Back

Anonymous 1

Hey I am on Medial • 1y

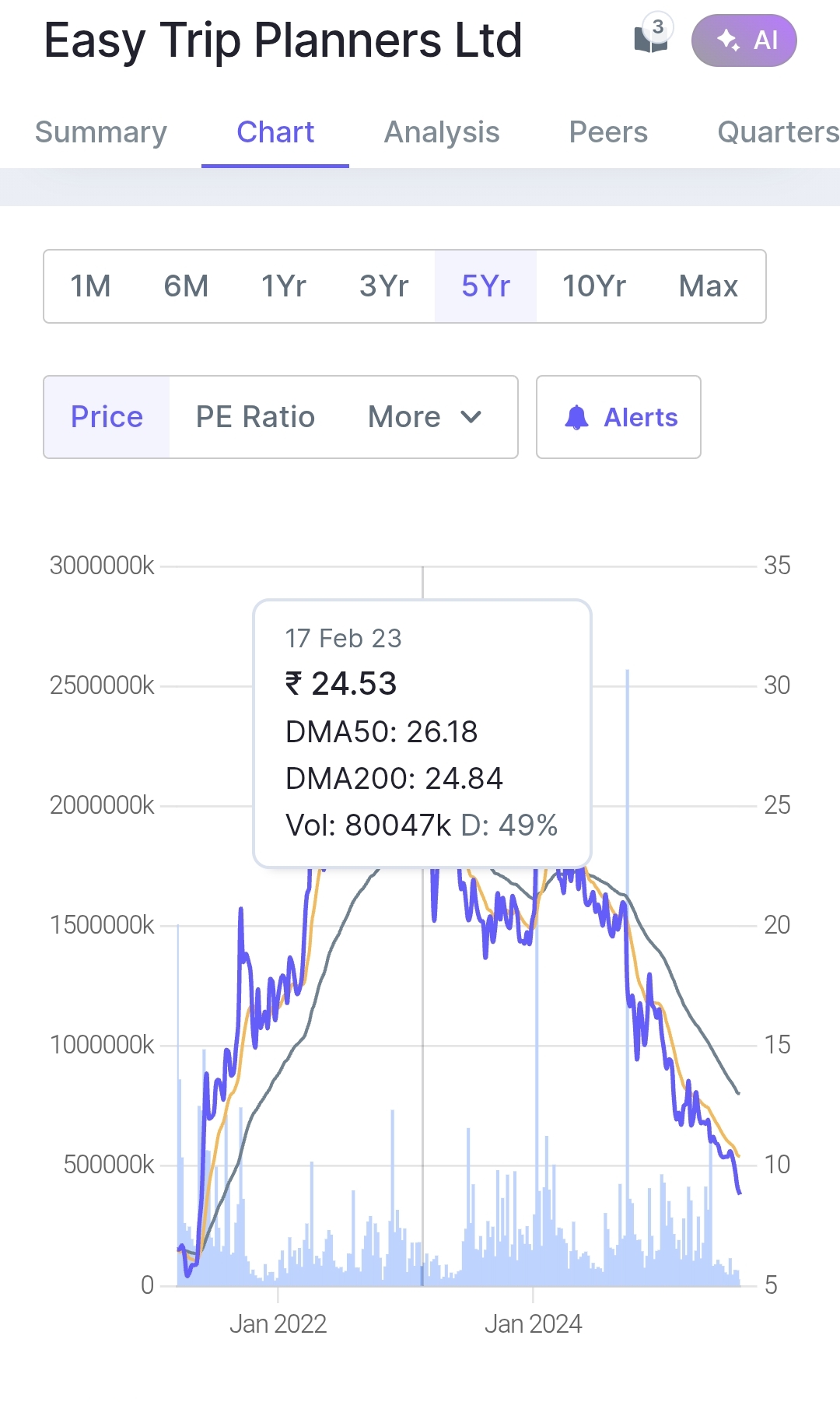

Ouch, that’s a tough hit, Wonder what a cringeworthy and weird call it must've been between the investors and the founders

More like this

Recommendations from Medial

Manik Gruver

•

Macwise Capital • 6m

Had an INCREDIBLE conversation with @JanhaviNagarhalli today! Thanks @medial_mentorship for connecting me to a wonderful founder. Here's what blew my mind: While most people complain about startup funding being "broken," Janhavi is actually BUILDING

See Moremanindra kumar pandey

Hey I am on Medial • 1y

Unlocking Success: Legal Solutions for Investors & Startups At Juristechlegal & Partner, we ensure seamless growth and compliance for investors and startups with tailored legal solutions. For Investors & VCs: ✔️ Compliance & Due Diligence ✔️ Struct

See MoreVedant Tiwari

Founder of VedspaceA... • 1y

India's One of most Anticipated Startup Bluelearn has to be shut down. Few days ago, CEO of Bluelearn release a official statement saying that Bluelearn is shutting down. Despite creating a vibrant community of over 250,000 students and raising $

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)