Back

Dr Sarun George Sunny

The Way I See It • 1y

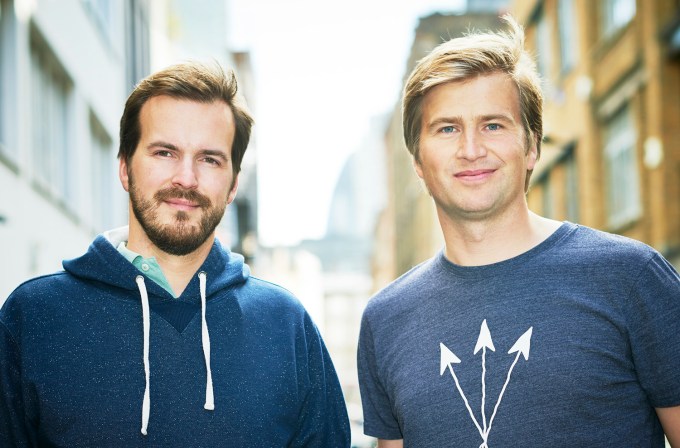

TransferWise: Revolutionizing Global Money Transfers In 2011, Estonian friends Taavet Hinrikus and Kristo Käärmann faced a common frustration: high fees and poor exchange rates every time they transferred money internationally. Taavet, earning in euros but living in London, needed pounds, while Kristo, earning in pounds but paying a mortgage in Estonia, needed euros. Traditional bank transfers were costly, with hidden fees and marked-up rates. Seeking a better solution, they began “swapping” currencies directly: Taavet would send euros to Kristo’s Estonian account, and Kristo would send pounds to Taavet’s UK account. They avoided bank fees and got fair rates. Seeing potential to help others, they founded TransferWise. How TransferWise Works TransferWise introduced a peer-to-peer model for currency exchange, bypassing traditional bank fees. Rather than moving money internationally, TransferWise matches users needing to send one currency with others who need the opposite. For instance, a UK user sending pounds to the U.S. is matched with a U.S. user sending dollars to the UK. Both exchange at the real mid-market rate, avoiding inflated rates and hidden charges. TransferWise charges a small, upfront fee, making it more affordable and transparent. Transparency became TransferWise’s core advantage. Unlike banks that mark up exchange rates and add hidden fees, TransferWise displays the real rate upfront, listing any fees clearly. This transparency resonated with users tired of traditional banking practices. Gaining Trust and Growing Building trust in a new international transfer service was challenging. TransferWise emphasized simplicity and transparency, showing exact rates and fees upfront. Satisfied customers shared their positive experiences, growing the company through word of mouth. High-profile investors like Richard Branson and Peter Thiel supported TransferWise, adding credibility and visibility. With strong customer feedback and backing, TransferWise quickly expanded. Expanding Services What began as a currency exchange concept grew rapidly. Today, Wise (formerly TransferWise) operates in over 70 countries, processing billions of dollars in transactions each year. Wise also introduced multi-currency accounts and debit cards, letting users hold and exchange money in multiple currencies and spend it easily abroad. These features made Wise a leading solution for international transfers for individuals and businesses alike. Key Lessons 1. Address Real Needs: TransferWise solved a common problem—high fees and unfair rates—giving it broad appeal. 2. Transparency Wins Loyalty: By showing real exchange rates and clear fees, TransferWise built strong customer trust. 3. Simple Models Scale: The peer-to-peer system allowed global growth with low costs. 4. Think Globally: TransferWise targeted international users from the start, building a scalable model.

More like this

Recommendations from Medial

DEVARAJ YADAV

Curious mind, relent... • 1y

TransferWise (now Wise) was founded in 2010 by Kristo Käärmann and Taavet Hinrikus as a solution to the high fees associated with international money transfers. The company's innovative peer-to-peer model quickly gained traction, leading to substanti

See More

Business Digital Twenty Four

Innovation | Insight... • 10m

TikTok Fined €600 Million for Data Breaches: What It Means for EU Users and Global Tech. European Regulators Crack Down on TikTok Over Data Transfers to China and GDPR Transparency Failures https://bdigit24.com/tiktok-fined-600-million-euros-for-ill

See MoreVijay Sahu

First Learn Then Ear... • 8m

I have a million dollars idea , Create a crypto broker company like Delta Exchange, jisme log Crypto me F&O trading kar sake becouse iss par 30% Tax nahi lagta hai , Ek already platform hai Delta Exchange but usme fees bahut jyada hai , 0.05% Buy and

See MorePR GRAPHIC'S

Hey I am on Medial • 1y

Startup Idea: "EcoSwap" - A Blockchain-based Circular Economy Platform for Sustainable Product Exchange Concept Overview: EcoSwap is a decentralized platform using blockchain technology to enable individuals and businesses to exchange pre-owned produ

See MoreVaibhav

Better to fail than ... • 11m

Building something that solves a real problem > Just building something." I started SafeBazaar because trust is the biggest barrier in peer-to-peer transactions. I’m also working on ReplyGenie, helping SMBs automate customer interactions with AI. T

See MoreSuprodip Bhattacharya

Entrepreneur || Star... • 1y

Posting again because more suggestions needed.Please provide your valuable suggestions and advices 1. Learning Pods: Notes, study partners, groups, instant tuition, doubt solving. 2. Global Hub: Colleges, scholarships, education systems, student rev

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)