Back

Anonymous

Hey I am on Medial • 1y

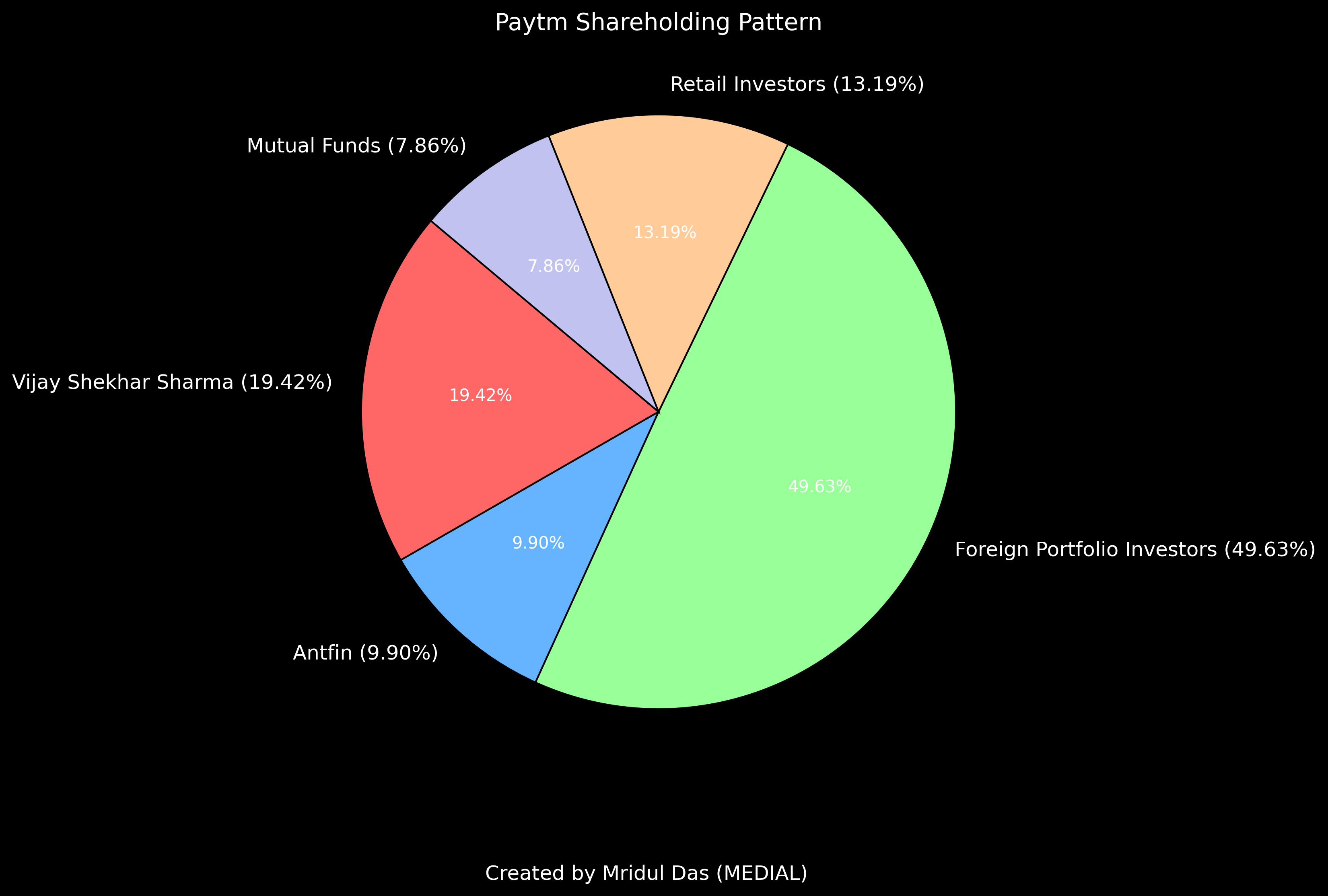

From $20 Billion to $2.5 Billion. Dramatic fall. Paytm is so dead.

15 Replies

1

21

Replies (15)

More like this

Recommendations from Medial

Mahendra Lochhab

Content creator • 1y

India's OTT market cap is $2.5 billion in 2023. According to VHI, Worldwide OTT market is $450 billion in 2023 which is projected to reach $1.56 trillion by 2028, expected to grow at an annual rate of 28.19%. The estimated size of India's video OTT

See More

1 Reply

2

12

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)