Back

Anonymous 2

Hey I am on Medial • 1y

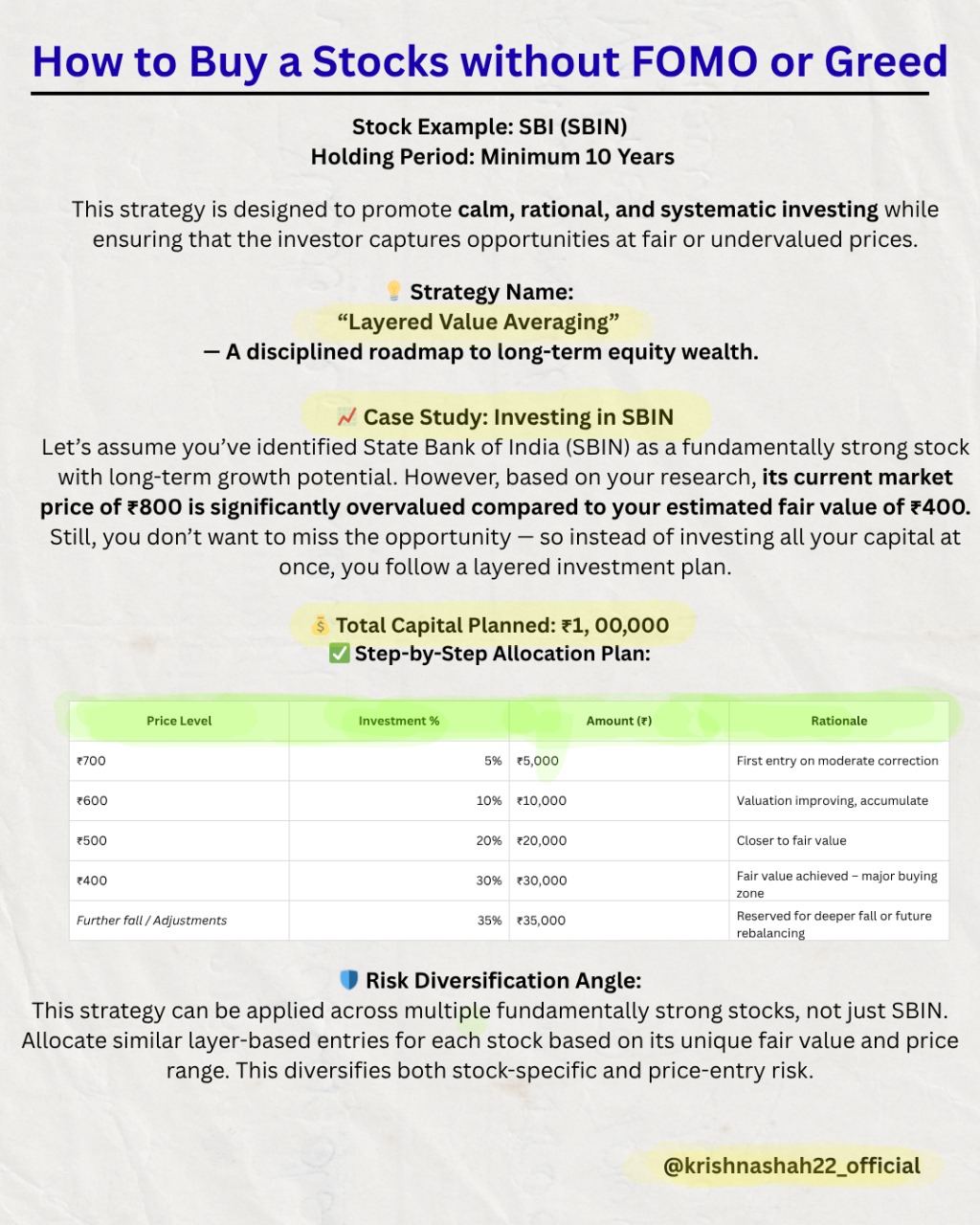

Investing in "boring" assets with strong fundamentals can yield greater long-term returns compared to chasing trends, this has been established. That's why i don't get into it.

More like this

Recommendations from Medial

Shanu Chhetri

CS student | Tech En... • 8m

🔍 10-Year Stock Returns: A Decade of Change Over the past 10 years, companies like NVIDIA have delivered massive returns (+17,950%), while others like BlackBerry have seen major declines (-64%). This comparison shows how innovation, strategy, and m

See More

KAVIT WAMANKAR

Hey I am on Medial • 1y

"We are looking for a person who is interested in agriculture-related projects. This project is for Farmers development, where our investment also yields high returns. Basically, it is a long-term investment with a 100% return, in the coming time, it

See MoreKhushi mishra

Becoming an Entrepre... • 1y

Hello everyone on medial, I believe this platform offers a great opportunity to enhance your business or startup. I am also looking to achieve the same goal. I am searching for investors who are interested in investing in assets that can yield substa

See MoreRohan Saha

Founder - Burn Inves... • 8m

These days, as more retail investors step into the bond market, high yield bonds are getting harder to find. I remember being able to buy AA rated bonds on the exchange with returns as high as 24% to 30%. Now, those same bonds hardly go beyond 12% or

See MoreMuttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Decline in India's Household Savings Net household savings in India declined to a 47-year low of 5.1% of gross domestic product in FY23, compared to 7.2% in the previous year. The finance ministry attributes this to changing consumer preferences for

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)