Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

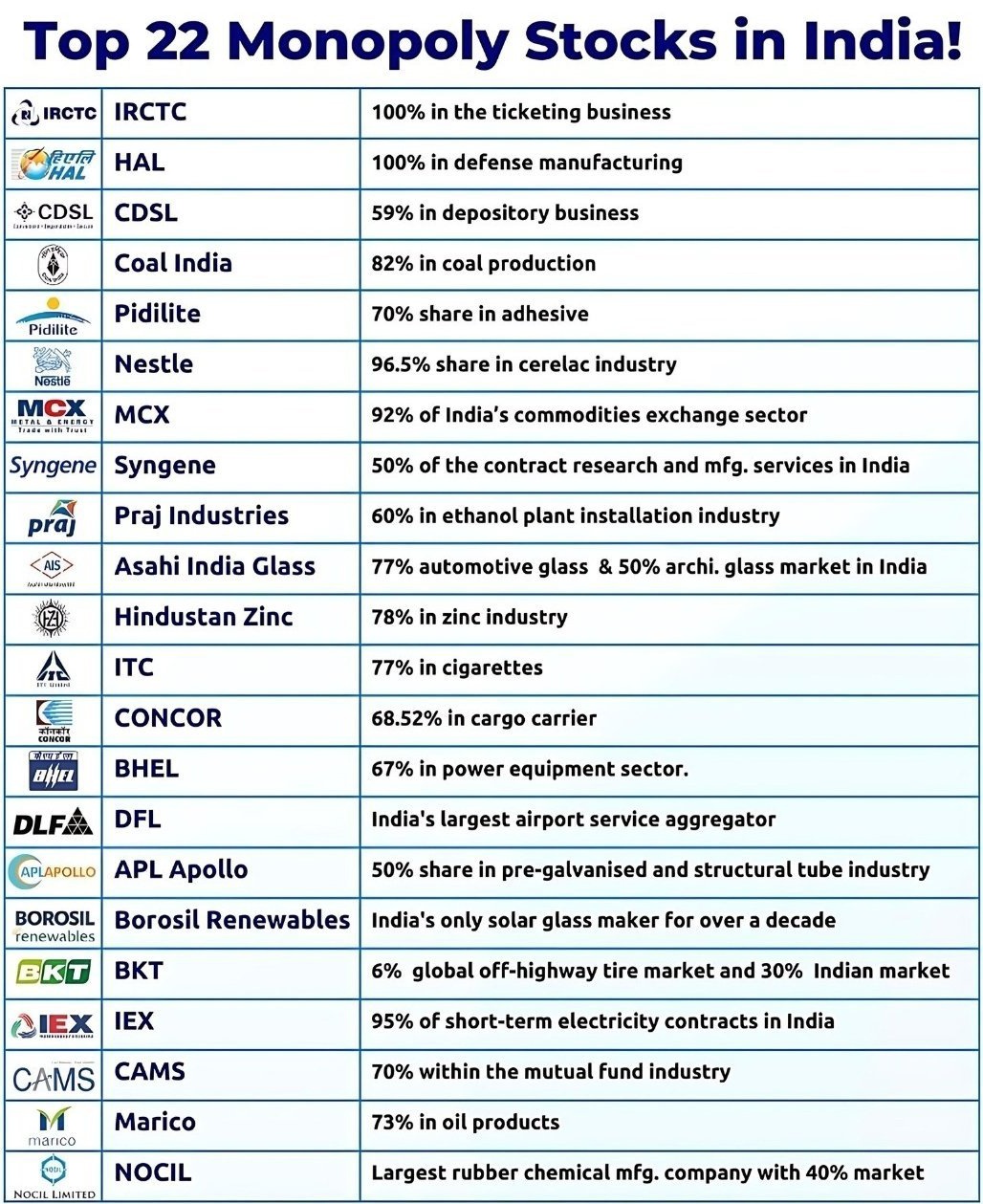

big share in small markets gives you monopoly advantage

1 Reply

1

3

Replies (1)

More like this

Recommendations from Medial

Sandip Kaur

Hey I am on Medial • 1y

The Art of Starting Small: Big Dreams, Small Steps- Dreaming big is essential, but the real magic happens when you start small. Here’s why: 1. Lower Risk: Small steps mean you can test your ideas without risking everything at once. 2. Learn as You

See More13 Replies

3

9

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)