Back

Ambar Bhusari

UX Designer for User... • 1y

Gotcha... i will be mindful of this... will add the post here instead. Can i link my substack at the end or will it be against the community guideline. Thanks for the headup! ✌️

Replies (1)

More like this

Recommendations from Medial

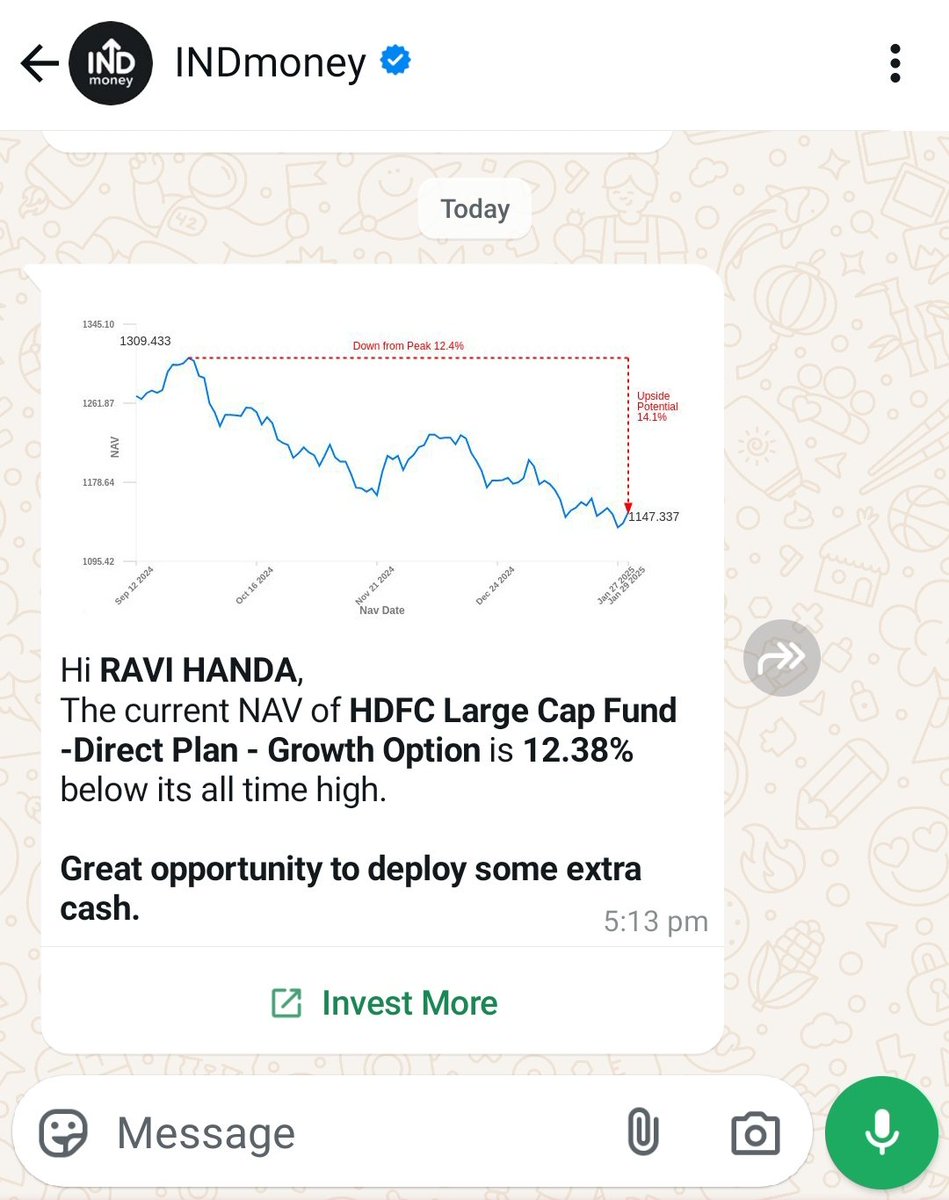

Ravi Handa

Early Retiree | Fina... • 1y

Are companies allowed to send such messages? Isn't this a violation of some SEBI / AMFI guideline? Also, not sure if it is good advice. Just the fact that a fund is 12.38% below its all time high cannot be the basis of a recommendation. There has

See More

Account Deleted

Hey I am on Medial • 9m

Some add plants as an afterthought. You create spaces where nature leads the design. At root | Elegance with Nature, we don’t chase trends — we craft timeless, mindful décor for those who live with intention. Not for everyone. Just for the aligned.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)