Back

Replies (1)

More like this

Recommendations from Medial

Aakash kashyap

Building JalSeva and... • 1y

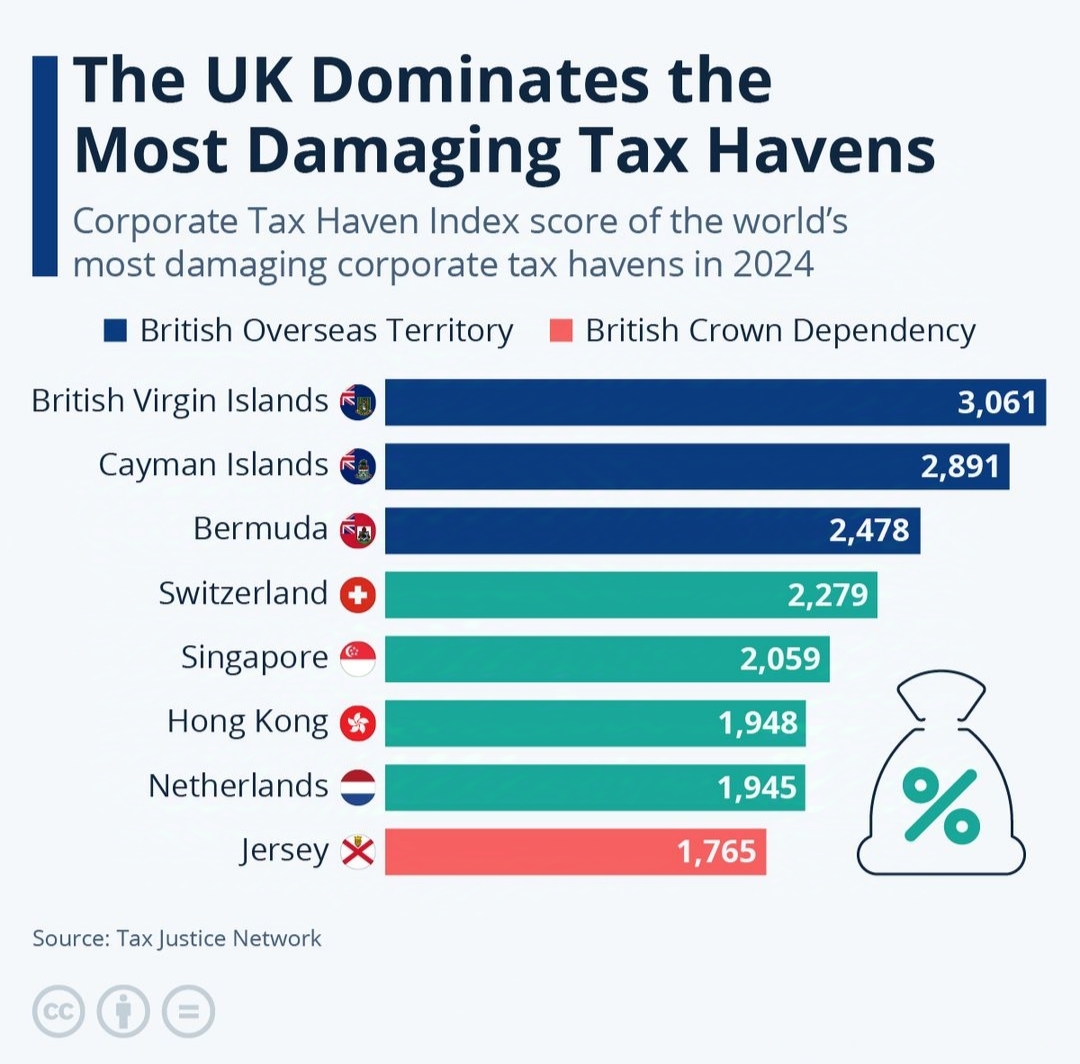

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

8 Replies

9

Sameer Patel

Work and keep learni... • 1y

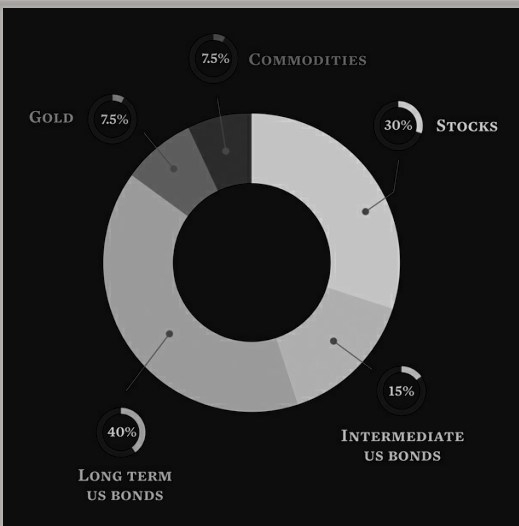

These are the different proportion in which you should diversify your portfolio according to book Money Masters The Game. Ray Dalio gave this suggestion for a diversified portfolio .This book contains many useful knowledge of finance you should read

See More

3 Replies

7

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)