Back

Ravi Handa

Early Retiree | Fina... • 1y

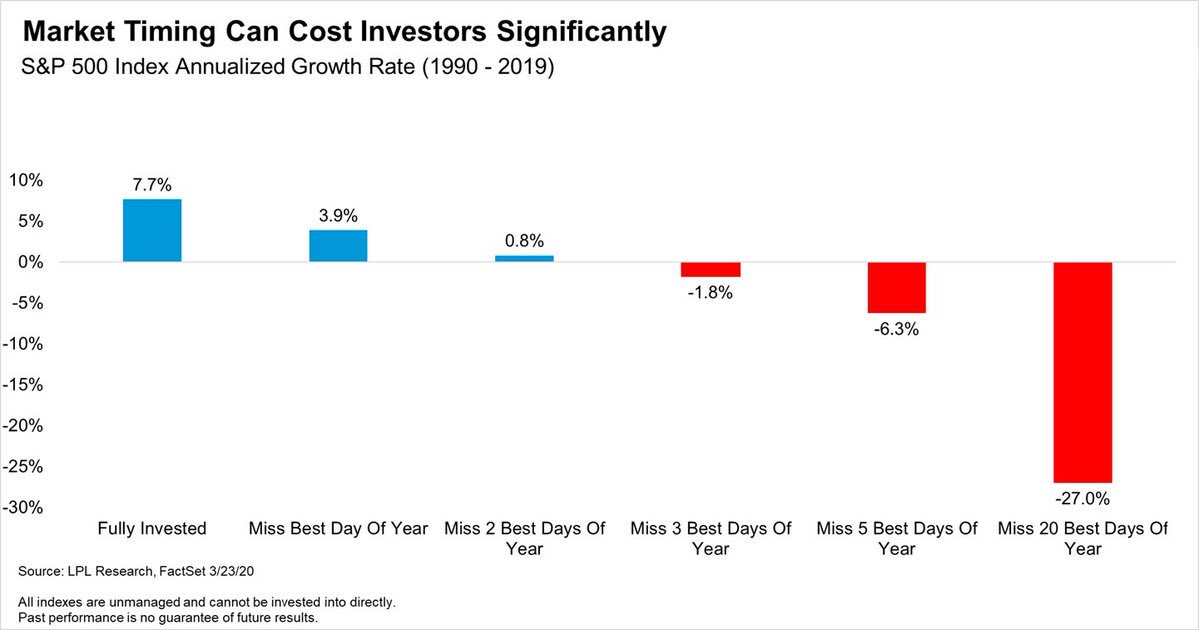

Time in the market is more important than timing the market. We have all heard that. We have all seen charts like the one given below. However, I do have a problem with blanket statements like that. If you are an early retiree like me or someone whose primary source of income is investments in the stock market: You do need to time the market. You do need to react to what the market is doing. You do need to have some sort of strategy to handle market at extremes. The tough question is - how to do it. Obviously, sell everything at top and buy everything at bottom happens only in stories. A much more realistic approach is to follow some sort of asset allocation plan. Whether it is 80-20 or 50-50, that depends on your individual goals or risk appetite. But having this sort of a structure ensures a few things: 1 - If the market does well, your portfolio will become overweight on equity. You will sell equity and hence you will be selling on a high. 2 - If the market tanks, your portfolio will have lesser equity in percentage terms. You will buy equity and hence you will be buying low. 3 - This would also mean that you are never out of the market, so “time in the market” condition is also met. Another approach that you can take is give the money to someone smarter and let him do the asset allocation for you. There are a large number of mutual funds available that do this for you. ICICI Balanced Advantage Fund is my personal favorite because it does not rely only on an individual’s decision but has a process built in. It is very important that you do it sooner than later because of how the markets are doing. We are in a glorious bull run and this is the time to add fixed income / bonds to your portfolio.

Replies (1)

More like this

Recommendations from Medial

Shivam Malhotra

Founder of stockkhat... • 1y

Hey fellow investors! 💰 I'm building a new stock tracking tool that aims to simplify your portfolio management you can add the stock which you want to buy or you can add the detailsof you last buying or selling and my software will help you with t

See MoreHari Om Kalki

Student and ambitiou... • 1y

I'm working on an ai application that is for all the people wanting to get into entrepreneurship. It is basically an idea validation tool that will give you a score between 1 to 100 and tell you how feasible your idea is based on historical evidence

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)