Back

Anonymous 1

Hey I am on Medial • 1y

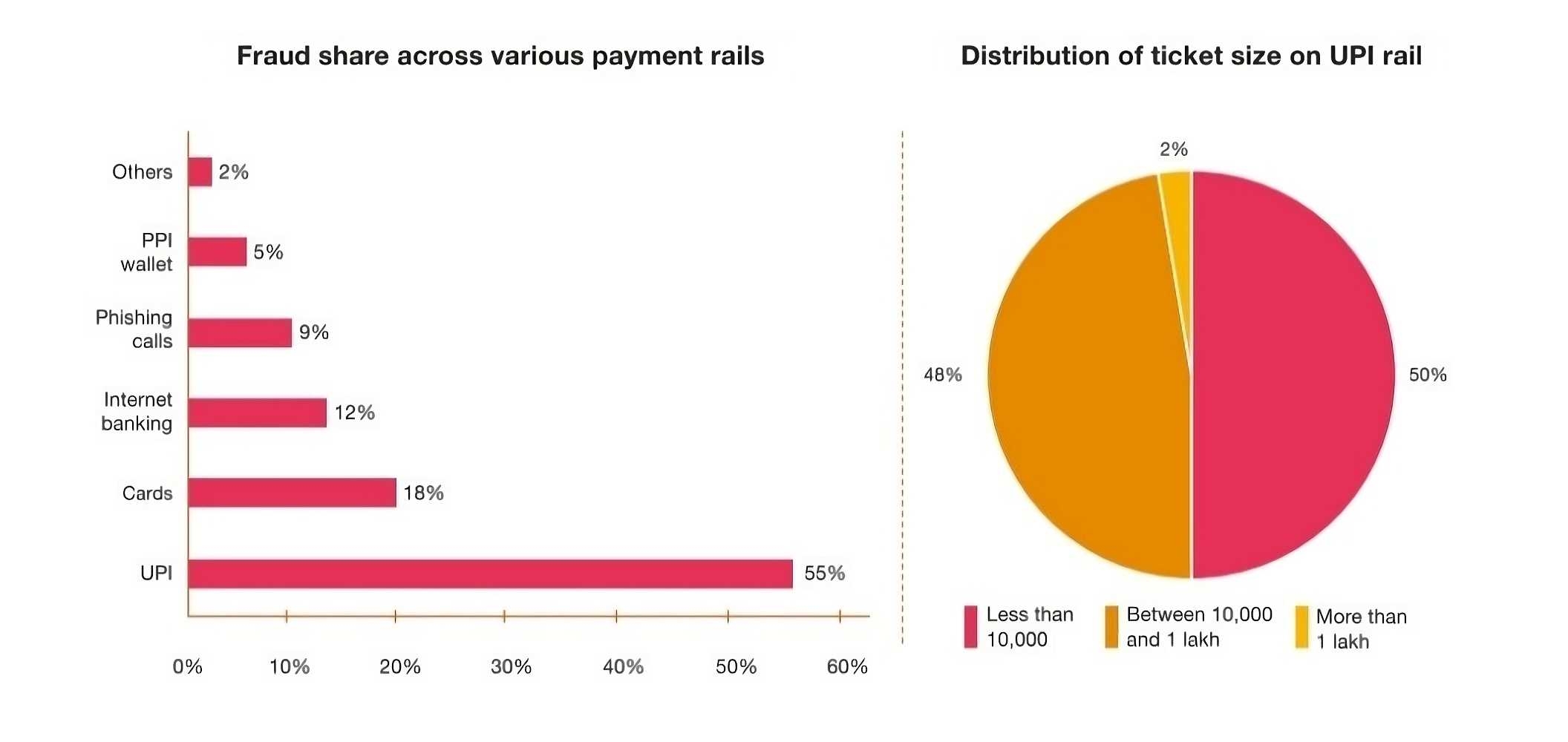

The hard part in these BNPL businesses is fraud customers not fraud apps.

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

DropX Marketing

Grow Fast, Sell Smar... • 10m

Restaurants, clothing stores, shoe shops, and other local businesses struggle to attract customers due to low visibility and lack of digital presence. Traditional marketing is costly, making it hard for small businesses to grow and compete. DropX

See More

Reply

4

Download the medial app to read full posts, comements and news.