Back

Nawal

•

SELF • 1y

1) it's your call, you should've have prepared the buisness plan and you'll definitely ask forba runway of 7 months atleast . 2) After Due diligence, it takes around 5 - 6 months to get money . 3) valuation mostly occurs on revenue x4 to x5 on industry norms , but if you don't have revenue , valuation can be look on impact your product can make and how big is TAM

More like this

Recommendations from Medial

Santhosh Gandhi

Decoding Venture Cap... • 11m

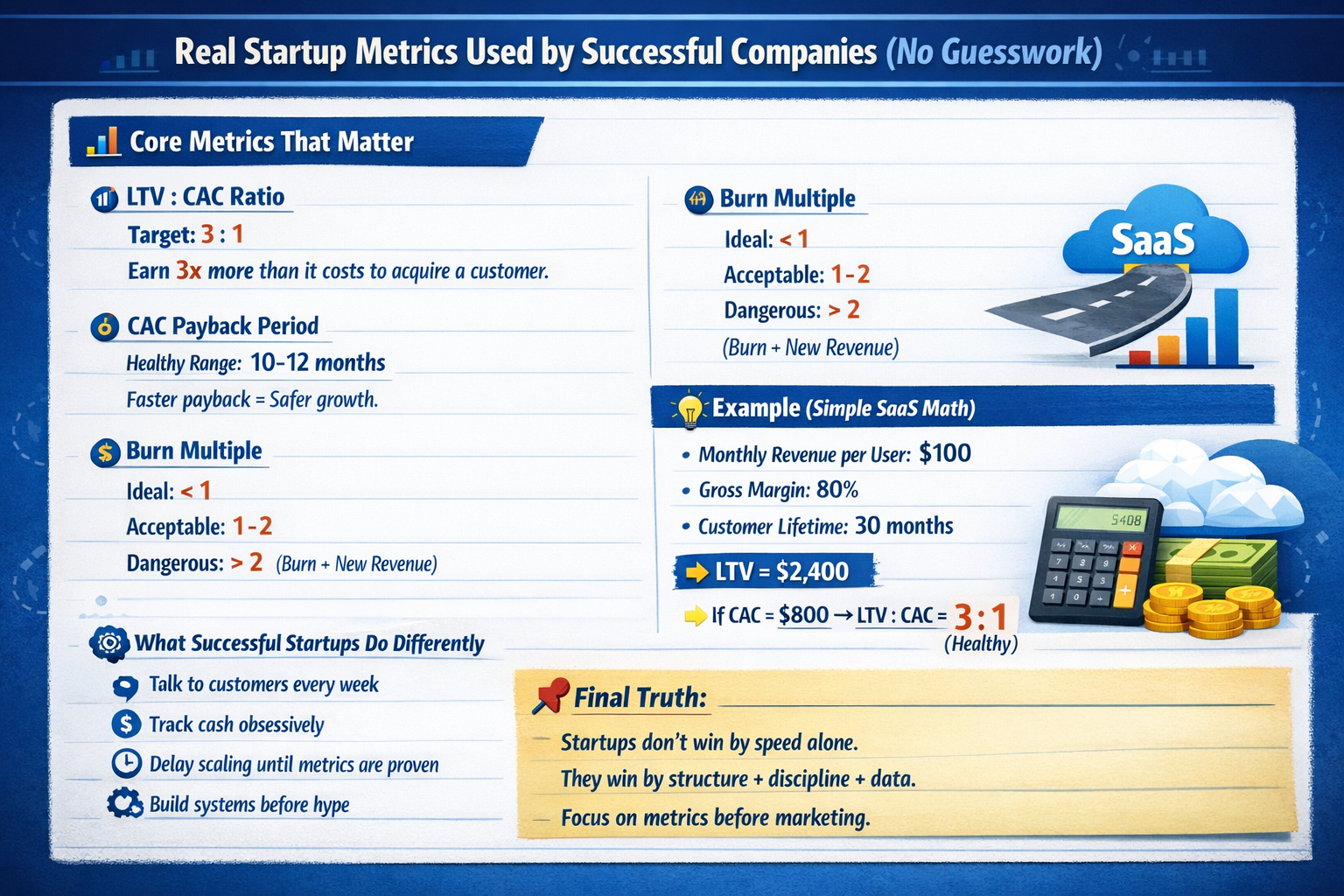

Startups don’t die because they have bad ideas. Most die because they run out of money. And that’s exactly why understanding Burn Rate and Runway is crucial. Burn Rate is the amount of money a startup spends every month to operate salaries, rent, ma

See MorePulakit Bararia

Founder Snippetz Lab... • 1y

I recently posted how do you calculate violation, many people were saying most startup doesn't earn profit , so there are two more ways you can go about Revenue Multiples Method 1. Focus on Revenue: Use your company’s current or projected revenue

See MoreAccount Deleted

Hey I am on Medial • 1y

Why Raising Startup Funding Takes 6–8 Months Raising startup funding is often a lengthy process, typically taking 6 to 8 months instead of just weeks. This timeline can be broken down into three essential phases. 1. Finding a Lead Investor (Approx.

See More

CA Vamshi

Practicing Chartered... • 9m

90% of startup founders overestimate their valuation. The other 10%? They raise smart, retain more equity, and stay investor-ready at every stage. Valuation isn’t just about numbers — it’s about narrative, traction, and timing. It reflects how well

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)