Back

Vikram Kumar

Founder at Stockware • 1y

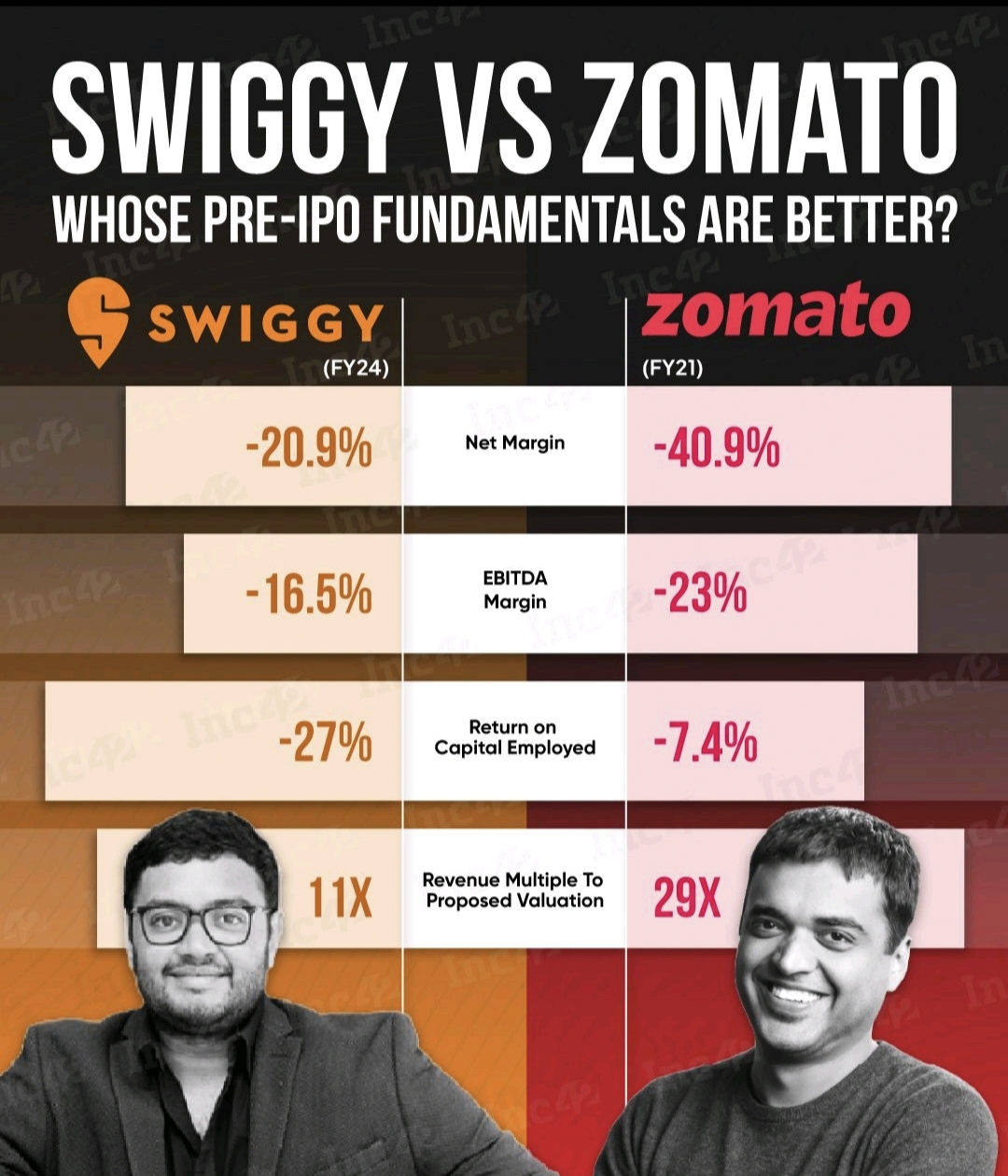

🚨 Zomato Exploring Cash Raise Through QIP! 🚨 I just came across an interesting development—Zomato is considering raising funds via a qualified institutional placement (QIP), marking its first funding move since its IPO in July 2021. This comes as Swiggy prepares for its own IPO, targeting $450 million in primary capital, with the option to go up to $600 million. As Zomato explores this, the company holds $1.5 billion in cash reserves as of June 2024 but recently spent $244 million to acquire Paytm's ticketing business. With both giants strategizing for growth, it’ll be exciting to see how these moves impact their competition in the food delivery market. #Zomato #Swiggy #IPO #QIP #FoodDelivery #Funding #Startup #BusinessStrategy #Investment

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

🚀 A Milestone Moment in the Food Delivery Industry! 🚀 Zomato congratulates Swiggy on their stock market debut! 🥳 This marks an incredible step forward for the industry, with two of India’s biggest food delivery giants now making waves in the fina

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

🎉 A historic moment for Swiggy! 🎉 Today marks a major milestone as Swiggy rings the bell at the NSE celebrating its entry into the stock market! 🛎️📈 This achievement is a testament to the dedication, hard work, and passion of the entire Swiggy t

See More

Sanskar

Keen Learner and Exp... • 1y

I thought that Swiggy was far behind than Zomato but in reality it is not as far as I thought. while scrolling YouTube I found this comparison table posted by GrowthX which shows the comparison between Swiggy and Zomato. What do you prefer Swiggy or

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)