Back

Anonymous 1

Hey I am on Medial • 1y

STT is doubled to 0.2% from 0.1% for FNO.

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Nandishwar

Founder @StudyFlames... • 1y

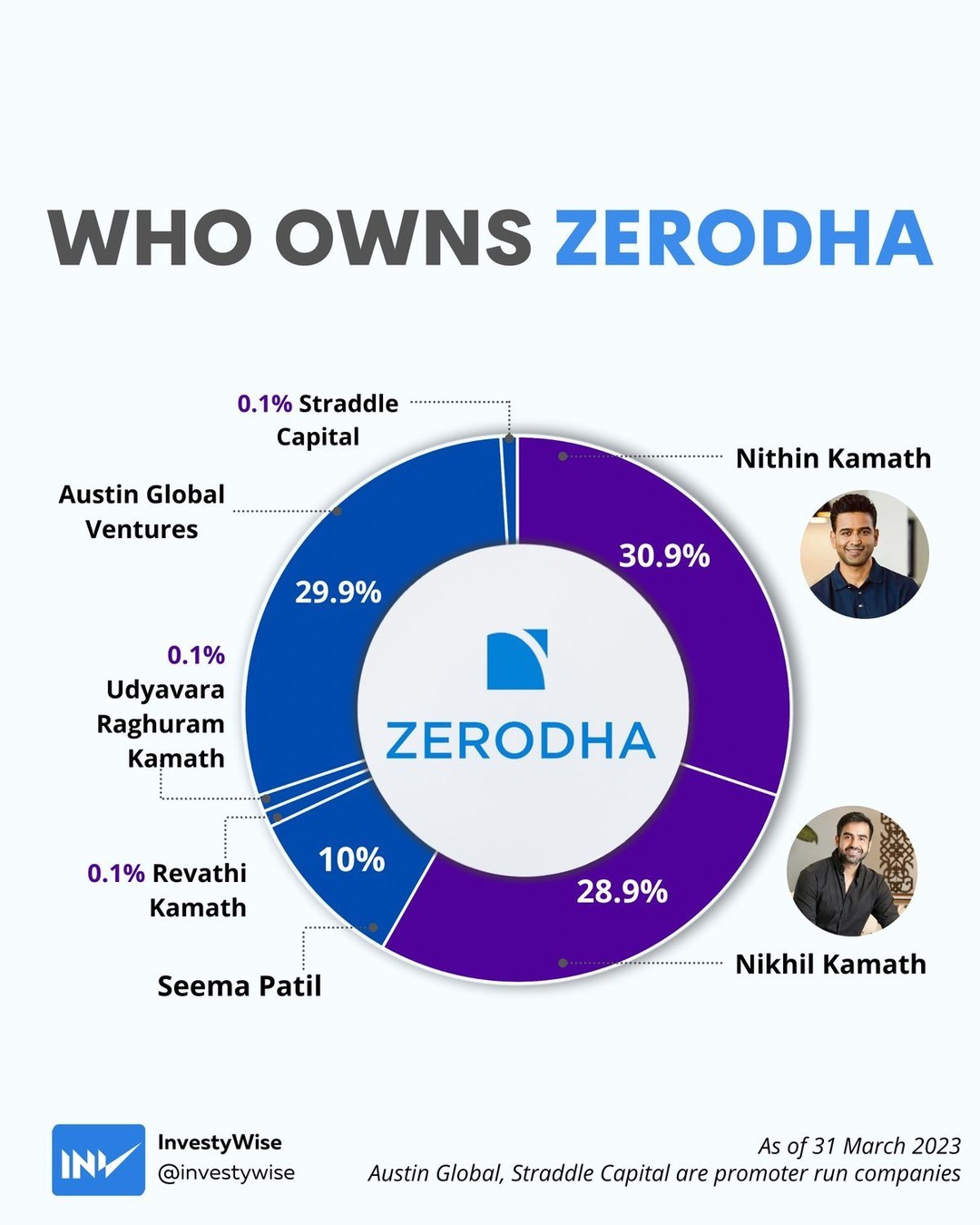

🚀 Who Really Owns Zerodha? The Inside Story! 📊 Zerodha, India's biggest stock brokerage, is 100% owned by its founders & close associates. No VC money, no outside investors—just pure bootstrapped success! 💪 Here's the breakdown of ownership: 🔹

See More

5 Replies

2

4

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)