Back

Kanhaiya Bharti

15-min free advisory... • 1y

You know the best ways of saving money, but your investments are low and your bank account wipes out in the first 15 days from the day salary credited in your account.💰 As information symmetry get established, stocks, and mutual funds became the mainstream investment avenues. B/w all this, consumer spending is touching new highs, new category of consumables get introduced by smart co-founders. I mean, who thought ever to spend money on fancy bottles or beard oil? 🤐 At 29 and being a finance guy, I will suggest that you may not get a multibagger stock in your portfolio, but if you have consistency, discipline in your investment journey and money management, even a Mutual fund with 10-11% CAGR 📈will give you a better corpus when needed. be SMART and be DISCIPLINED!!

Replies (9)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

Many people think that if they buy mutual funds from different platforms and keep them, it will be difficult to track them. But that's not true. There's a platform called MF Central, which is SEBI-regulated and keeps records of MF folios and manages

See MoreHemanth Varma

''Money can't buy ha... • 1y

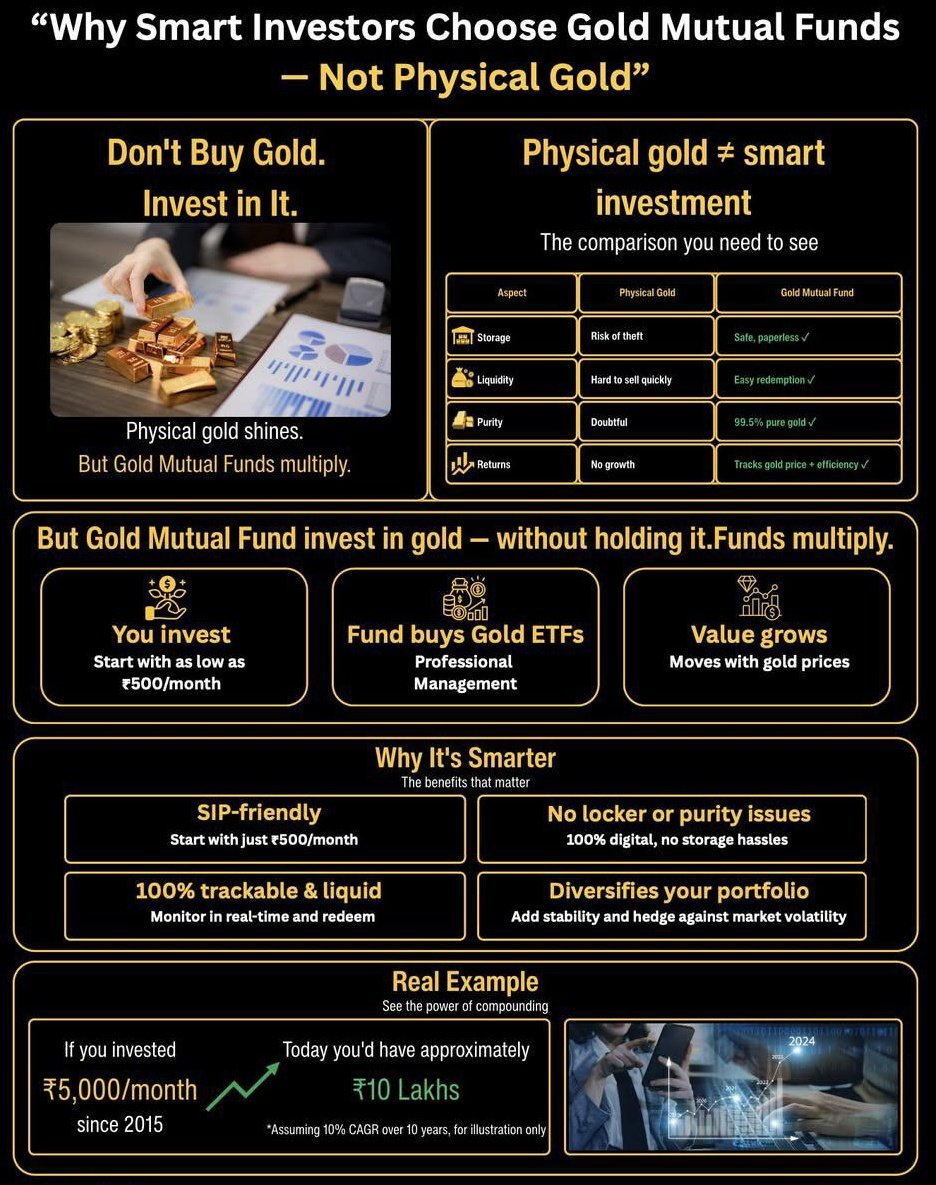

can mutual fund be a profitable investment? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its po

See More

Three Commas Gang

Building Bharat • 1y

Imagine instead of keeping your money in boring savings account, you could simply do an FD of it and get good interest rates, but also get a steady no interest credit line upto FD amount to be used by you for daily expenses? Basically your money will

See MoreShanu Chhetri

CS student | Tech En... • 9m

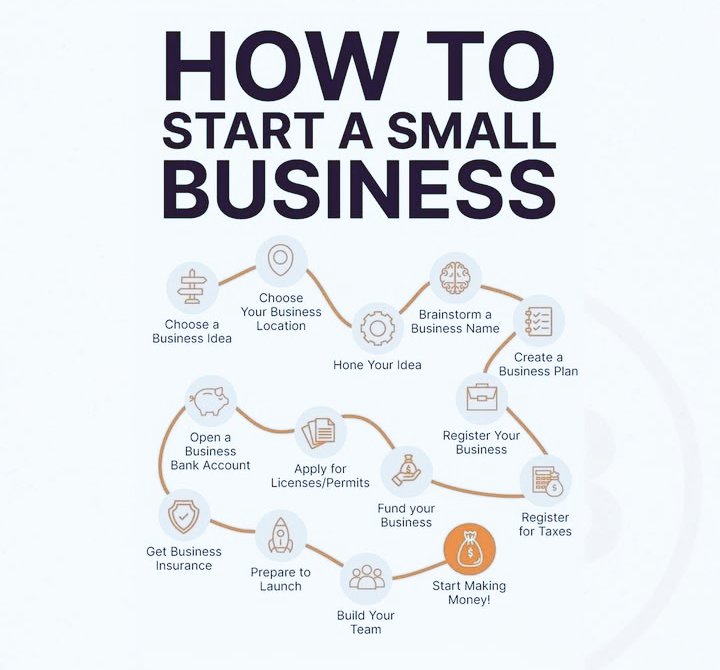

*How to Start a Small Business* Here’s a quick guide! Start by choosing your business idea and location, then brainstorm a name and create a business plan. Register your business, get the required licenses and permits, open a bank account, arrange f

See More

PVSN RAJU

Start Small Dream Bi... • 1y

Hi All, We are developing an investment platform specifically for non-income earners like students and house wives where they can independently invest in digital,mutual funds,stocks etc.from income earner's account. Your valuable ideas and suggestio

See MoreSWAYAM DAS

Hey I am on Medial • 1y

Mutual Fund Maestro Slogan: "Your guide to navigating the world of mutual funds." Description: Mutual Fund Maestro is a comprehensive platform dedicated to helping investors understand, research, and invest in mutual funds. It provides a one-stop-sho

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)