Back

Anonymous 2

Hey I am on Medial • 1y

In the US, there is a real problem with filing and paying for taxes. You have to do your own calculation and check before you send and they will do their own due deligence and send you either a notice or a fine or both sometimes but will not tell you how much taxes you are supposed to pay. There are companies like Intuit there, trying to solve for this. Here in india, the CAs are stuck with doing their own math and filing and working on excel with folmulas and checking and rechecking. There are no systems in place. Every firm has their own and it is very disorganised so there is opportunity there for sure. Maybe it lies in checking and rechecking different fields of info where info is filled and they have to check if things are done correctly before submitting things forward to govt agencies or to their clients so there is no notices of bad filling or docs missing etc. Just a thought.

Replies (1)

More like this

Recommendations from Medial

Suman solopreneur

Exploring peace of m... • 1y

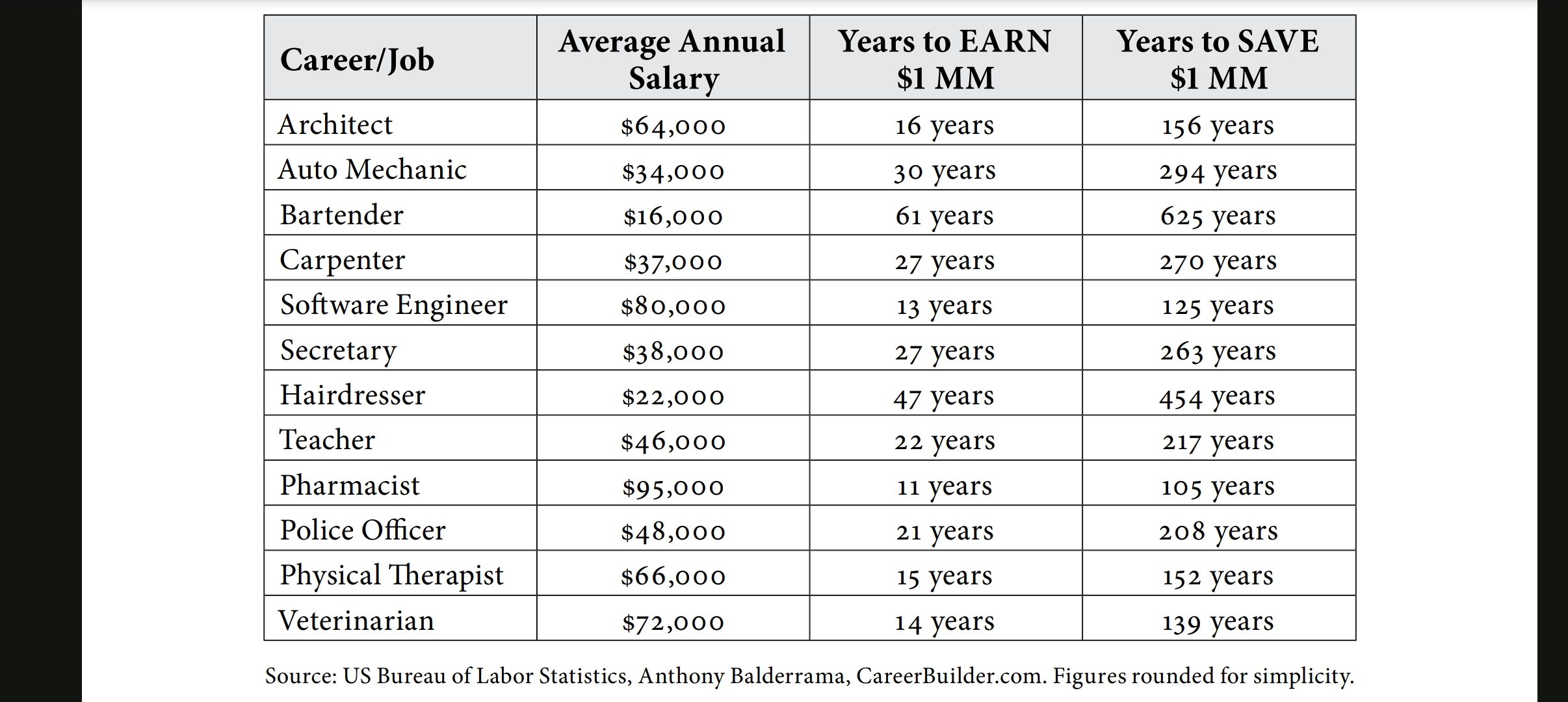

(millionaire fastlane) Jobs constrain learning, offer modest income growth, and exchange time for money, all of which reduce wealth. Workers are subject to office politics, pay high taxes, and have no influence over their income. Since there are so f

See More

Recouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

Havish Gupta

Figuring Out • 2y

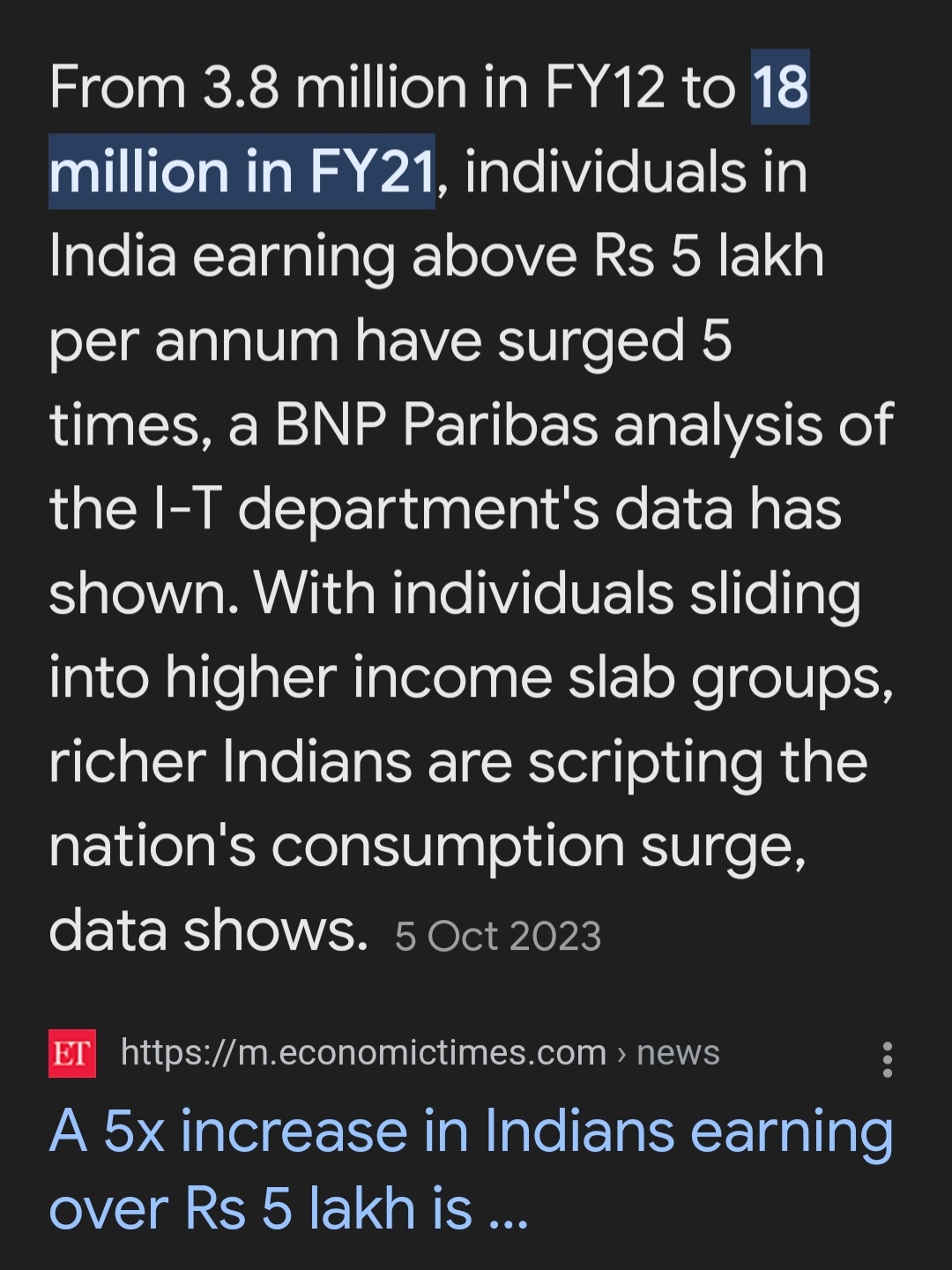

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)