Back

Aakash kashyap

Building JalSeva and... • 1y

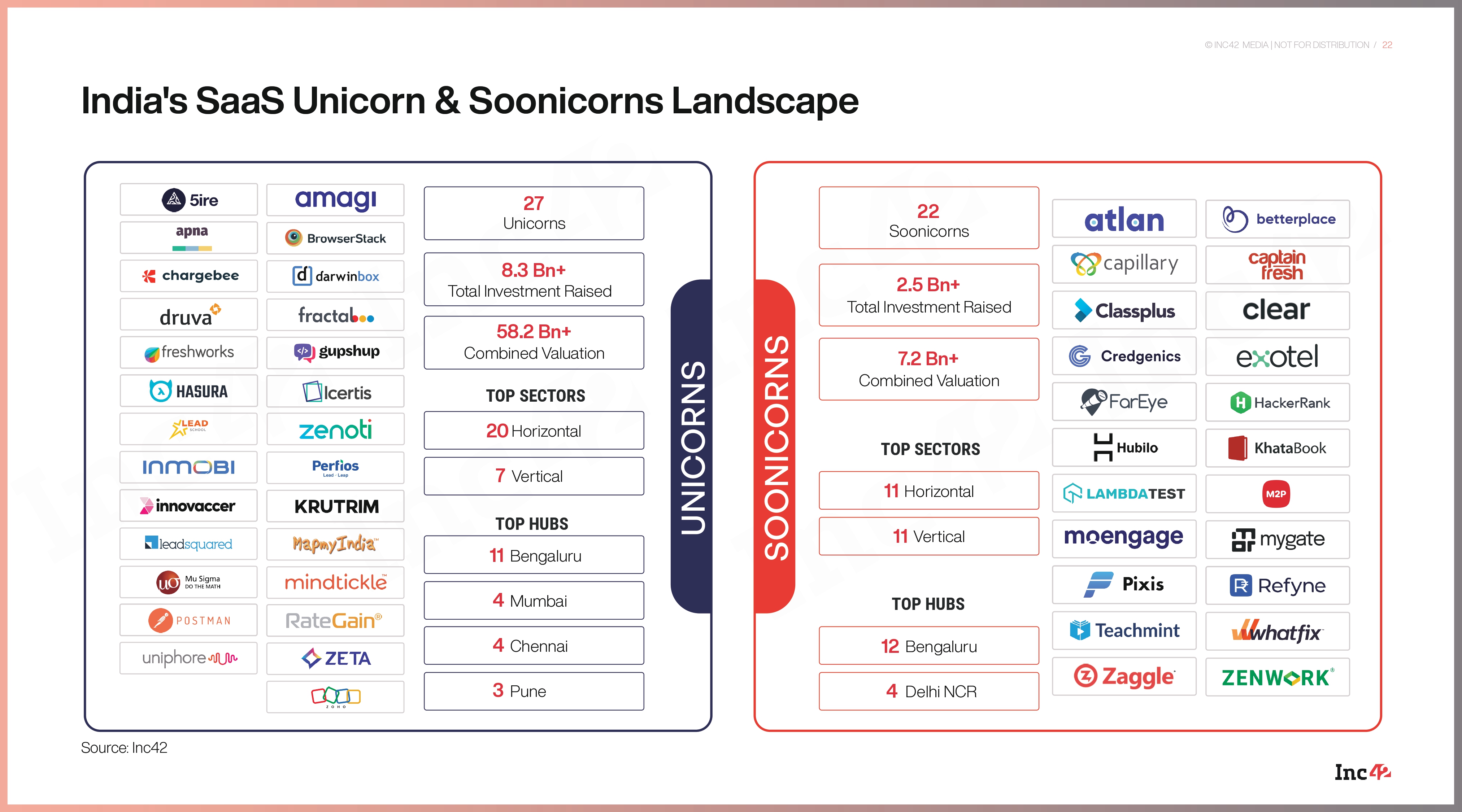

This image highlights India's SaaS (Software as a Service) landscape, divided into Unicorns and Soonicorns. Here's a brief summary: Unicorns: There are 27 unicorns with a combined valuation of $58.2 billion and a total investment of $8.3 billion. The top sectors are 20 horizontal and 7 vertical markets, with major hubs in Bengaluru (11), Mumbai (4), Chennai (4), and Pune (3). Soonicorns: These are companies on the verge of becoming unicorns, with 22 soonicorns, a combined valuation of $7.2 billion, and a total investment of $2.5 billion. The top sectors here are 11 horizontal and 11 vertical markets, with hubs in Bengaluru (12) and Delhi NCR (4). The image also lists some prominent companies in each category, like Amagi, BrowserStack, Zenoti (unicorns) and Atlan, Clear, Whatfix (soonicorns).

Replies (16)

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

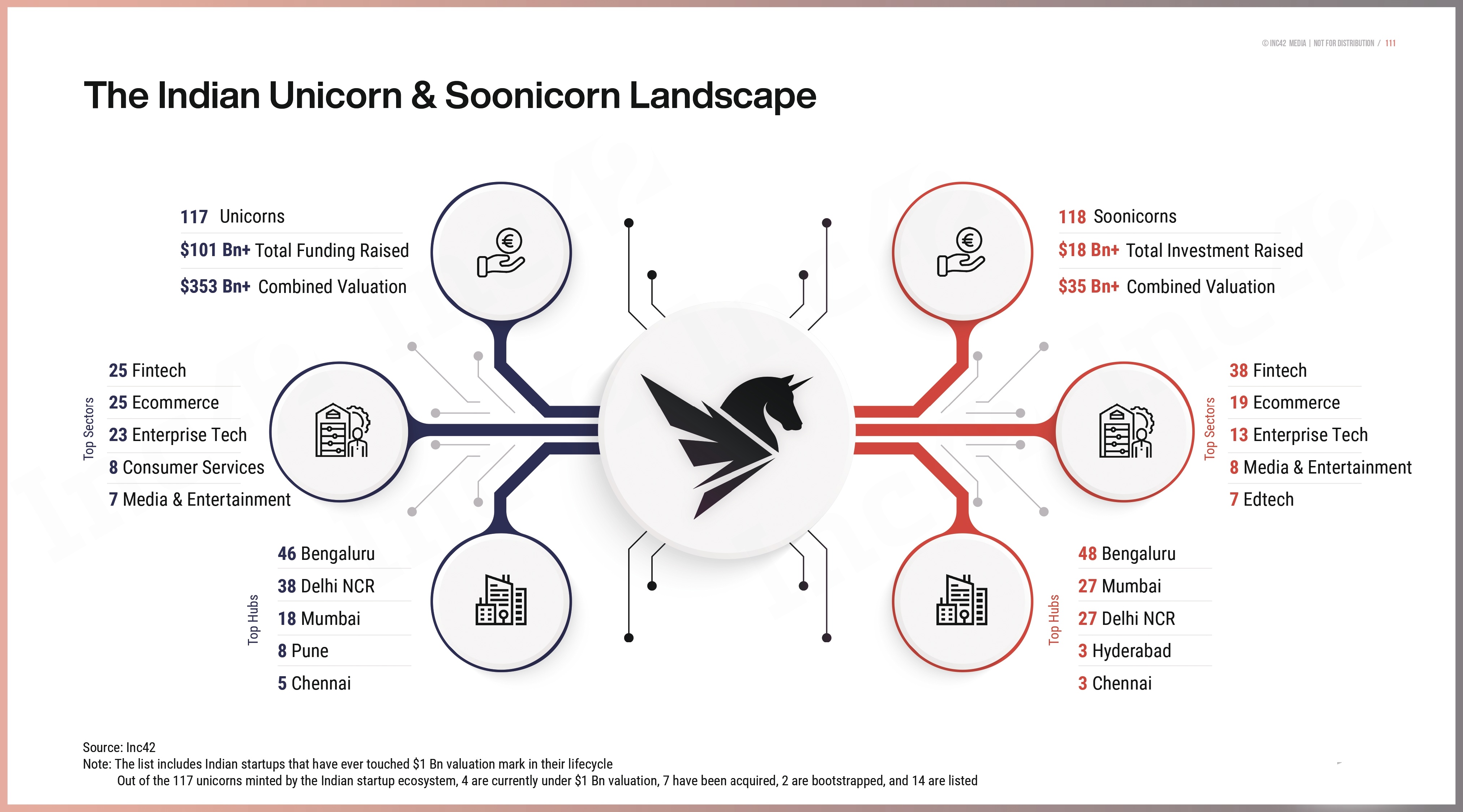

The Indian startup ecosystem is thriving with 117 unicorns and 118 soonicorns as of 2023. Unicorns have raised over $101 billion in funding with a combined valuation of $353 billion, while soonicorns have raised $18 billion with a $35 billion valuati

See More

Aakash kashyap

Building JalSeva and... • 1y

"The Great Indian SaaS" The current state and future potential of India's SaaS (Software-as-a-Service) ecosystem. Below is a summary of the key information: Key Market Insights: ▫️$70 billion+: India’s SaaS market opportunity by 2030. ▫️$26 bill

See More

Rahul Tomer

Founder & CEO TomerT... • 6m

India’s startup story is no longer limited to Bengaluru, Delhi, or Mumbai. According to ET Soonicorns Summit 2025, tier-II cities across Karnataka are fast emerging as vibrant startup hubs, driven by government support and growing local innovation. T

See MoreAtif

Building Something M... • 6m

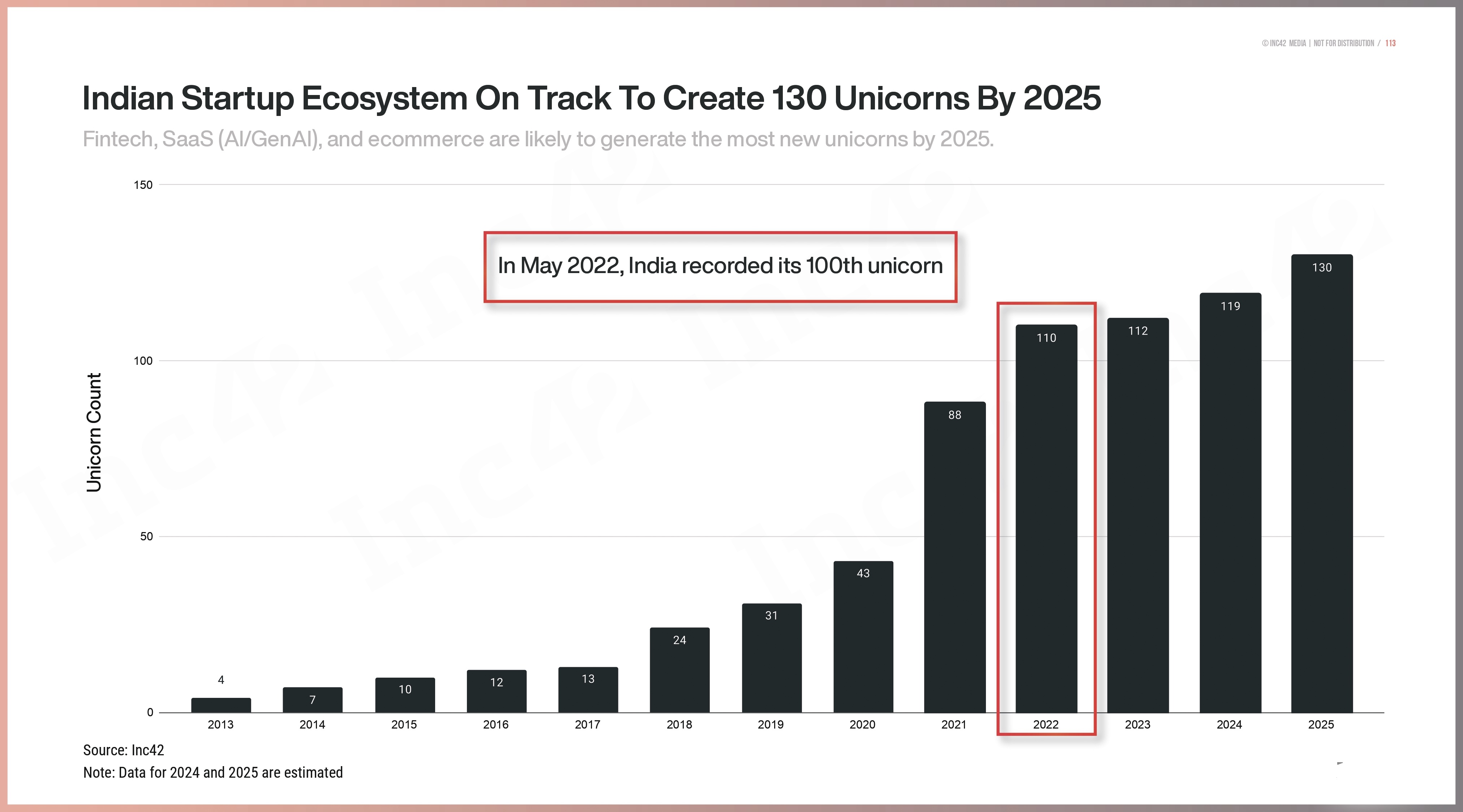

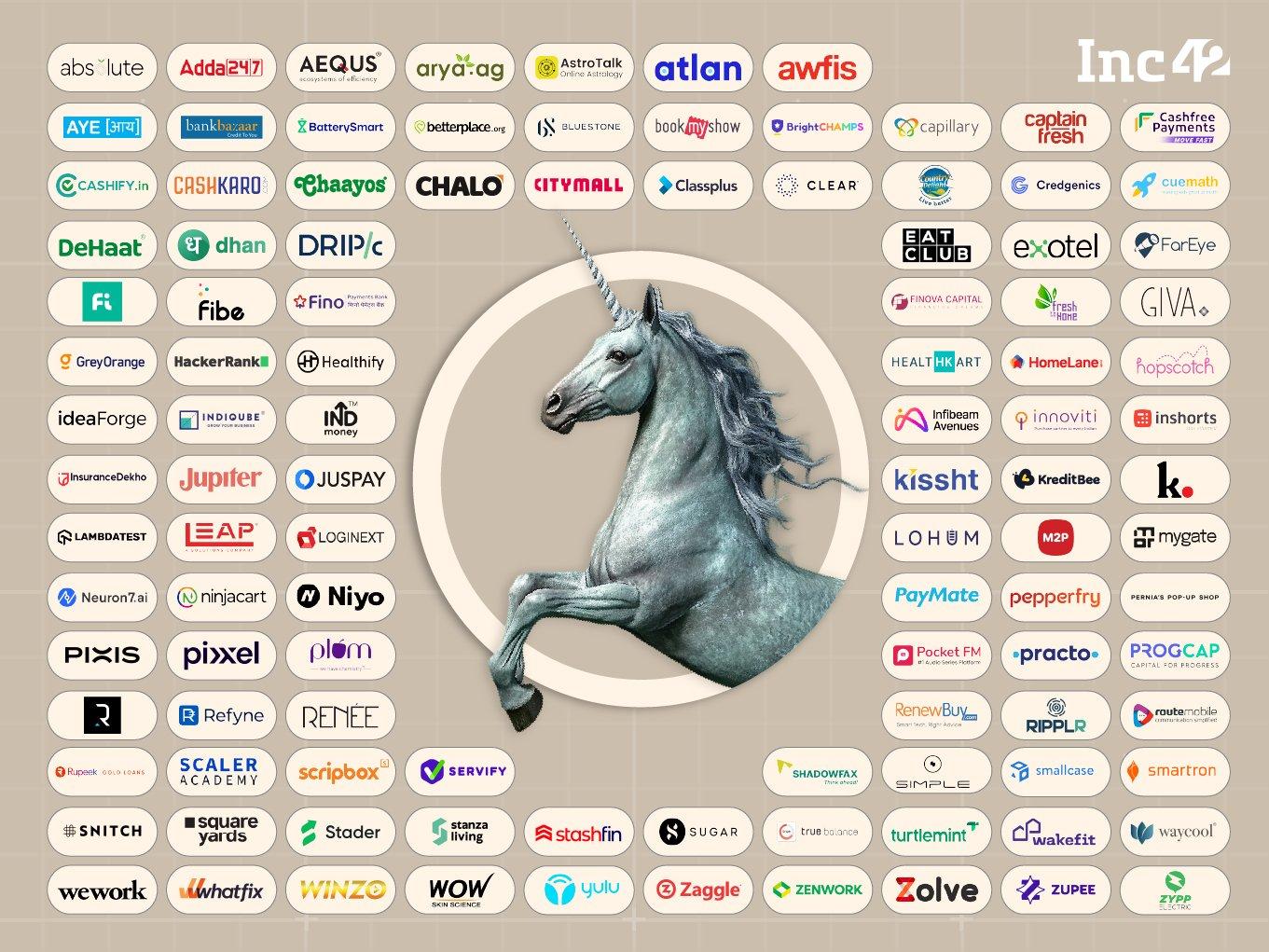

🚀 Soonicorns are startups that haven’t yet hit the $1B unicorn milestone but are on track to get there soon. They’re India’s unicorns-in-waiting, building fast and scaling stronger. 🇮🇳 India already has 124 unicorns, with 5 new entries in 2025 li

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)