Back

Varun Bhambhani

•

Devza • 1y

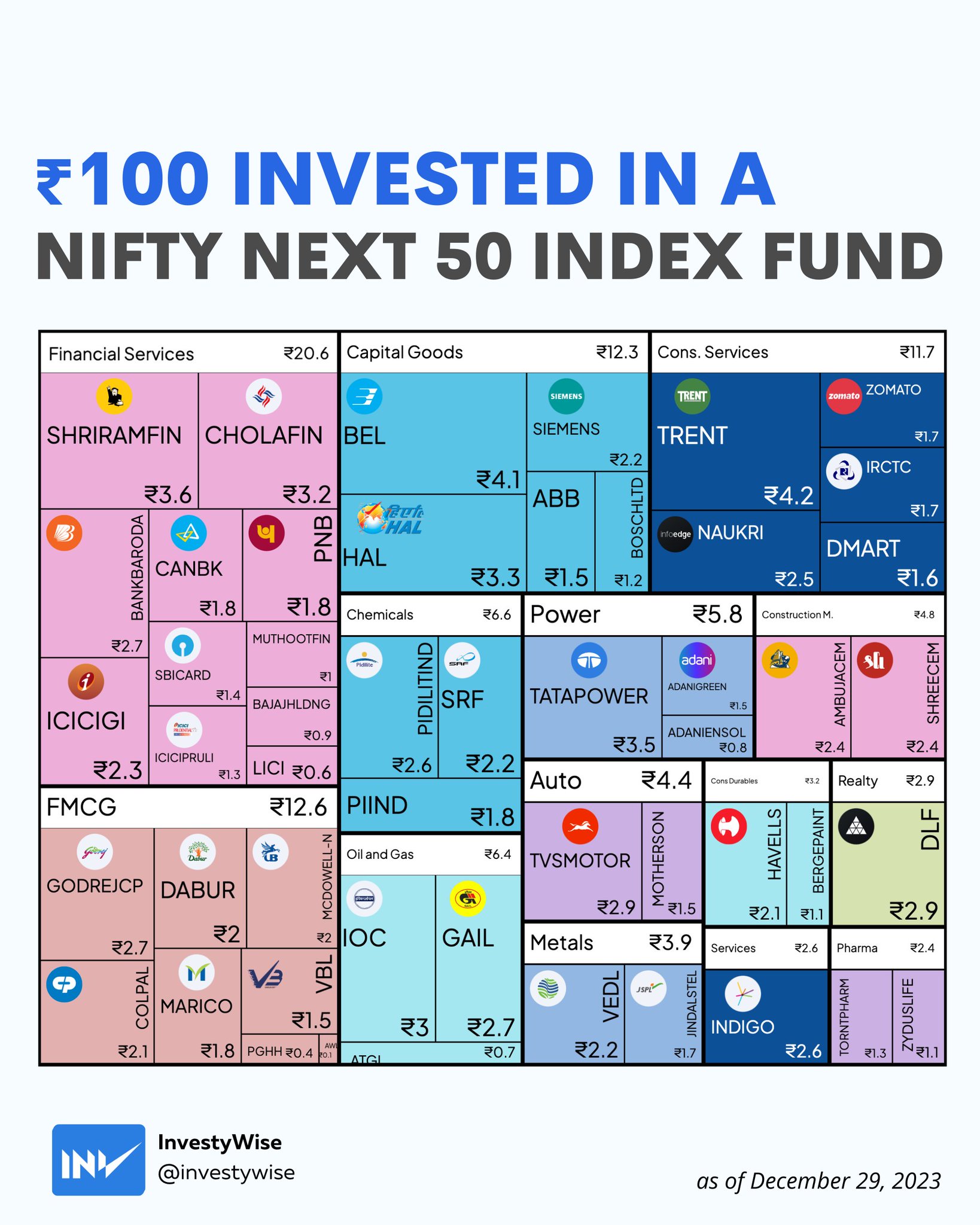

- Nifty 50 includes 50 companies. - Nifty Next 50 includes the next 50 companies (51-100). - Nifty 100 includes all 100 companies from Nifty 50 and Nifty Next 50. Your investment portfolio in the Nifty 100 would overlap your company portfolios from both Nifty 50 & Nifty Next 50. So I would suggest you to stick with a basic Nifty 50 index fund for starters. You can also invest in a Flexi cap fund to diversify your portfolio. Note: I’m not a finance advisor neither am I giving you investment suggestions. Please do more research before investing.

Replies (2)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 3m

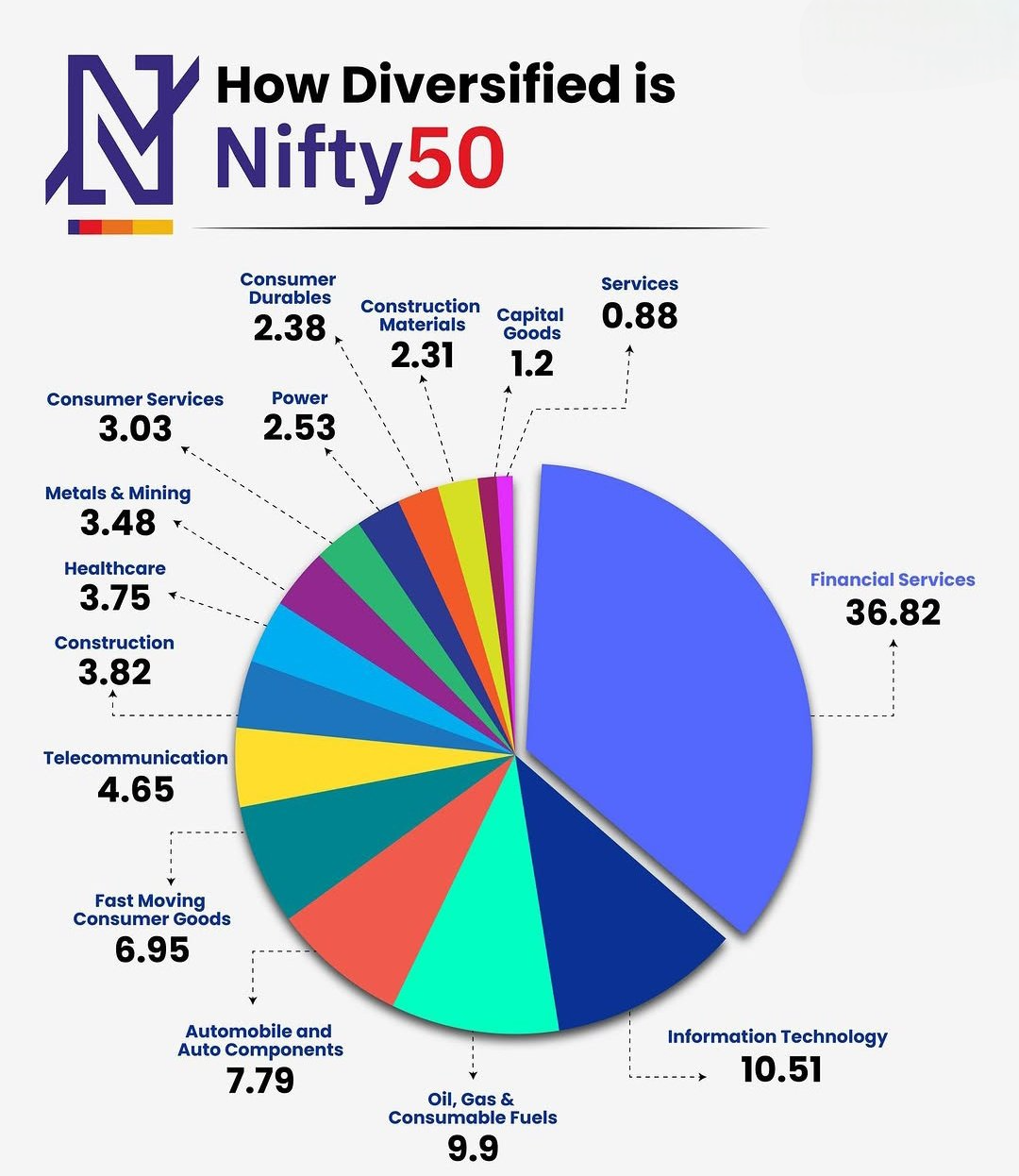

How Diversified is Nifty 50? Did you know that Financial Services alone make up 36.82% of the Nifty 50 Index? 💼 IT, Oil & Gas, and Auto sectors also play a major role — but true diversification lies in balance! 📈 Top Sectors in Nifty 50: 1️⃣ F

See More

VIJAY PANJWANI

Learning is a key to... • 3m

TOP PERFORMING STOCKS IN NIFTY 50! 💥 These are the companies that delivered massive returns in just 1 year! 🚀 From Bajaj Finance to Eicher Motors, the bulls are roaring loud in the market! 🐂💹 💰 Who’s your favorite pick for the next rally? 👇 Com

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)