Back

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 5m

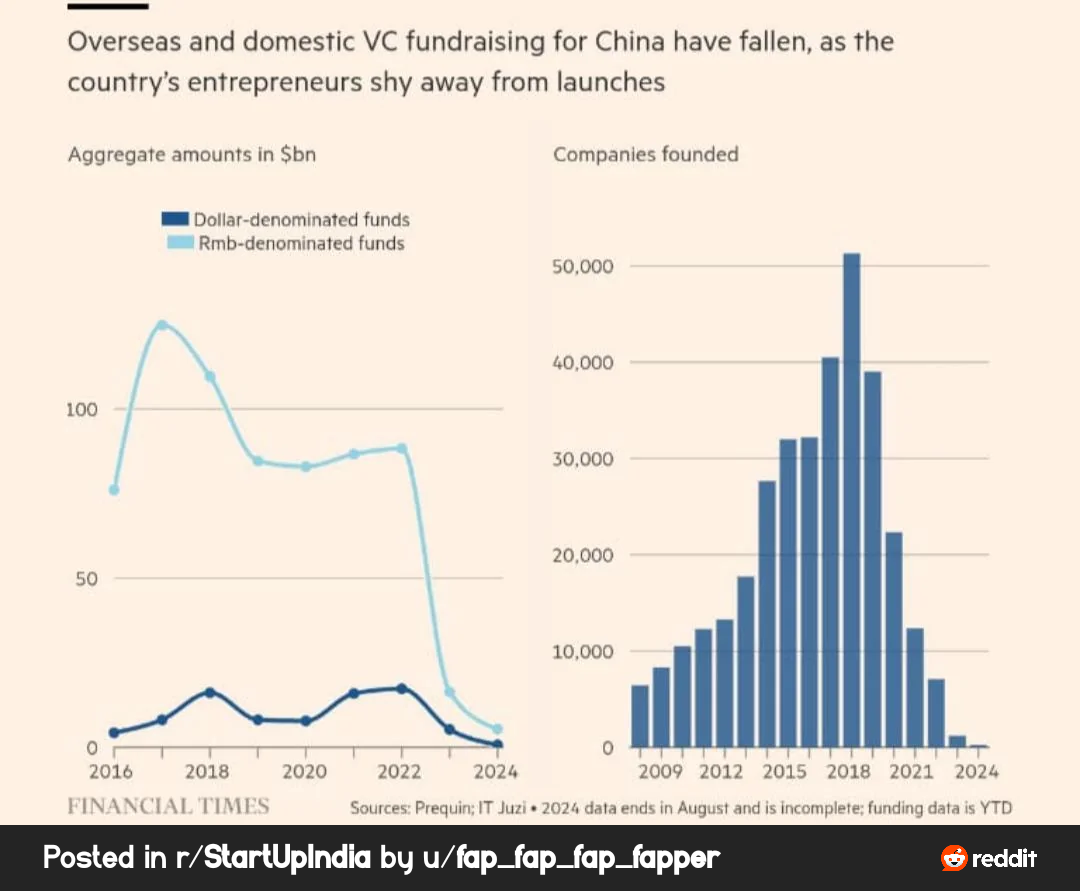

As India ties with China continue to improve the outlook of Western countries toward India has shifted not long ago their stance was largely positive but now it has turned more negative the main reason is that India’s relations and business partnersh

See More Reply

9

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)