Back

Setu

Student | Freelancer... • 1y

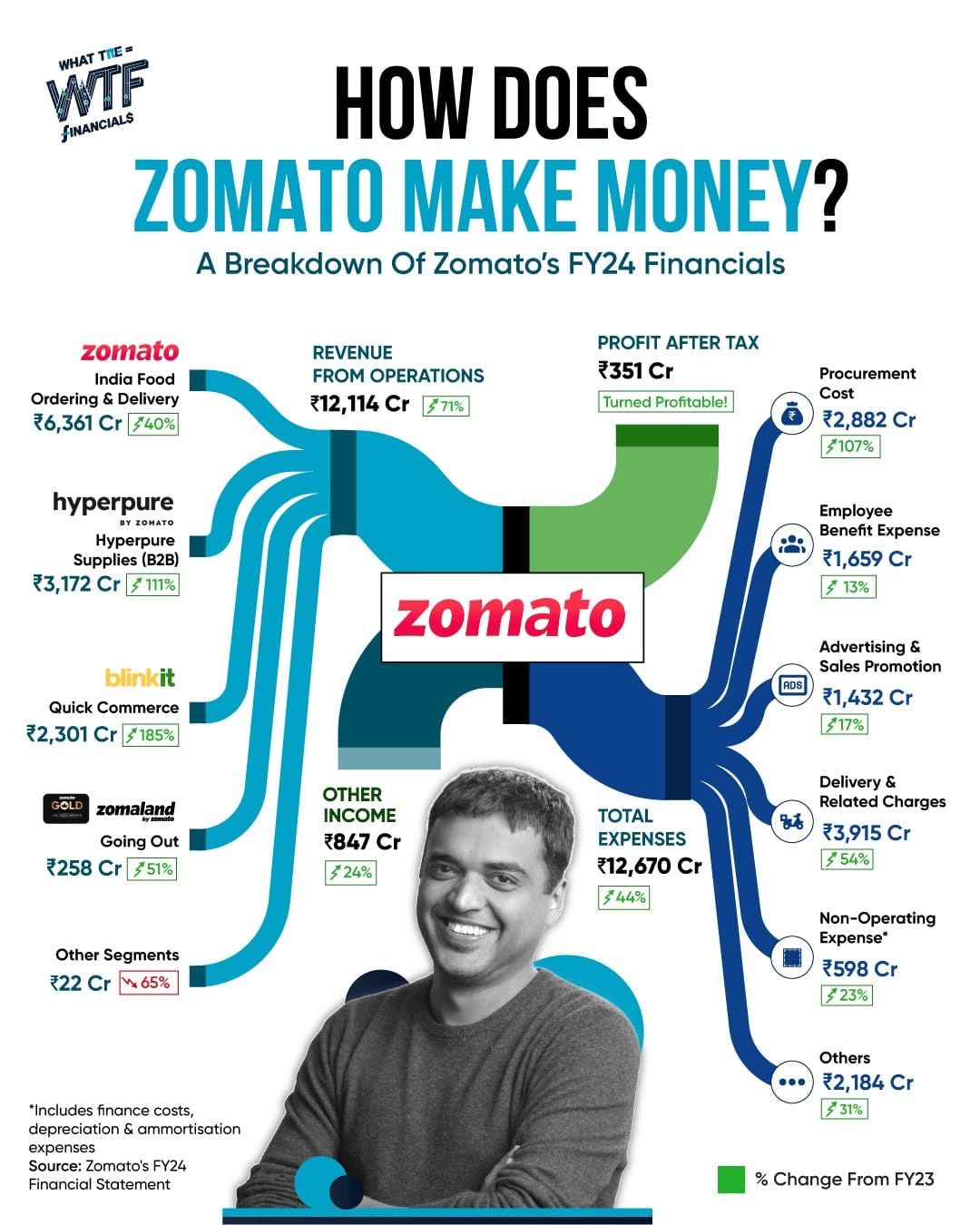

As per the new reports Blinkit have Collected More revenue than Zomato. This proves that Indians need everything quickly. Including me.

10 Replies

1

16

Replies (10)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)