Back

Medial Startup Trivia

Trivias Around start... • 1y

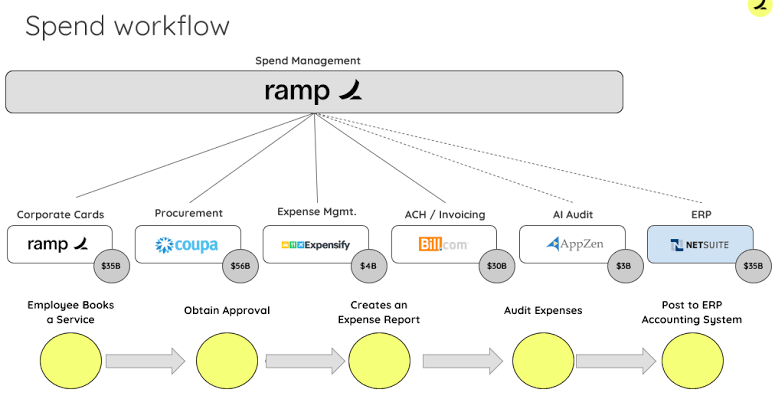

Pivot or Die: Brex Who are Brex? Pedro Dubugras and Henrique Franceschi, both originally from Brazil, taught themselves how to code from a very young age. Franceschi's coding journey began when he hacked an iPhone at just 11 years old, modifying it to make Siri understand Portuguese. As for Dubugras, he started building clones of video games that his parents wouldn't buy for him back in middle school. In fact, his version of the game "Ragnarok" generated tens of thousands of dollars for him before he received a legal warning from the Brazilian distributor. The two self-taught coding prodigies crossed paths over social media when they were 16 and decided to embark on an entrepreneurial journey together. In 2013, they launched [Pagar.me](http://pagar.me/), a Brazilian equivalent of the online payments platform Stripe. Their startup flourished, employing 150 people and processing over $1.5 billion in transactions by the time Dubugras and Franceschi sold it in 2016 for tens of millions of dollars. The first idea that they got into while applying into YC wasn’t actually in fintech. It was a VR company. When the founders sold their last company, they were tired of fintech. So VR seemed like it. But a few weeks into YC, what they realized was that they had no clue what they were doing and decided to pivot into — Brex. Currently, Brex has shook the businesses management market with their AI-powered spend platform for modern companies, from startups to enterprises. Combining corporate cards, expense management, travel, business accounts, and bill pay, Brex makes it easy to control spend before it happens with unprecedented efficiency and accuracy. Their mission is to empower employees anywhere to make better financial decisions, so they designed the platform to make expenses effortless with unrivaled automation of manual expense work and real-time tracking. Brex supports more countries and currencies than any other spend solution. They have tens of thousands of customers, including some of the most successful, high-growth companies, such as DoorDash, SeatGeek, Coinbase, ScaleAI, MasterClass, Indeed, Allbirds, and Superhuman. How Though? Business expense management represents a sizeable market segment with substantial potential for growth. Global business-to-business (B2B) payments totaled a staggering $149 trillion in 2022. However, in the previous year of 2021, only $1.5 trillion out of the then $120 trillion in worldwide B2B spending was transacted via corporate credit cards. Many businesses continue to rely on outdated, inefficient, and mistake-prone manual methods like paper receipts or spreadsheets to handle their expenses. A 2022 study highlighted that 19% of expense reports contained errors, with the average cost of processing each report amounting to $58. The key points are that while B2B payments are a massive market, corporate card usage is still relatively low. Many businesses cling to archaic, error-prone expense management processes instead of adopting more modern, digital solutions. This presented an opportunity for disruption and growth in the expense management space. Since, Brex has raised a total funding of $1.2B over 10 rounds. Their valuation stood at $12.3 billion after raising a $300 million Series D led by Greenoaks & TCV. Brex initially started out offering credit cards targeted primarily at startups and small-to-medium businesses. Over time, the company expanded its business model with the goal of becoming a comprehensive financial services provider for these types of companies. In April of last year, Brex announced it had integrated its credit cards, business bank accounts, spend management tools, and bill payment software into a single unified dashboard as part of its "Brex Premium" service costing $49 monthly. Currently, Brex is concentrated on the corporate credit card product it has been developing since its founding, banking solutions, and expense management offerings. To put it succinctly, Brex aspires to function as an all-encompassing "financial operating system" for its business customers. Lessons Conventional entrepreneurial wisdom often emphasizes the importance of focus and perseverance, advising founders to commit wholeheartedly to one path. However, the remarkable journey of Henrique Dubugras and Pedro Franceschi challenges this notion, revealing that an open and adaptable mindset can be equally vital for success. Rather than stubbornly clinging to a singular vision, their story highlights the significance of remaining receptive to new possibilities, pivoting at the opportune moment, and astutely exploring the right markets at the ideal time. This agile approach allowed them to capitalize on emerging trends and seize promising opportunities as they arose. Their willingness to reassess, recalibrate, and reorient their entrepreneurial pursuits exemplifies the value of adaptability and dynamic thinking. While unwavering dedication is undoubtedly crucial, their story underscores that an open mind, coupled with the courage to pivot when circumstances demand it, can propel entrepreneurs to even greater heights.

Replies (7)

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

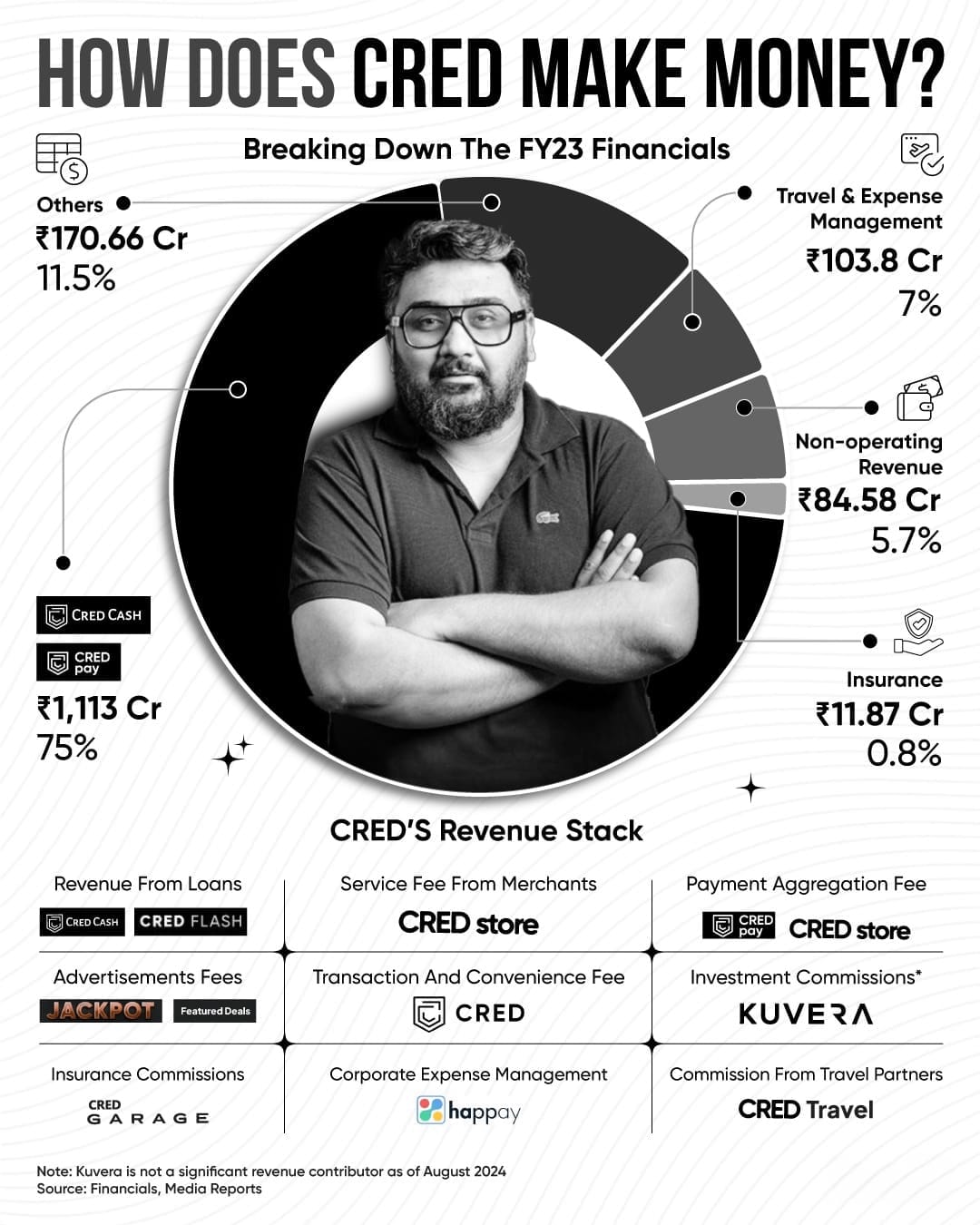

Here's a breakdown of how CRED makes money, based on their FY23 financials. With a significant chunk coming from loans, payments, and travel management, the platform diversifies through advertising fees, insurance, and corporate expense management. T

See More

Mohammed Zaid

building hatchup.ai • 10m

OpenAI CEO Sam Altman said using phrases like 'please' and 'thank you' with ChatGPT is costing OpenAl "tens of millions of dollars". Responding to X user's question on "how much money OpenAl has lost in electricity costs from people saying 'please' a

See More

Ansh Kadam

Founder & CEO at Bui... • 1y

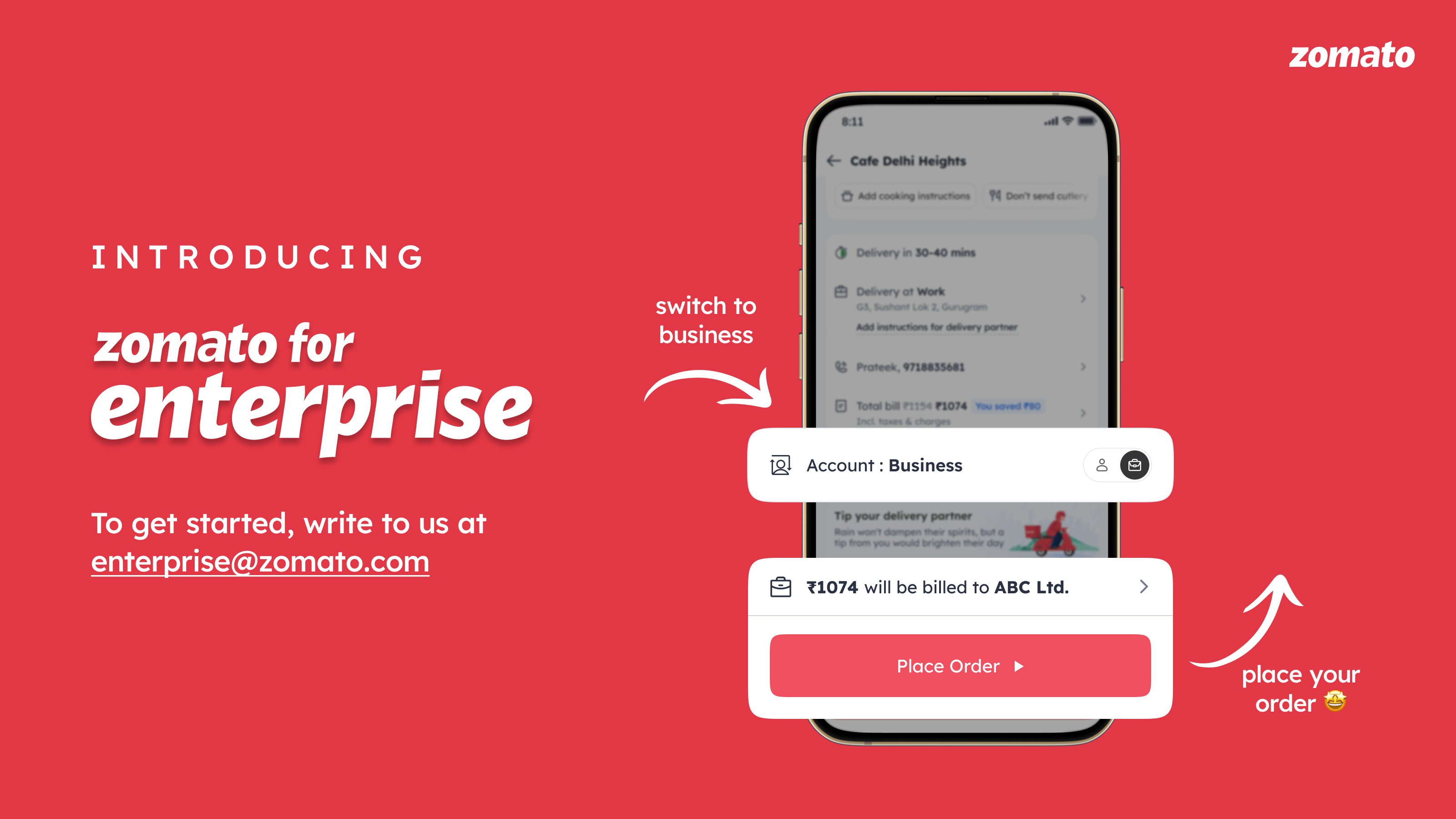

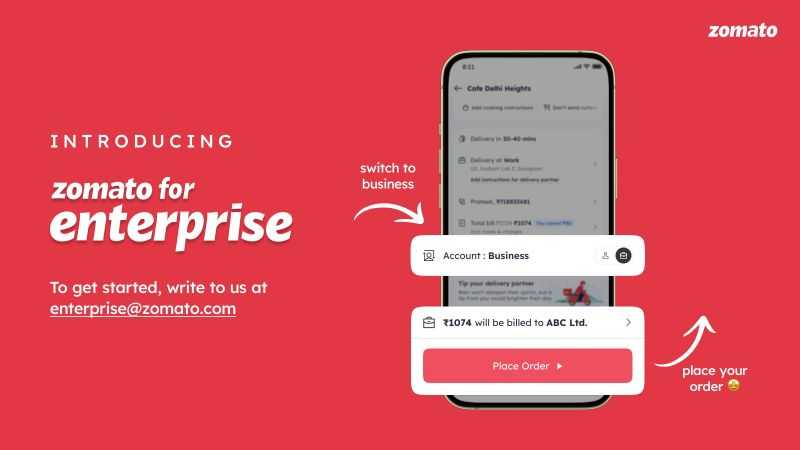

One of the best lessons business men or people starting their business can learn from Zomato At the time when Zomato's stock was not at the height which it is at today, and the sentiment in the market was against such companies they had show through

See MoreRomin Pokiya

Hey I am on Medial • 1y

A very common and brilliant strategy of most business owner I have seen is when their business reached a height exponentially, they just sell their majority stake to a big player in the market but staying at a position of top management. they get th

See MoreDr Sarun George Sunny

The Way I See It • 1y

Ishitva Robotics: Transforming Waste Management Founded in 2017, Ishitva Robotics is an Indian startup dedicated to enhancing waste management through advanced technology. They focus on AI-powered robotic systems designed for waste sorting, capable

See More

Sourav Kumar Sahoo

•

AMIGOS ESPORTS • 1y

So there is a very cluttered market of creator management agencies. Most of the agencies who manage creators, use illegal means to increase the numbers of the creators. And many take maximum part of the money as their cut which is wrong. Creator man

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)