Back

Niket Raj Dwivedi

•

Medial • 1y

True. VC startups do need to push an extra mile for growth though. We are trying to balance things.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 6m

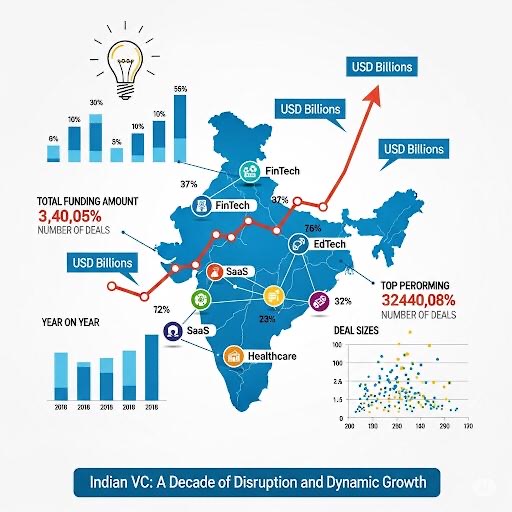

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Arcane

Hey, I'm on Medial • 1y

Even though 25% of all startups on Carta have just a solo founder, VCs hesitate to fund them. Having 2 to 3 founders seems to be the sweet spot if you were to raise VC money while building a startup. So, Is there a way to make VC funding easier as

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Fuel your growth! ⛽ Indian startups in their growth stage, Excess Edge Experts Consulting is actively looking at VC-bound ventures. Share your deck at info@excessedgeexperts.com and let's chart your course to expansion. #VCFunding #IndianStartups #

See More

Mayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)