Back

Looper

If nothing goes righ... • 1y

I am job hunting currently, pls help me with a referral if possible. let's get into personal finance. I am telling you a simple guide. you need to divide your money into 50 - 30 - 20. 50 for needs, 30 for wants and 20 for investing. its percentage of your salary. I would prefer you to use 20k for needs, 15k for wants, travel and explore. invest remaining 25k. let's get into where to invest. always keep your funds diversified.I would say invest at least 20k in mutual funds, ETFs. remaining into sgb gold bonds which have constant 13 % returns. where in mutual funds. I would suggest you zerodha coin app. where you will have different mutual funds. you can filter them by bonds, stocks, gold, debt, flexi cap and multi cap. you need to understand them by some blogs or browsing and invest them. after all my final suggestion for you will be: invest at least 15k or max 25k per month. 5k in sgb gold bonds 13% returns. 10K in nifty 50.- zero risk. 10k in parag flexi cap fund- low risk. This is my final call. also please understand things. don't just follow what I said. understand and if you are ok with it then just move forward. you can dm me if you have any other questions.

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 15d

Flexi Cap Mutual Funds – Smart Investing Made Simple Market kabhi Large Cap chalta hai, kabhi Mid Cap, kabhi Small Cap… Lekin ek cheez constant hai — Market Rotation. 💡 Flexi Cap Funds give flexibility to invest across Large, Mid & Small Caps — so y

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 11m

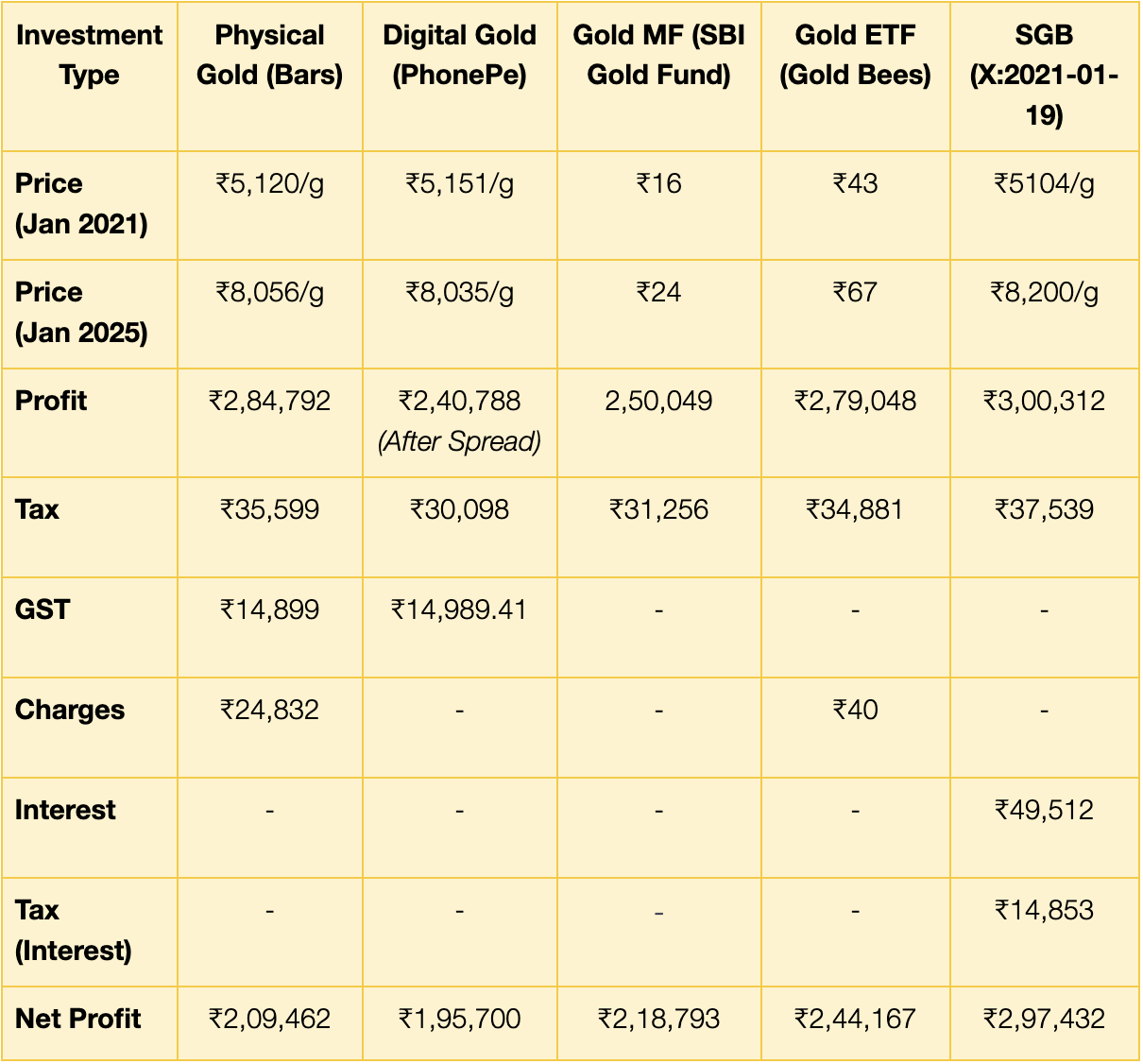

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

financialnews

Founder And CEO Of F... • 1y

"Sebi Permits Mutual Funds to Invest in Overseas Funds Holding Indian Securities for Enhanced Transparency" Sebi Permits Mutual Funds to Invest in Overseas Funds with Limits on Indian Securities Exposure The Securities and Exchange Board of India (

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)