Back

Mudassir ShAikh

I do a thing called ... • 1y

Cash burn

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 10m

Raising millions won’t fix a broken business model. Plenty of startups burn through cash chasing growth, thinking more funding will solve their problems. But if the fundamentals aren’t strong - bad unit economics, no real demand, weak execution - VC

See MoreVedant Patel

Hammer it until you ... • 8m

cash clarity tool I recently built a simple tool called Cash Clarity – it's designed for freelancers, solopreneurs, and startup founders who want to get a clear picture of their monthly inflows, outflows, and how long their cash will last. ✅ Track

See More

Vedant Patel

Hammer it until you ... • 8m

Curious how long your startup can survive on its current cash? Or wondering where all your money actually goes each month? I built a lightweight Google Sheet called Cash Clarity Tool to help founders (like me) answer exactly that. It tracks: 🔹 Rea

See More

Vedant Tiwari

Founder of VedspaceA... • 1y

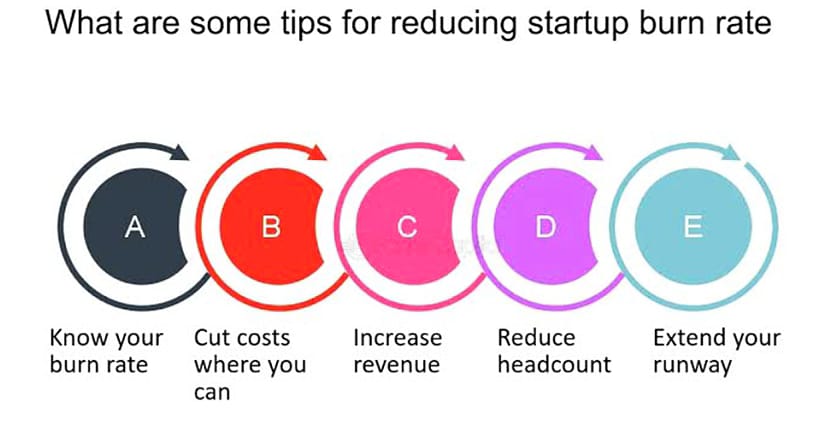

Guysss... How to calculate the burn rate? like a initial startup... who's in initial stages... And a investor asking how much you need??? as our last post, a lot of you suggested some of the great ideas.... thanks for that... one of them was, burn

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

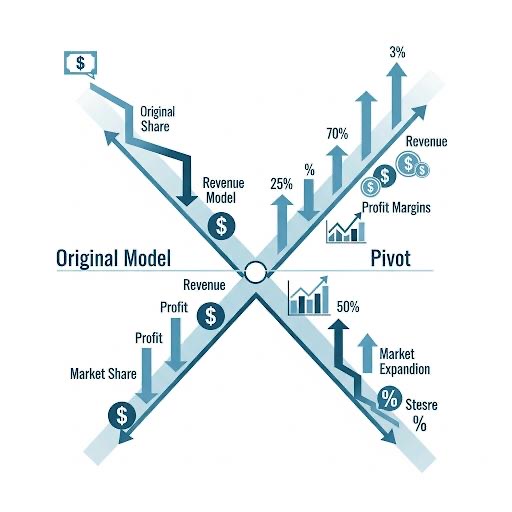

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)