Back

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

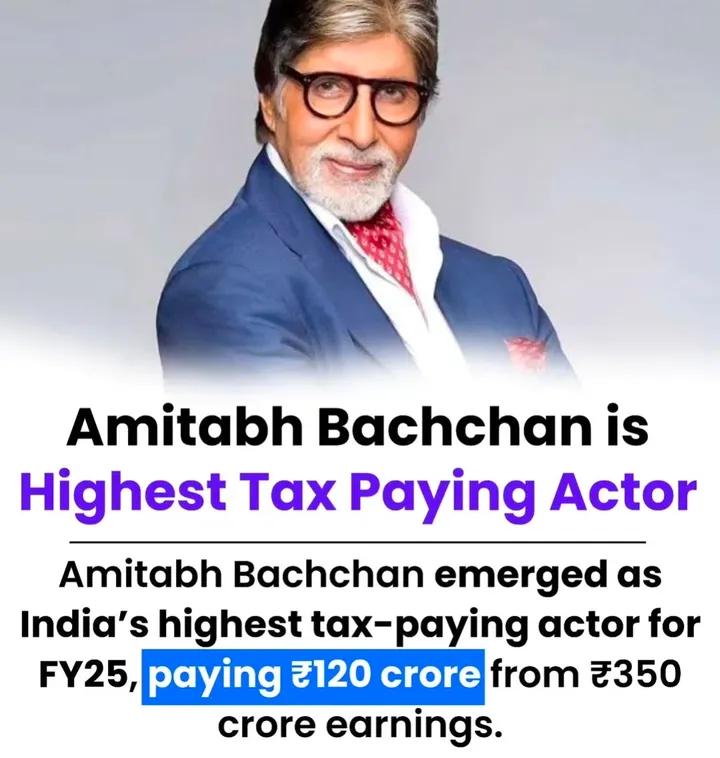

I think next civil war in India happens because of tax . We are facing this huge problem since 1947 and every government force only middle class people's for tax . According to reports only 3.5% people in India paying tax and other are just enjoying

See MoreAayush Sharma

Building a startup i... • 8m

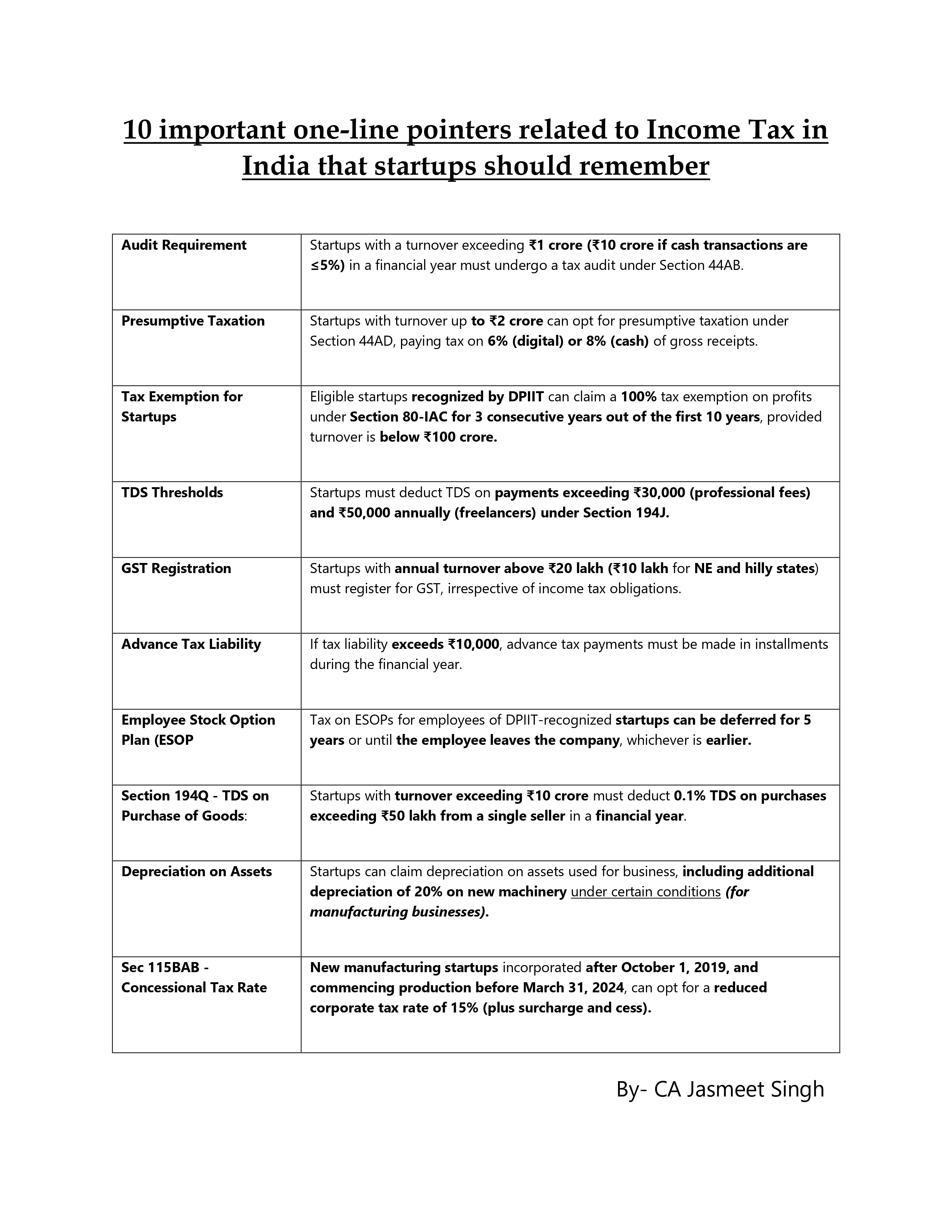

As more and more work gets automated, is it a good idea to levy a "UBI Contribution Tax" on companies beyond a certain Revenue per Employee threshold? (UBI = Universal Basic Income, a proposal to give all citizens a minimum income to fulfill basic n

See MoreTREND talks

History always repea... • 1y

😳 Guy named Kopparam revealed on twitter that a dosa vendor near his home earns Rs 20,000 daily, amounting to Rs 6 lakh a month. After deducting costs, the vendor takes home Rs 3-3.5 lakh monthly, all without paying tax🤣 but employee gives 7-10% Ta

See More

Download the medial app to read full posts, comements and news.