Back

Medial Startup Trivia

Trivias Around start... • 1y

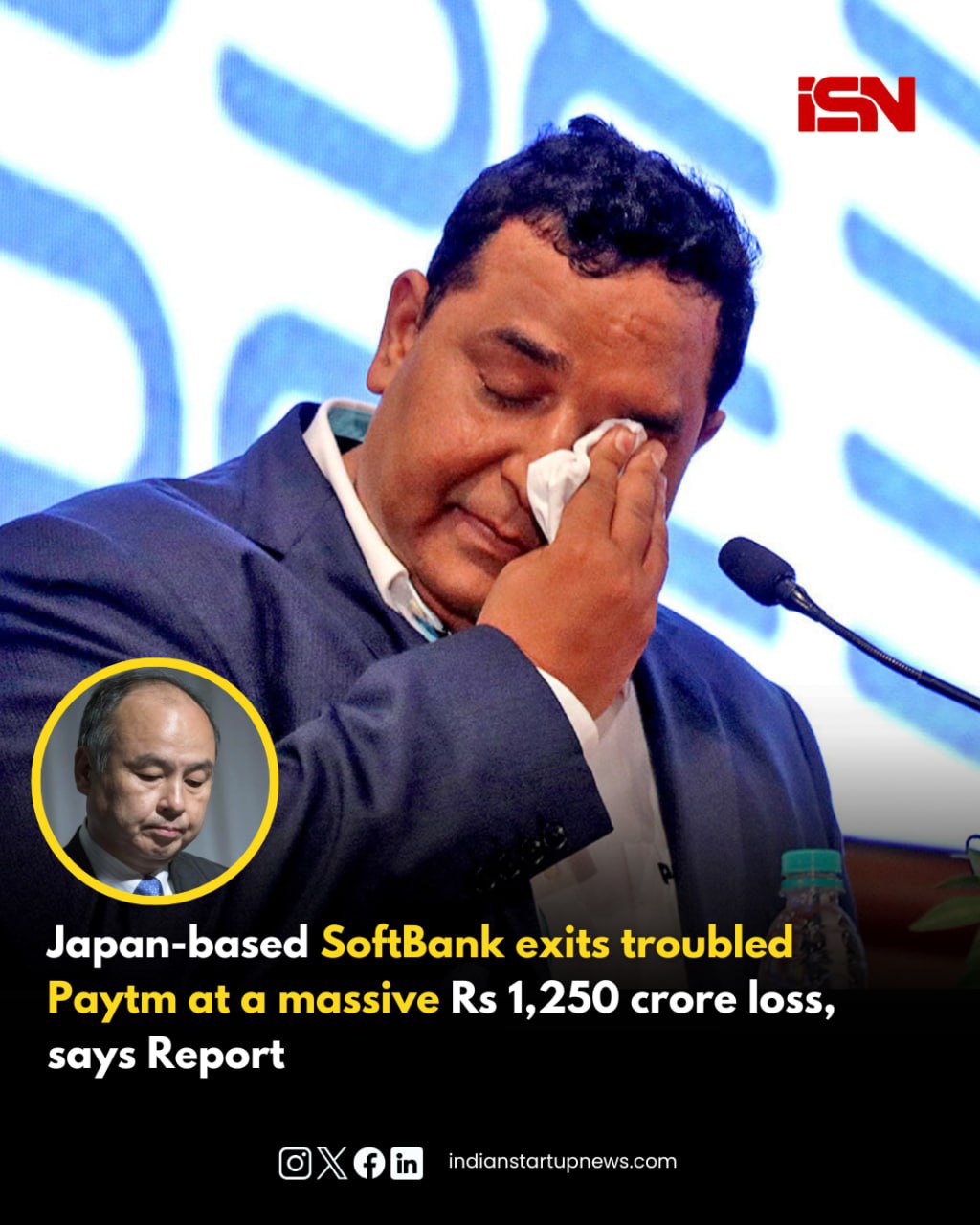

Bet Like a Pro: Masayoshi Son Masayoshi Son is one of the most successful and idiosyncratic entrepreneurs and investors of the modern era. The billionaire founder of SoftBank has an insatiable appetite for new ideas and bold bets that have disrupted industries and minted millionaires around the world. Born in Japan to South Korean immigrants, Son faced adversity from a young age, being bullied due to his heritage. However, this only fueled his ambition to succeed and become Japan's most successful businessman, inspired by Den Fujita, who brought McDonald's to Japan. At the age of 16, Son moved to California to pursue his business dreams. He enrolled in an American high school but soon realized that this was taking too long. Showcasing his entrepreneurial spirit, he convinced the school to let him take the college entrance exam early. He graduated less than a month after enrolling and went on to study economics and computer science at the University of California. In 1981, Son created SoftBank, a company that distributed computer software. Despite initial struggles, SoftBank rode the wave of demand in personal computing in the early 1990s and became a billion-dollar company. Son took SoftBank public in 1994 and began making audacious bets on tech companies, cementing his reputation as a brash investor willing to take big risks. A legendary example of Son's unconventional approach was when he flew to California to pitch his mobile phone designs to Steve Jobs - only for Jobs to reject them outright. However, Son was undeterred. He managed to convince Jobs to grant him exclusive rights to sell the iPhone in Japan on one condition - that SoftBank acquire or build a mobile carrier by the iPhone's launch date. True to his bold style, Son next threatened to set himself on fire in front of Japanese parliament unless he was allowed to purchase Vodafone's Japanese unit to meet Jobs' demand. The extreme tactic worked, and Son acquired Vodafone Japan, rebranding it as SoftBank Mobile. This allowed SoftBank to become the exclusive carrier for the iPhone in Japan when it launched in 2008. Flush with the success of the iPhone deal, Son doubled down on his tech investment strategy, taking major stakes in companies like Yahoo, E-Trade, and most famously, a $20 million investment in the Chinese e-commerce giant Alibaba that is now worth over $100 billion. Over the decades, Son has demonstrated an uncanny ability to spot promising startups and technologies before they hit the mainstream. Some of SoftBank's most successful investments include: - $20 million in Alibaba in 2000 (now worth over $100 billion) - $5 billion in Uber in 2018 - Lead investor in WeWork - Major stakes in Sprint, ARM Holdings, Boston Dynamics, and many others No matter how you view his quirky personality and extreme tactics, one thing is certain - Masayoshi Son has had a monumental impact on the tech industry through his cavalier investing style and unrelenting drive to bet big on the future. From a humble start importing arcade games to Japan, Son built a telecommunications empire in SoftBank and one of the highest-valued tech investment portfolios in the world. His $100 billion Vision Fund allows him to double down on backing audacious startups and bold ideas that he believes will shape the next wave of innovation. Love him or hate him, Son remains one of the most fascinating and unpredictable moguls in business today. At 65 years old, he shows no signs of slowing down his pursuit of ambitious, eccentric, and often highly profitable investment theses. The ultimate contrarian, Son seems to revel in proving critics wrong time and time again. Only time will tell what other wildly disruptive companies and technologies get swept up in the SoftBank founder's singular vision for the future. But you can be sure that when Son makes his next big bet, the reverberations will be felt across Silicon Valley and around the globe. Staying power and an unshakeable self-confidence remain core tenets of the SoftBank manifesto under its quirky creator and chief.

Replies (7)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

SoftBank's Masayoshi Son is pivoting to AI and chips.📈 • In Q4 2023, SoftBank listed loss of 500 Million Dollars and recently Softbank didn't invest in any startups . • Mostly SoftBank is investing in AI Startups . • What do you think about it an

See More

Account Deleted

Hey I am on Medial • 1y

Masayoshi Son, the visionary behind SoftBank, is betting big on AI, predicting that by 2035, AI will be 10,000 times smarter than humans. His company owns 90% of chipmaker Arm and is aggressively investing in AI research, planning to deploy $500 bi

See More

Sanskar

Keen Learner and Exp... • 1y

Masayoshi Son (CEO of soft bank) also known as the Bill Gates of japan or you can say "The Crazy Genius" - Why? Because he is behind almost everything you can think of. The one who has raised 45 billion in 45 minutes and the one who has raised 100 Bi

See MoreAccount Deleted

Hey I am on Medial • 1y

The Stargate Project : The Stargate Project is investing $500 billion over four years to build AI infrastructure for OpenAI in the U.S., starting with $100 billion. This initiative will bolster American AI leadership, create hundreds of thousands o

See More

The next billionaire

Unfiltered and real ... • 11m

Marriages are so scary. Billion dollar founder gets cheated on by his wife who then files a fake case & abducts his son. Due to normal laws in Singapore and America, the authorities clear him but he makes the fatal mistake of coming to India to sav

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)