Back

Aakash kashyap

Building JalSeva and... • 1y

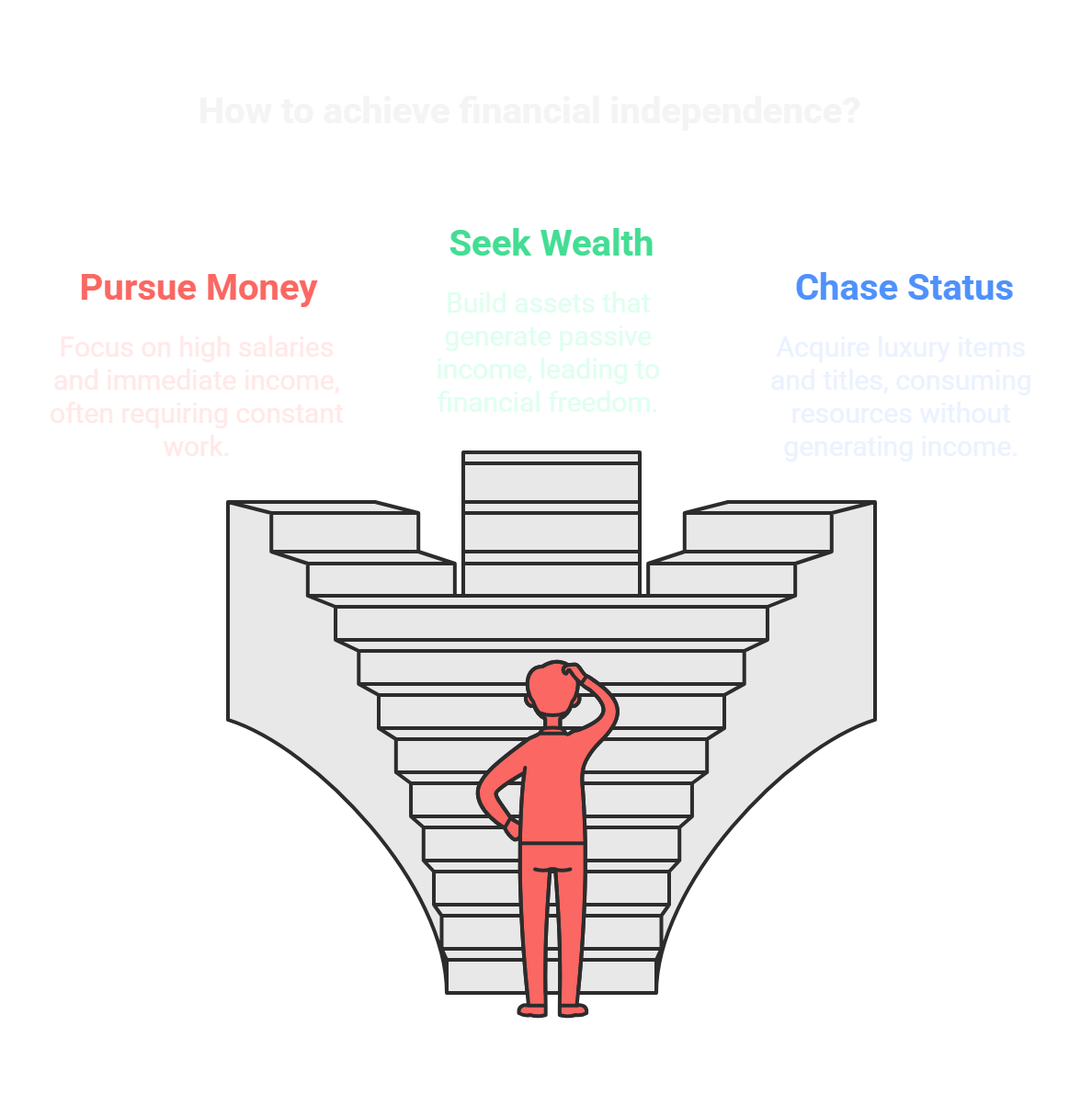

"The psychology of money" 🌟 (Book summary) Day 01 1. Wealth vs. Richness •Definition: Housel distinguishes wealth as the assets you have that generate income, while richness refers to a high income or spending power. •Living Below Your Means: True wealth often involves frugality and saving rather than flashy spending. 2. The Role of Behavior •Financial Behavior: Success in finance is more about behavior than knowledge. Good decisions are often about self-control and emotional intelligence. •Personal Experiences: Everyone has a unique relationship with money shaped by their upbringing and experiences. 3. Compounding •Time Value of Money: The longer you invest, the more significant the impact of compounding can be. Small amounts can grow substantially over time. •Patience is Key: Wealth building requires a long-term perspective; quick gains are often elusive. 4. Risk and Luck •Unpredictability: Acknowledge that luck plays a significant role in financial outcomes. Some people achieve success due to fortunate circumstances. •Understanding Risk: Different individuals have different tolerances for risk, influenced by their personal histories and experiences. 5. Endurance Over Flash •Focus on Sustainability: Financial strategies that may seem mundane often lead to more stable and lasting wealth than flashy schemes or trends. •Consistency: Small, consistent actions over time can yield significant results. 6. Happiness and Money •Money as a Tool: Money should be viewed as a means to achieve personal happiness and security, not as a primary goal. •Contentment: Understanding what truly brings joy can lead to more satisfying financial decisions. 7. The Influence of Time •Investment Horizon: The longer you can let investments grow, the better the outcomes, highlighting the importance of starting early. •Market Fluctuations: Recognize that markets will rise and fall, but a long-term perspective can help weather the ups and downs. 8. Understanding Financial Independence •Freedom: The ultimate goal of financial success should be to achieve freedom—freedom to choose how to spend your time and pursue your passions. •Sustainable Lifestyle: Prioritize sustainable financial habits over temporary indulgences. 9. The Dangers of Overconfidence •Caution in Predictions: Be wary of those who claim to predict the future with certainty; financial markets are inherently unpredictable. •Avoiding Hubris: Overconfidence can lead to poor decisions; humility in financial matters is essential. 10. Legacy and Giving •Passing on Values: Consider what financial values and lessons you want to pass on to the next generation, rather than just monetary wealth. •Philanthropy: Engaging in acts of giving can enhance personal fulfillment and community well-being.

More like this

Recommendations from Medial

Saksham Arora doda

DREAM BIG, BECAUSE D... • 1y

Three Types of Freedom Freedom can be categorized into three essential types: financial, geographical, and time freedom. Financial Freedom Financial freedom refers to the ability to manage one’s finances effectively, allowing individuals to live c

See More

Rutuja Sutar

Finance Enthusiast! • 1y

As a financial enthusiast, I am passionate about empowering youth and women to take control of their financial futures. With a strong foundation built on personal investment experience, I’ve learned the power of discipline, patience, and emotional ma

See More

financialnews

Founder And CEO Of F... • 1y

"8 Powerful Assets to Help You Achieve Financial Freedom and Quit Your Job" Robert Kiyosaki's 8 Essential Assets to Achieve Financial Freedom Robert Kiyosaki, author of the bestselling book Rich Dad Poor Dad, is known for his unique approach to per

See MoreAdarsh Patél

Hey I am on Medial • 1y

Mastering Personal Finance: A Comprehensive Guide to Building Wealth In today’s fast-paced world, understanding personal finance is no longer optional—it’s essential. Whether you’re saving for a home, planning for retirement, or trying to pay off de

See MoreTushar Aher Patil

Trying to do better • 1y

From Janitor to millionaire The Inspiring Story of Ronald James Ronald James, a janitor, left behind $8 million at his death. How did he do it? Simple habits: saving consistently, living below his means, and letting compound interest work its magic.

See More

Suman solopreneur

Exploring peace of m... • 1y

The Slowlane is a trap of mediocrity—trading five days of servitude for two days of freedom. People celebrate Friday because it marks a brief escape from a life they don’t control. True wealth isn’t just money; it’s freedom, and the only way out is t

See MoreCHINMAYEE SAMAL

Digital Marketing St... • 1m

Your salary is just the beginning — financial freedom is the goal. 💼📈 Financial Freedom: Step-by-Step for Salaried Employees is a practical guide to help you save better, invest smarter, and build long-term wealth with clarity. 👉 Buy now: https:

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)