Back

Hiral Jain

CA inter • 1y

Hello everyone! To understand the topic of national income we need to have some basic knowledge of what we do at the end of every financial year (startups who hire a chartered accountant to file their ITRs or to look after their accounting) All these amounts are transferred to the gov And upon all the level (district,state, nation etc) (this is a simpler version to understand national income accounting) Whatever I have written above is a part of my CA foundation syllabus It comes under macro economics What say, isn’t commerce field interesting?!!

More like this

Recommendations from Medial

Niranjan C

Hey I am on Medial • 1y

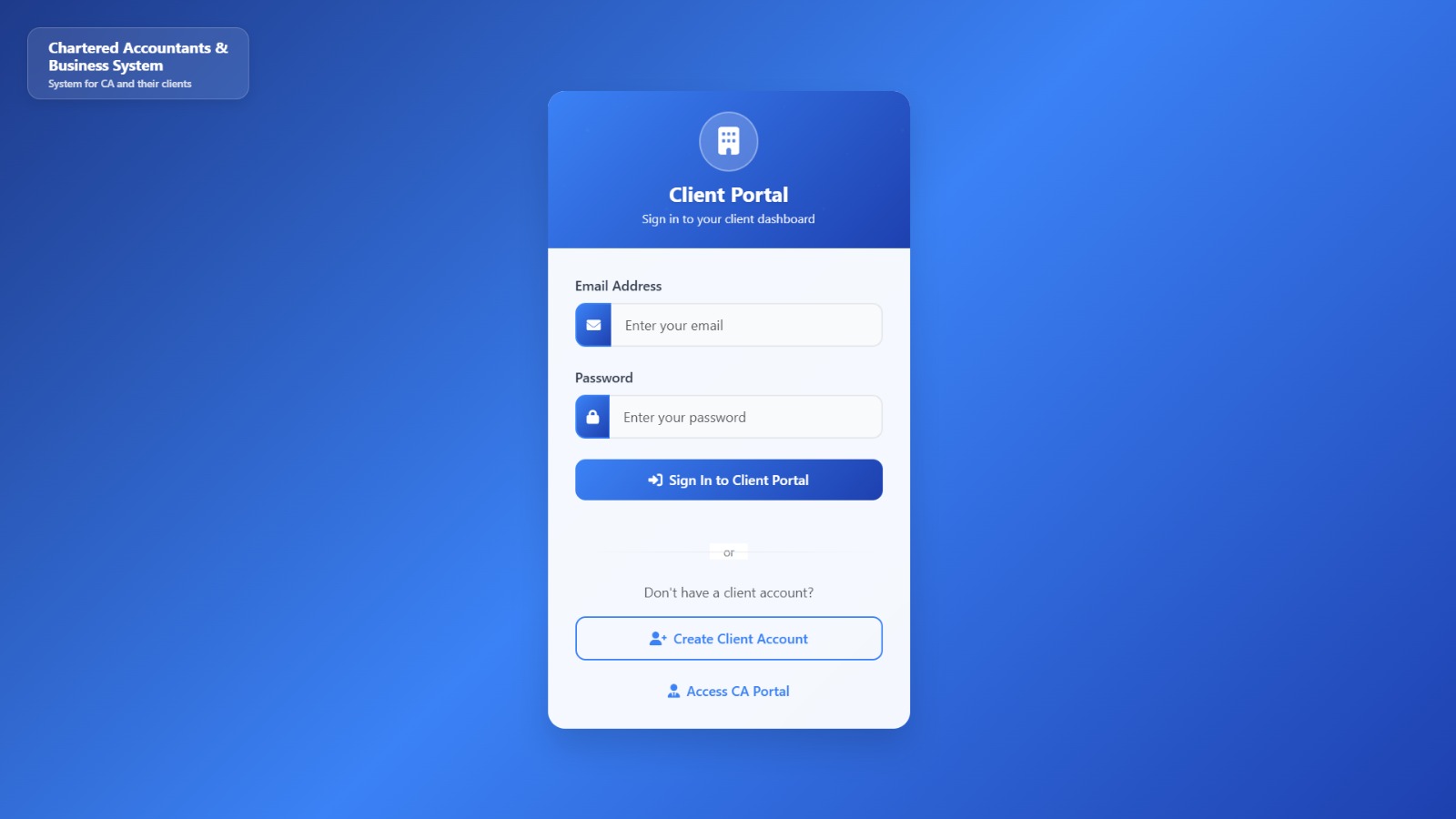

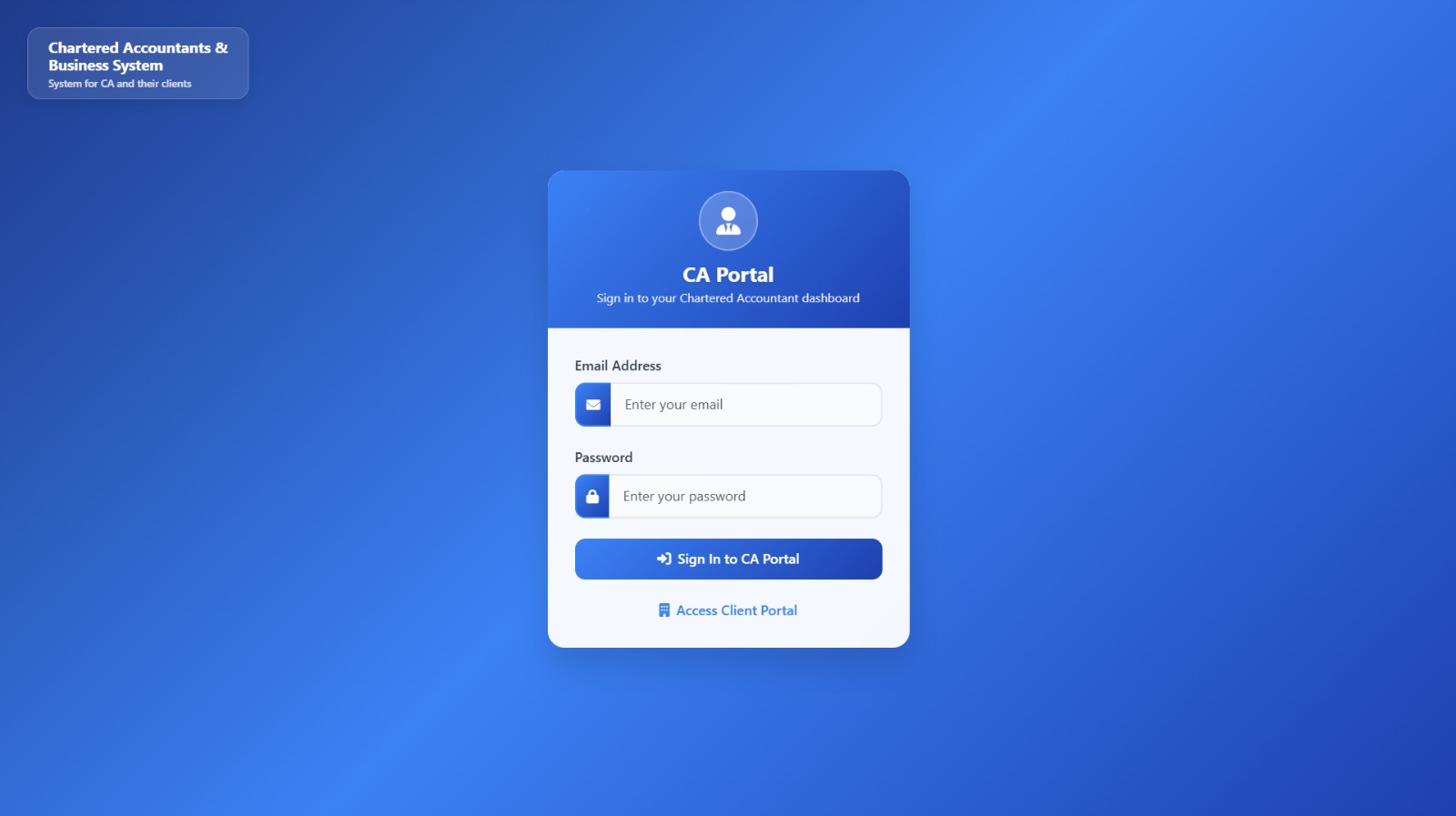

Can anyone tell how AI can enhance the work of Chartered accountant, how can a group of tech enthusiasts help to build a tool that really be an useful tool for all Chartered accountants. required a detail about : what can be automated in this role a

See MoreBishesh Kasera

Founder and Chairman... • 3m

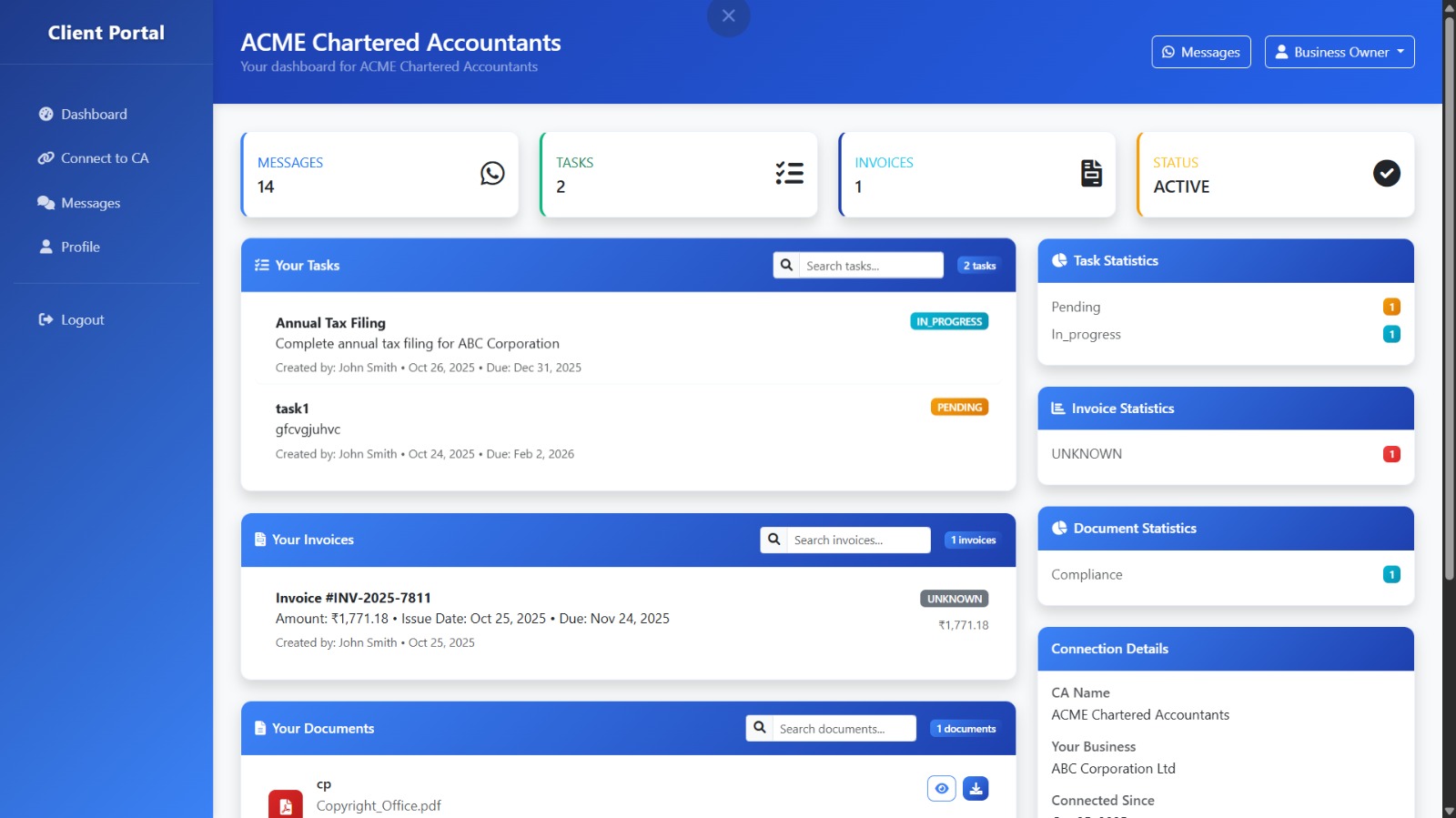

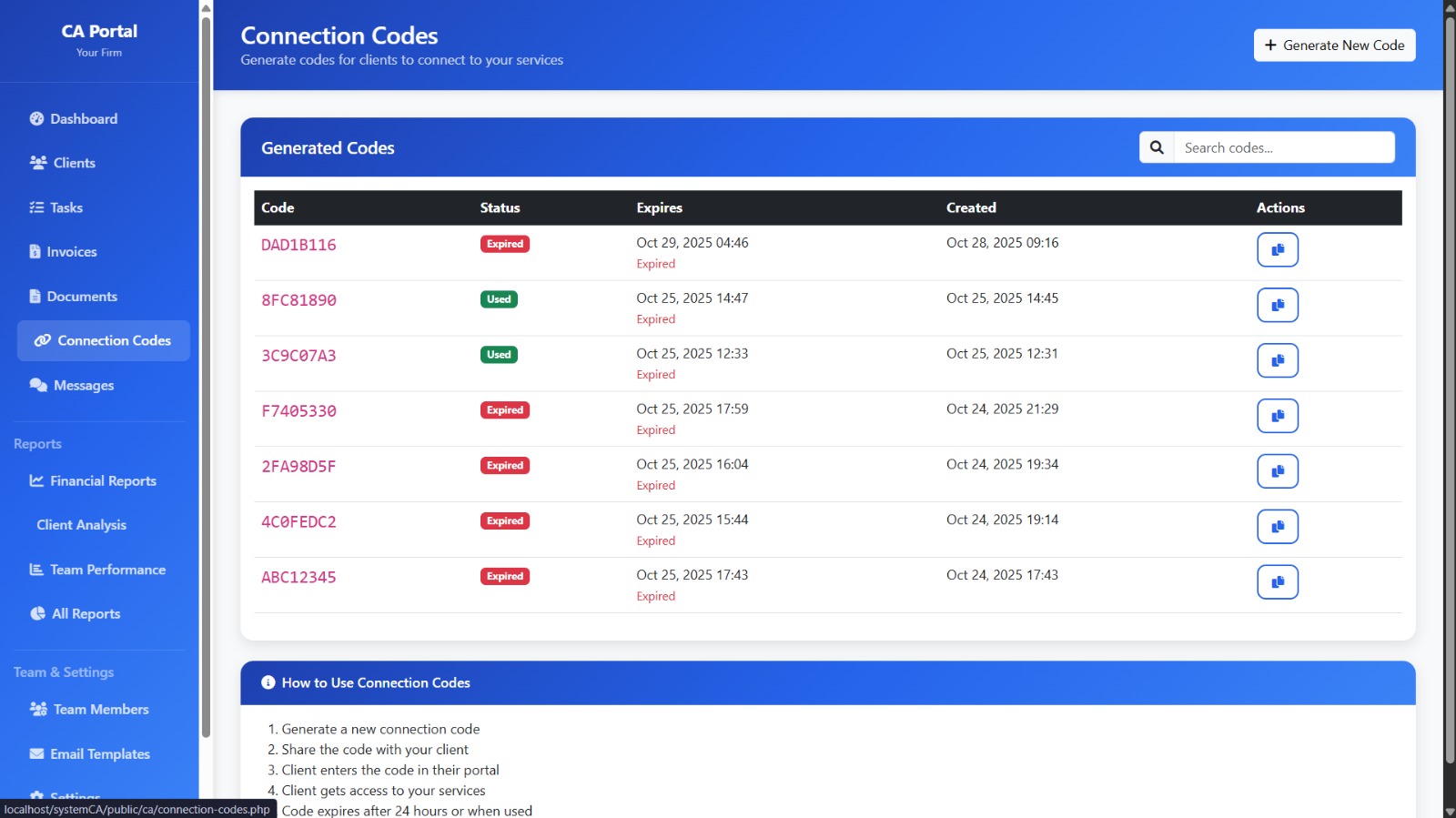

Chartered Accountants have dozens of clients — GST, TDS, IT, ROC filings, billing, invoicing, documentation. So I was thinking one day… why does an expert like a Chartered Accountant work inefficiently? For all their tasks, they use 5 to 6 different

See More

Aakash

Interested in startu... • 1y

I am interested to join any startup as a cofounder or employee - i left my high paying job to do something of my own. I realised that i need to learn lot of things, I dont mind about compromising my compensation, All i want is to be part of an eletri

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)