Back

Medial Startup Trivia

Trivias Around start... • 1y

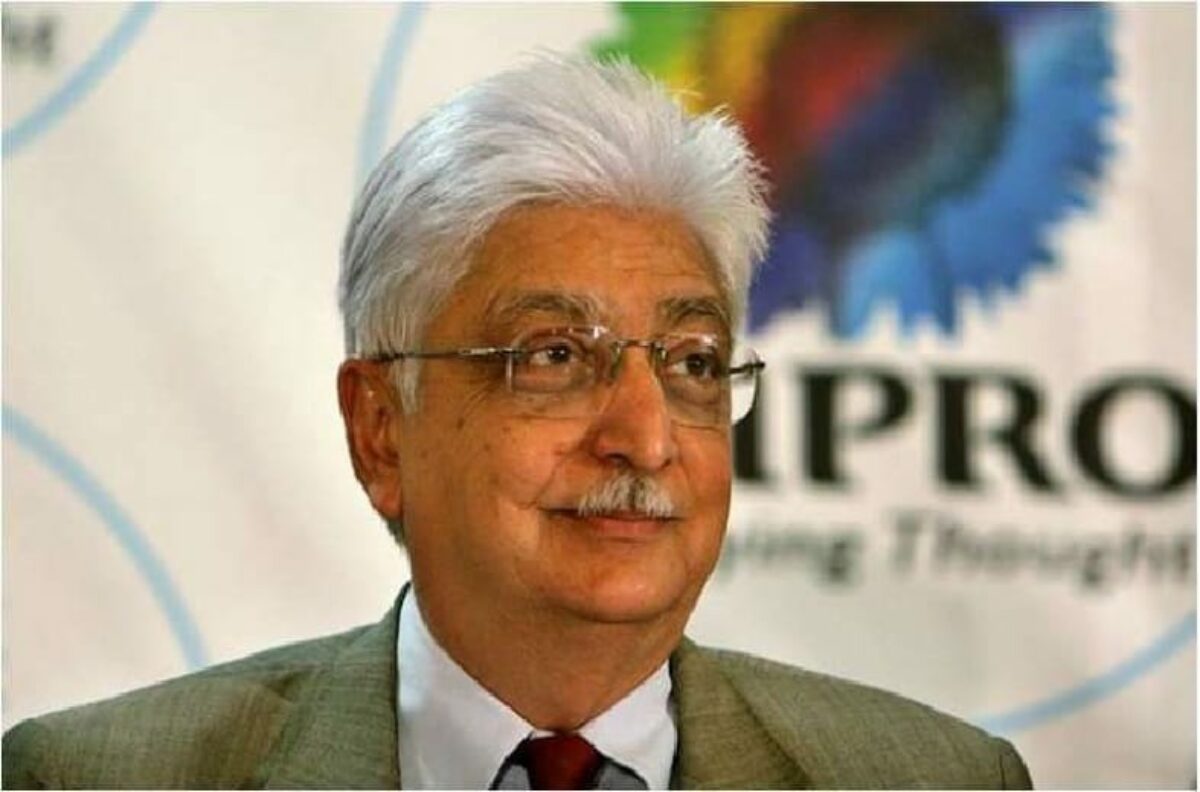

From Cooking Oil to Tech Giant: Azim Premji's $9 Billion Wipro Empire Only few stories are as compelling as that of Azim Premji and Wipro. From humble beginnings in 1945 as a cooking oil manufacturer, Wipro has transformed into a $9 billion tech giant under Premji's leadership. When Mohamed Hasham Premji passed away in 1966, his 21-year-old son Azim abandoned his studies at Stanford University to take the reins of the family business. At the time, Wipro's annual revenue was a modest $2 million. Fast forward to 2023, and Wipro's market capitalization stands at approximately $30 billion. Premji's visionary decision to diversify into IT services in the 1980s catapulted Wipro into the big leagues. Today, Wipro is India's third-largest technology outsourcer, boasting annual revenue of $9 billion (FY 2023), over 250,000 employees across 66 countries, and more than 1,100 global clients, including 75% of Fortune 500 companies. Wipro's Silicon Valley innovation center, established in 2017, focuses on Artificial Intelligence, Machine Learning, Industrial Internet of Things (IIoT), and Blockchain technology. Collaborations with over 100 Valley startups have yielded 60+ joint solutions, driving Wipro's competitive edge in the global market. Azim Premji's net worth, as of 2023, stands at $9.8 billion, making him one of India's wealthiest individuals. However, his philanthropy is equally noteworthy. He has donated shares worth $21 billion to his foundation and pledged 34% of Wipro shares to charitable causes. The Azim Premji Foundation works with 350,000 schools across India, furthering education initiatives. Rishad Premji, Azim's son, now leads Wipro's strategy and holds a board seat. Under his guidance, Wipro has completed over 15 strategic acquisitions since 2016, totaling more than $2.5 billion in value. The company has expanded its digital and cloud services portfolio, which now accounts for 38% of its revenue. Wipro Ventures, a $250 million fund for tech startups launched in 2015, has invested in 25 companies to date, with two successful exits. From a $2 million cooking oil business to a $9 billion tech giant, Wipro's journey under the Premjis exemplifies the transformative power of vision, adaptability, and relentless innovation. As Wipro continues to evolve in the digital age, the Premji legacy of turning challenges into billion-dollar opportunities remains firmly intact.

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

Meet the man who turned a cooking oil into a 300,000 CR IT company. 1. In 1966, Azim Premji suddenly came to India because of his father's untimely death. At 21, Azim had to run his hydrogenated cooking oil business - Western Indian Vegetable Produc

See More

financialnews

Founder And CEO Of F... • 1y

-Tata Steel; target of Rs 160: Motilal OswalMotilal Oswal recommended Neutral rating on Tata Steel with a target price of Rs 160 in its research report dated November 07, 2024. -Gujarat State Petronet; target of Rs 415 Motilal Oswal Motilal Oswal r

See MoreAltamash Zia

Building Strategies ... • 1y

Azim Premji and Ranjan Pai's family offices are set to invest approximately $100 million in Akasa Air, acquiring a minority stake, according to The Economic Times. This investment is part of a larger funding round worth $130-$140 million, which value

See More

Todays India level

Hey I am on Medial • 1y

Hello guys You know this oil it is a palm oil The palm oil are import in India about 9-10 matric ton in a year. It is not a problems but due to the the extrem consumption of oil it cause a hart disease mean (Hart attack). The palm oil contain satu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)