You really want the truth?” What it told me next lowkey felt illegal to know. 👇 🔍 AI is NOT free. It’s stra

See More

Jaskaran Singh

Content Writer | Con... • 1y

YouTube isn’t just a passion anymore – it’s a business. 💼 (No matter what business you’re in, you’re in the marketing business.) 🎯 Here are 4 essential tips to boost your growth: 📈 1. Know your audience If you don’t know who you’re talking to,

See MoreSairaj Kadam

Student & Financial ... • 1y

When you think about advertising, what comes to mind? For me, it’s a mix of emotions—sometimes it’s that one ad that tells a great story, connects deeply, and stays with you. Other times, it’s just noise, fighting for attention in a world that’s alr

See MorePriyansh Khimani

AI Automation | Grow... • 11m

Jobs ≠ Rat Race Not every job is a rat race. When you hold a reputable position in a top company, like a Product Manager at Microsoft or an IAS/IPS officer, you're not just working—you’re leading, making an impact, and earning respect. Success isn’t

See MorePulakit Bararia

Founder Snippetz Lab... • 11m

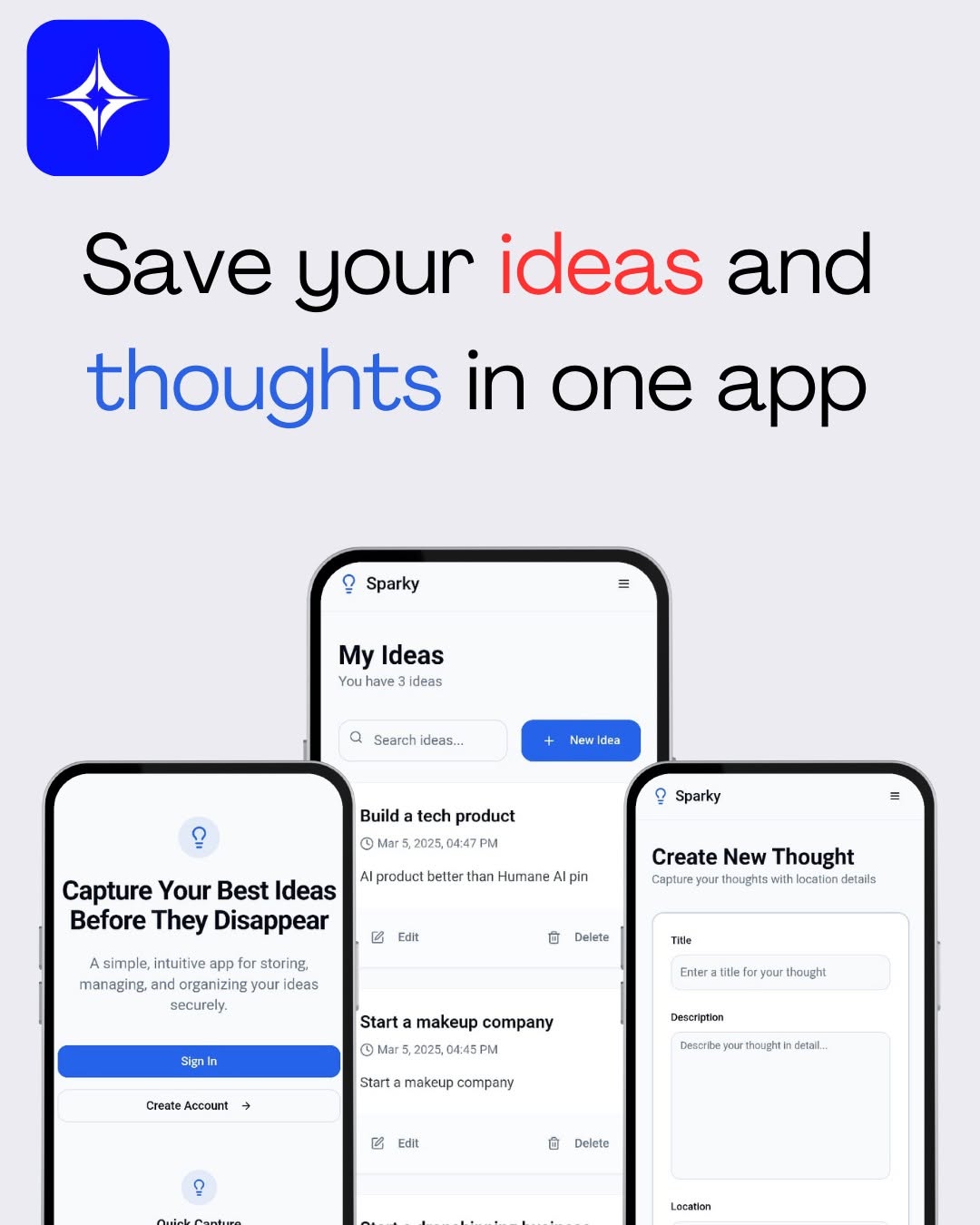

Sparky is finally released We’ve all been there. A brilliant idea strikes while you’re in the middle of something, and you think, I’ll remember this later. But later comes… and the idea is gone. Sparky was built for moments like this. It’s not just

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)